This is a consolidated and slightly edited version of the series on economic fundamentals we ran last month.

Do economic fundamentals matter today? We look at the strange market conditions today. We are living in truly interesting times …

Stock Market Valuations

Equities globally have never been more valuable with market capitalization hitting $90 trillion.

Amazon trades at what a Price to Earnings ratio of some 200. Apple is worth some $900 billion. Even Tesla which makes no profit and is unlikely to make any profit any time soon is worth some $55 billion, more than Ford or General Motors.

Netflix is valued at $159 billion (13.6 times revenues of $11.7 billion) with 110 million paid (and 117 million total) subscribers. Netflix trades at a price to earnings ratio of 220. The company expects free cash flow of -$3 to -$4 billion in 2018 (yes, that is negative cash flow). Yet Netflix’s market cap is now greater than Disney’s and Comcast’s.

Don’t mention fundamentals …

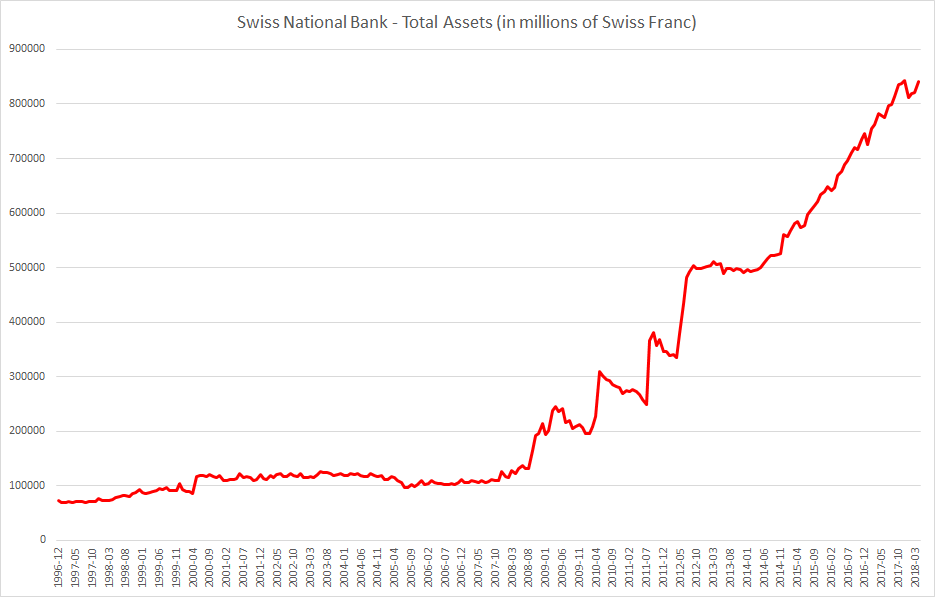

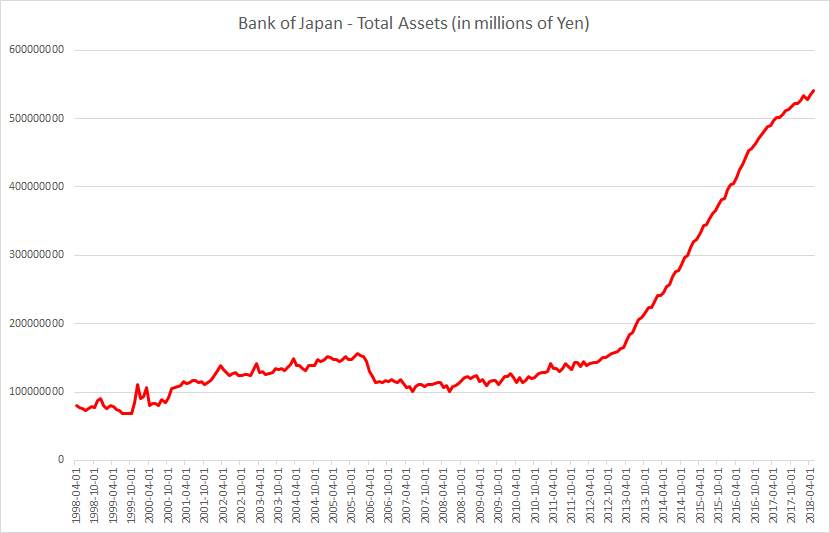

Central Banks printing money and buying equities

Both the Swiss National Bank and the Bank of Japan have negative interest rates (-0.75% for Switzerland and -0.10% for Japan) and have done a lot of Quantitative Easing in the last 5 years. Both have a balance sheet greater than the GDP