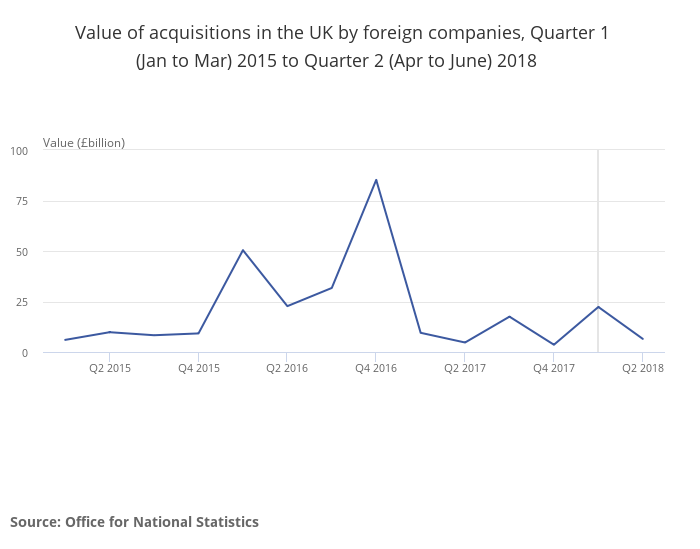

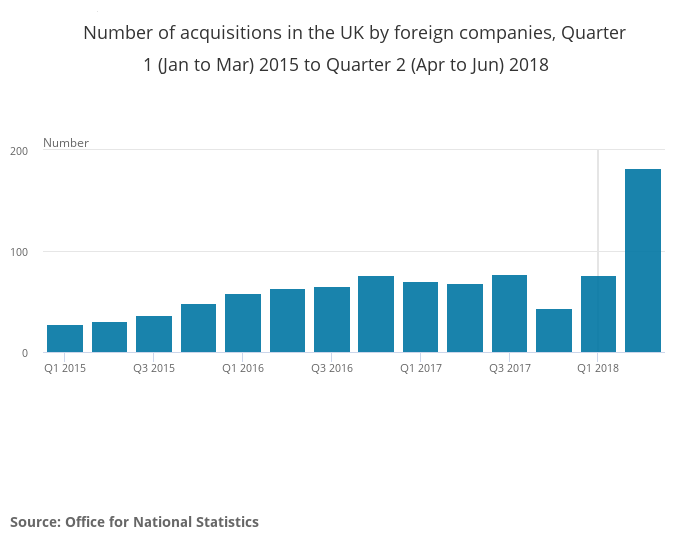

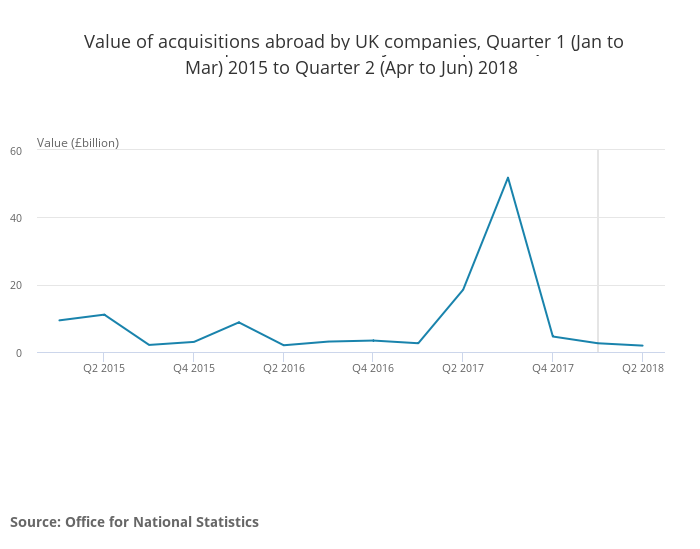

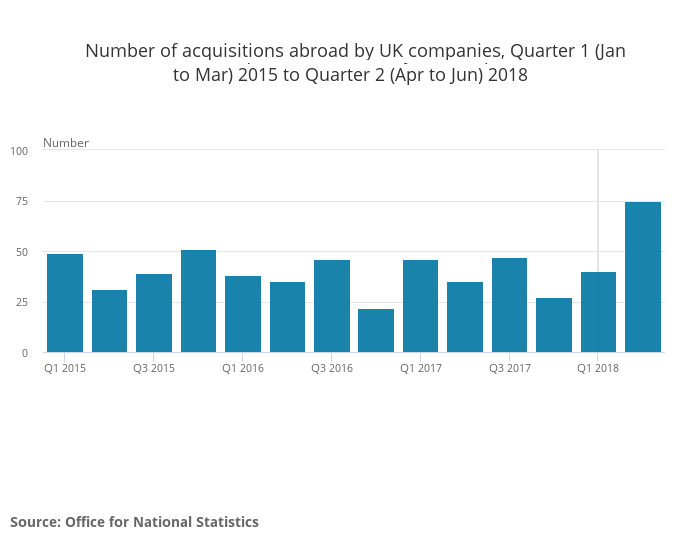

Have inward mergers and acquisitions (foreign companies acquiring UK companies) really soared in the United Kingdom due to a weak pound? The answer is no. The Office for National Statistics (ONS) publishes numbers for inward, outward and domestic mergers and acquisitions and it doesn’t appear either have really changed pace despite a weaker pound.

The ONS numbers are based on, 1) legally completed transactions only, 2) with a value of at least £1 million 3) the transactions results in a change of