of their respective countries with Bank of Japan’s balance sheet 101% of GDP of Japan and the Swiss National Bank with a balance sheet of 125% of GDP of Switzerland. What do they do with freshly printed money?

The Swiss National Bank has around $800 billion in foreign currency investments. Amongst its famous holdings are a $3 billion investment in Apple (and it has been buying more shares) and $1.5 billion investment in Facebook. It made a profit of 54 billion Swiss Francs ($55 billion) for the 2017 financial year mainly down to its overseas equities investments.

The Bank of Japan has a target to buy 6 trillion Yen ($54 billion) worth of exchange traded funds a year. It now holds almost 82% of all ETFs in Japan and is indirectly the largest shareholder in many large Japanese companies, almost about half of listed companies.

Central Banks don’t just manage monetary policy now, they are also major shareholders in private corporations.

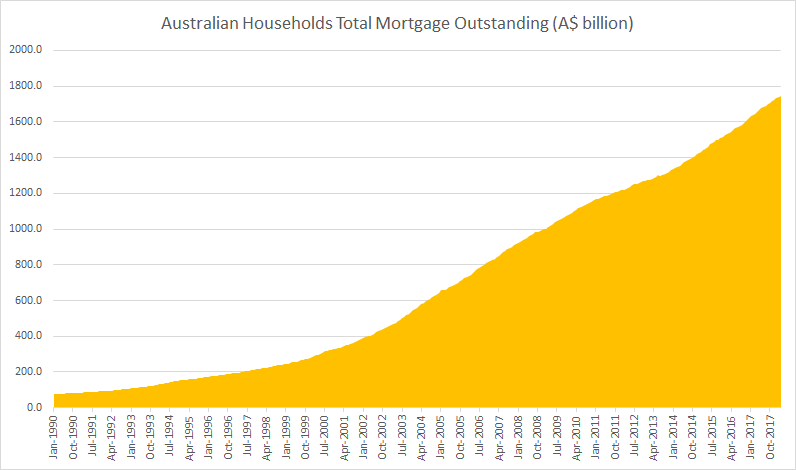

Residential Mortgage Debt greater than the GDP of a country

Take Australia for instance.

Total Residential Mortgage Debt Outstanding: A$1.75 trillion (Up 67% since September 2008), 96% of GDP (2017)

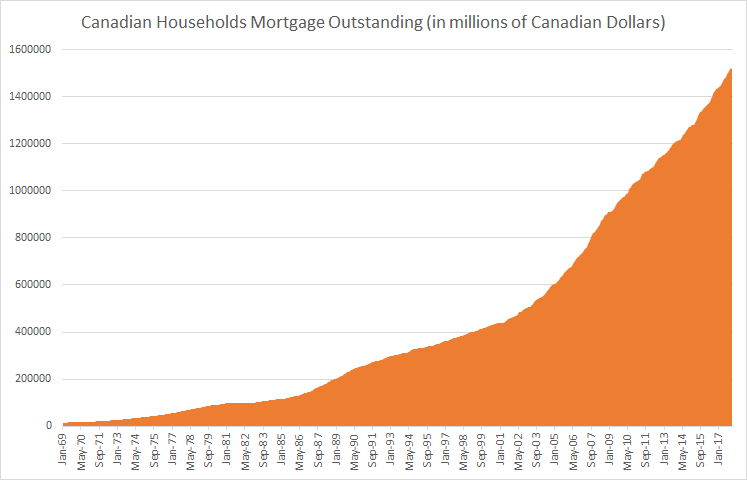

Or Canada

Total Residential Mortgage Debt Outstanding: C$1.53 trillion (Up 70% since September 2008), 102% of GDP (2017)

The European Banking Crisis

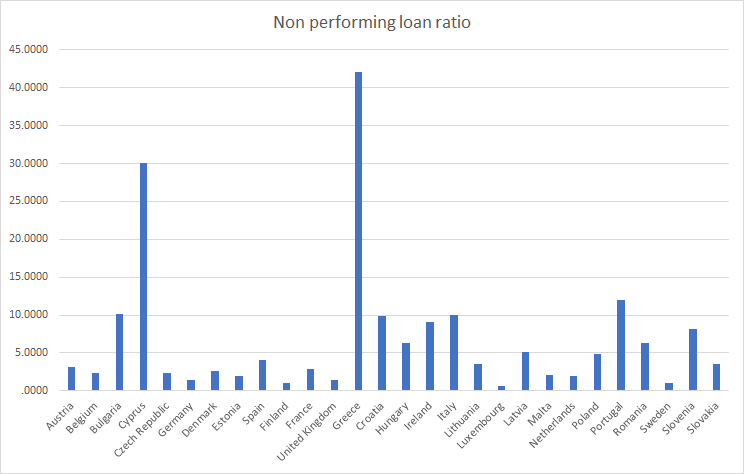

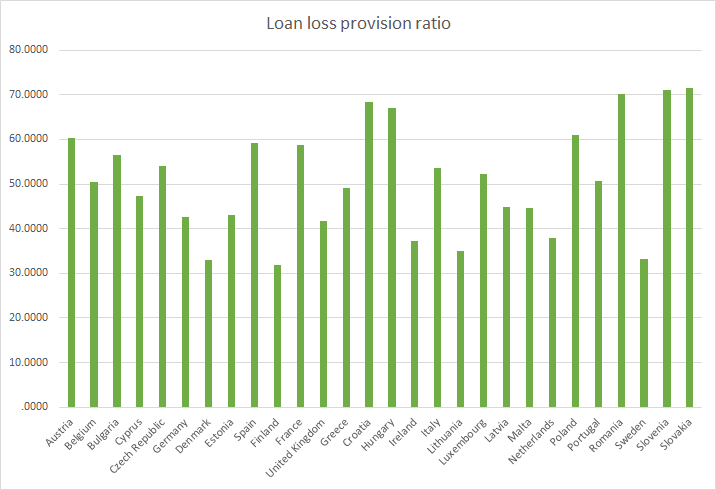

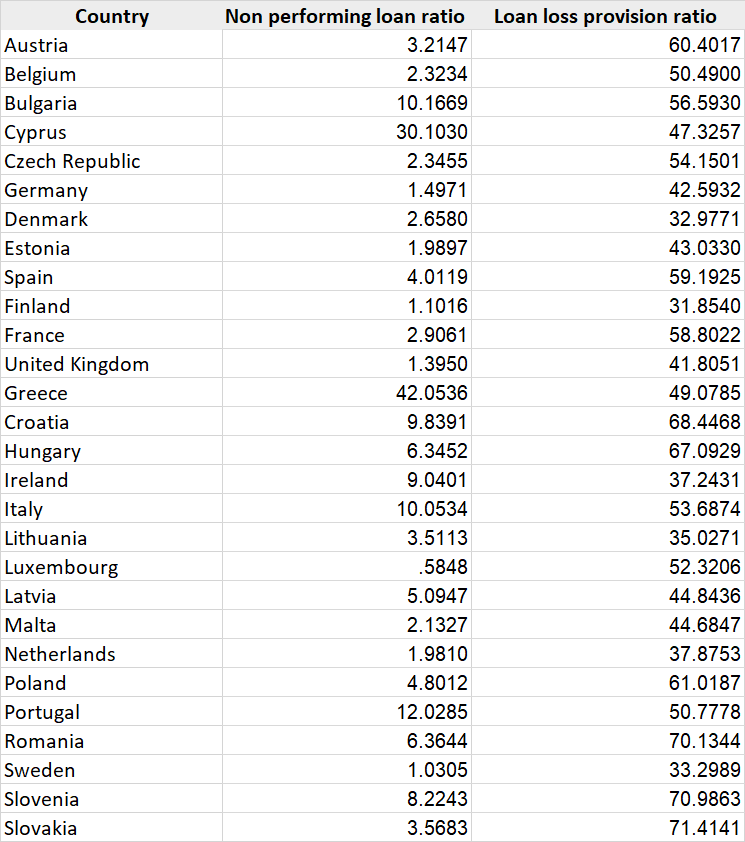

Banks in Greece, Cyprus, Portugal and Italy have a non-performing loan ratio of over 10% a decade on from the financial crisis and have only provisioned around 50% of the losses. The European Banking Crisis is far from over.