ultimate control of the target company and 4) all values are in current prices, and therefore have not been adjusted for the effects of inflation.

In the aftermath of the Referendum on the United Kingdom’s membership of the European Union in June 2016, the pound fell to a 31-year low against the U.S. dollar and there have been multiple reports that foreign companies are acquiring UK companies at a record pace, but it simply hasn’t been the case.

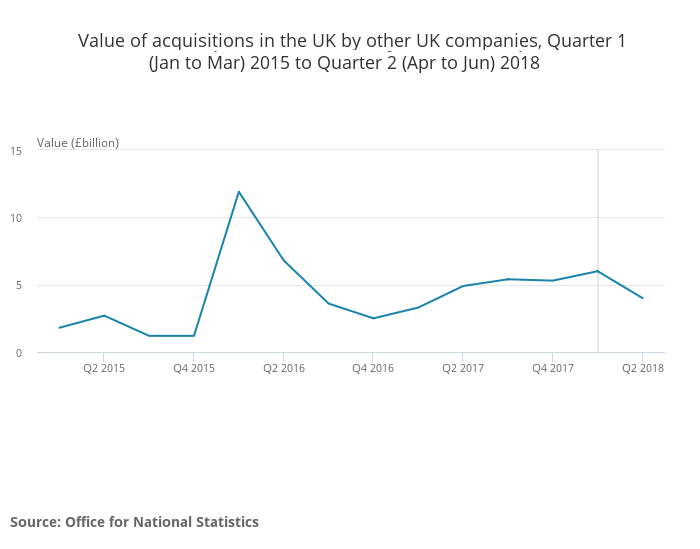

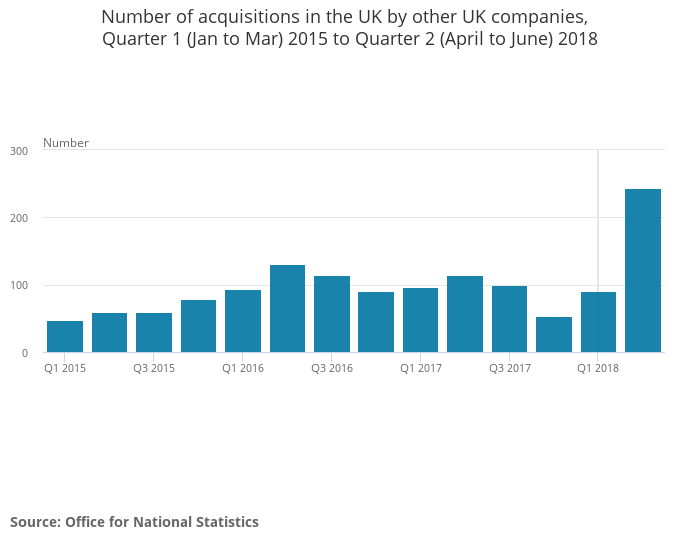

Here are graphs which show the M & A activity did briefly rise after the referendum, but those deals were announced far before the referendum.