2018 feels just like 2008 for European Banks …

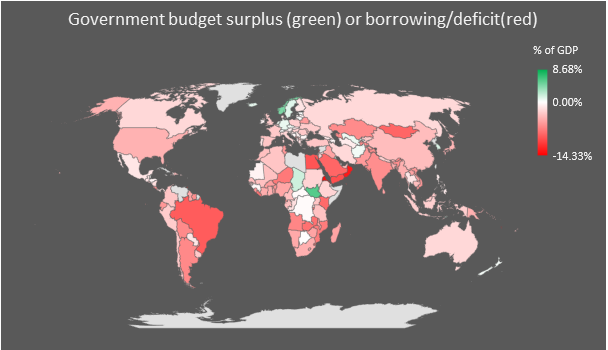

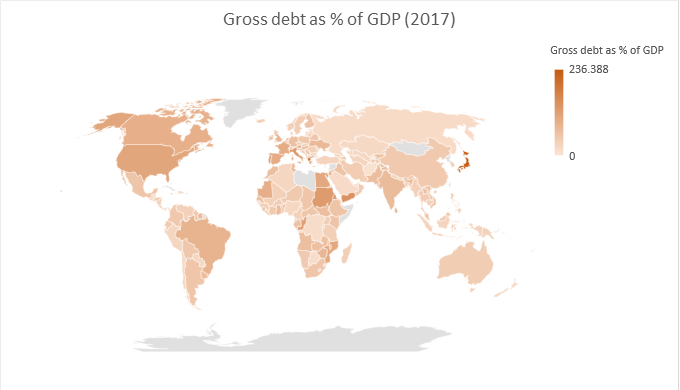

Soaring Government Debt

Just 30 out of the 193 countries that report data to the IMF reported a budgetary surplus in 2017. Only 2 of the 20 G20 nations reported a budgetary surplus. These were South Korea (1.21% of GDP) and Germany (0.69% of GDP).

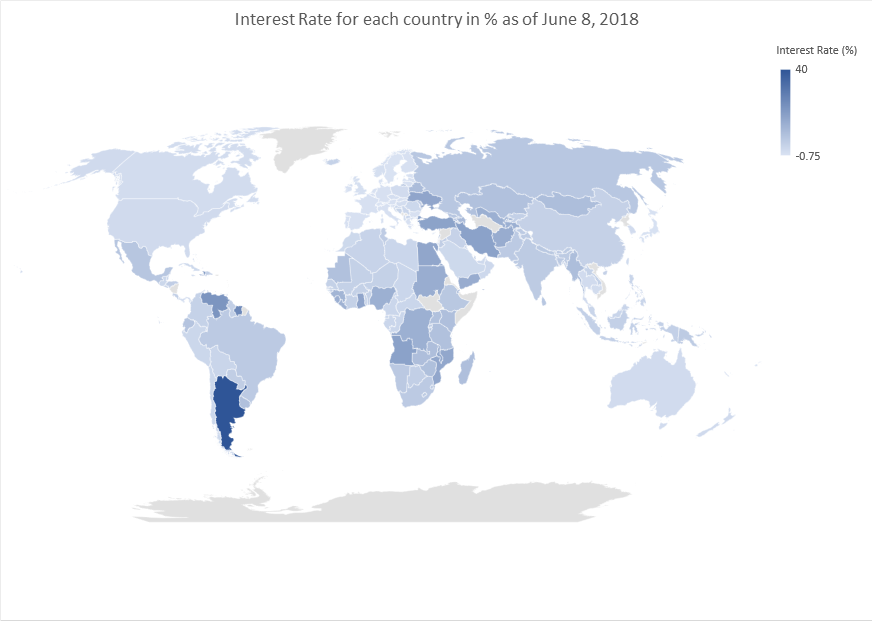

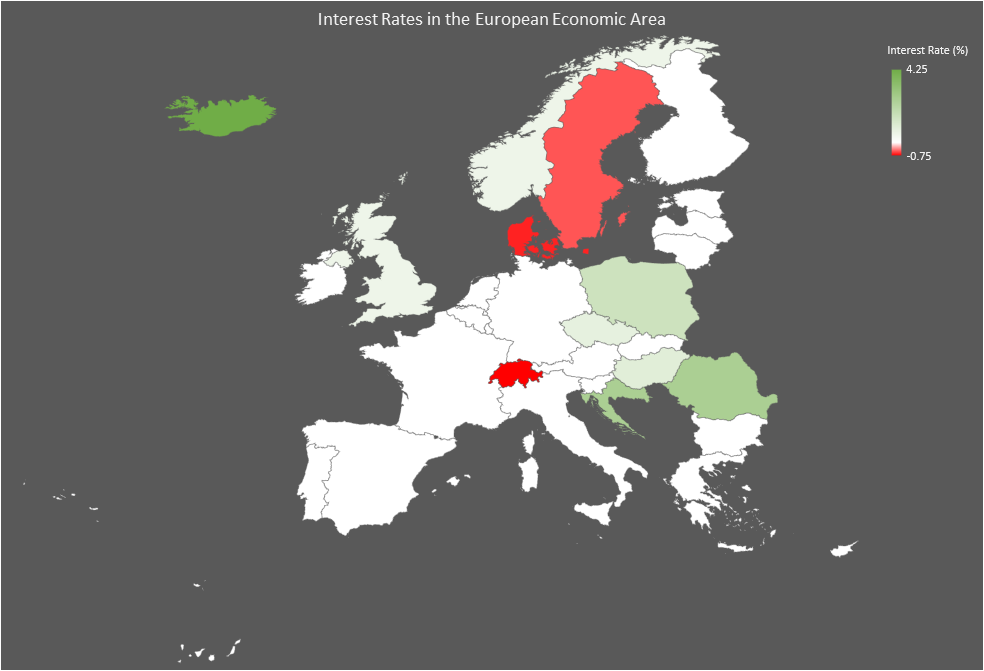

… at a time when Interest Rates around the world have never been lower

Never ever in history has there been a time when 24 nations in the world have had zero or negative interest rates.

Never ever in history have interest rates around the world been lower.

The average interest rate in the world is 5.75% today, the lowest on record.

Here are countries with zero or negative interest rates,

Switzerland -0.75%

Denmark -0.65%

Sweden -0.5%

Japan -0.1%

Austria 0%

Belgium 0%

Bulgaria 0%

Cyprus 0%

Estonia 0%

Finland 0%

France 0%

Germany 0%

Greece 0%

Ireland 0%

Italy 0%

Latvia 0%

Lithuania 0%

Luxembourg 0%

Malta 0%

Netherlands 0%

Portugal 0%

Slovakia 0%

Slovenia 0%

Spain 0%

European interest rates have never been lower. You could get a mortgage in parts of Europe that pays you interest for borrowing money!

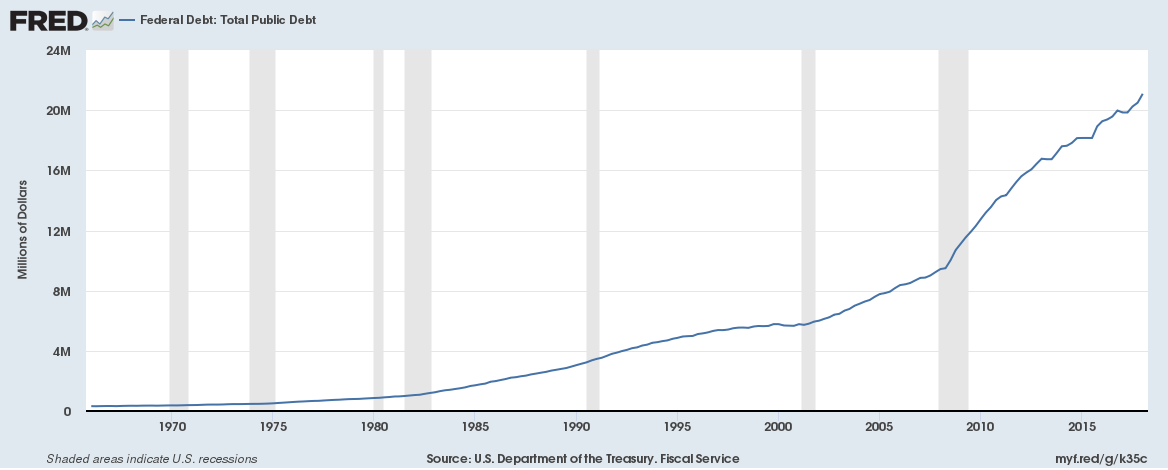

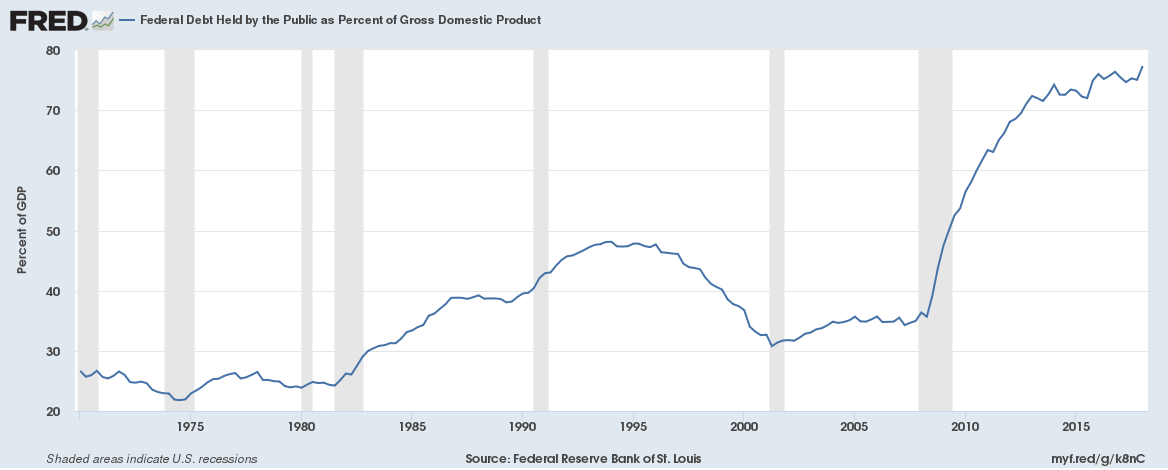

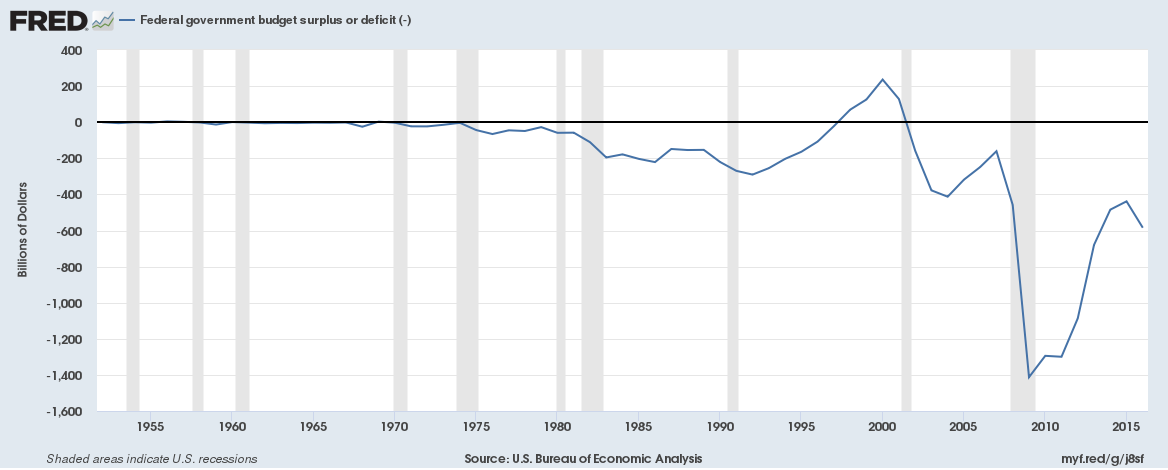

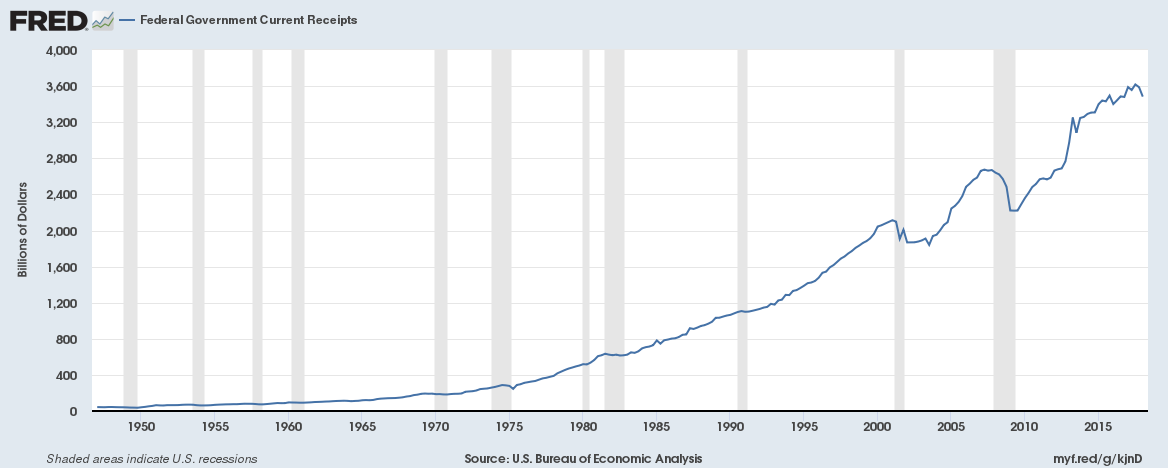

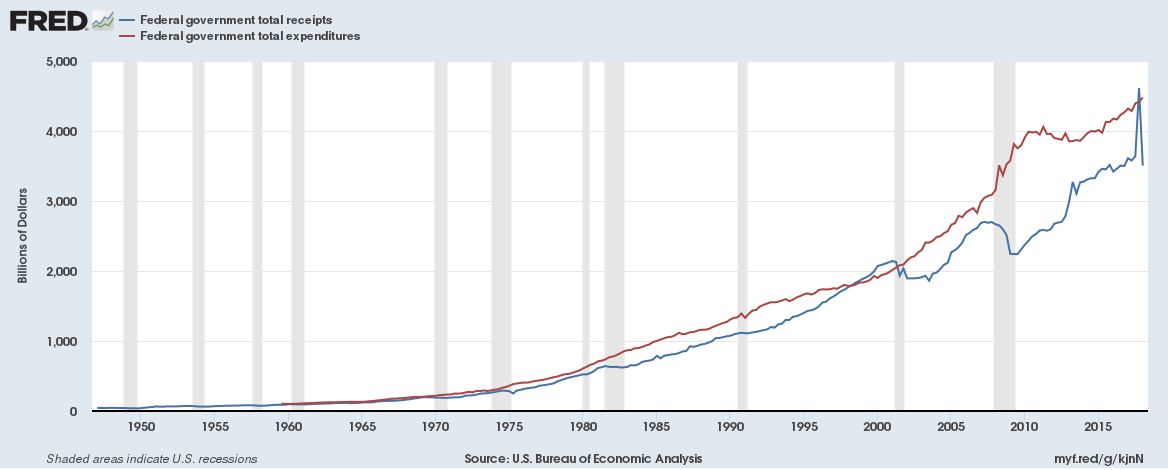

The United States as a global financial leader has a rising budget deficit, soaring interest costs and falling federal tax revenues

The US last had a budgetary surplus in 2001 and is now projected to run a surplus next in 2035.

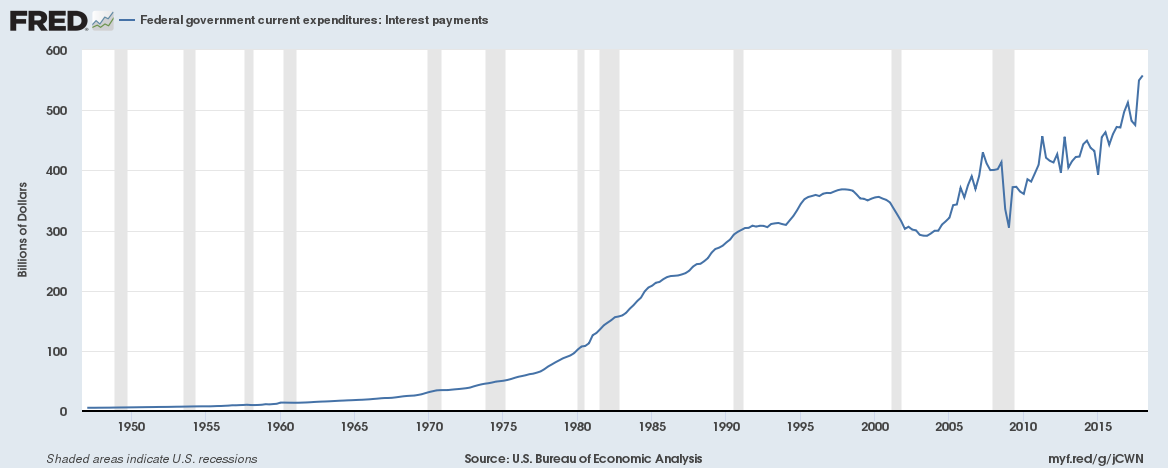

As with rising debt and rising interest rates, expenditure on interest payments has been soaring too. The US pays around $558 billion in interest payments a year.

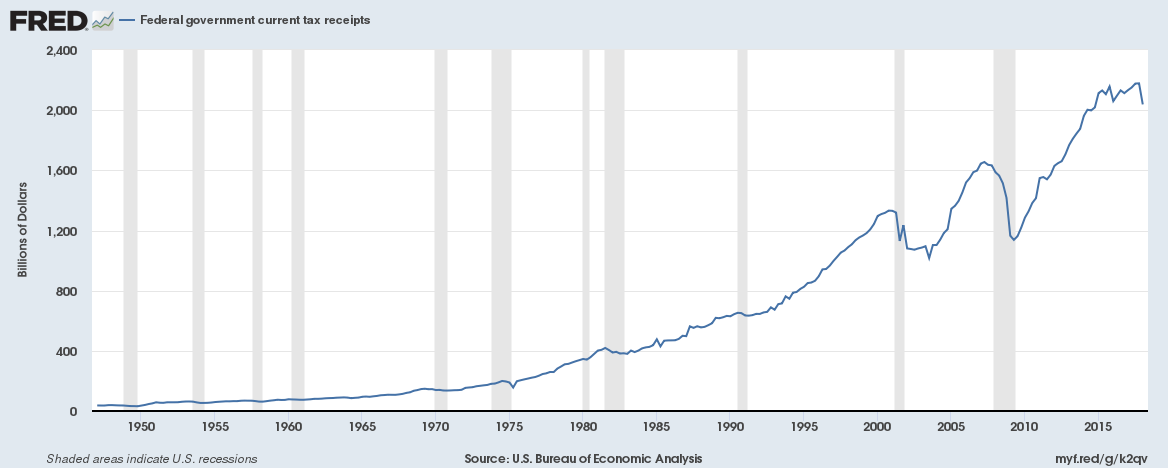

And tax revenues have started to fall given the recent tax cuts.

Falling government revenue, rising budget deficit, growing debt, soaring interest costs (due to rising yields) and rising total expenditure. Doesn’t look good structurally at all.

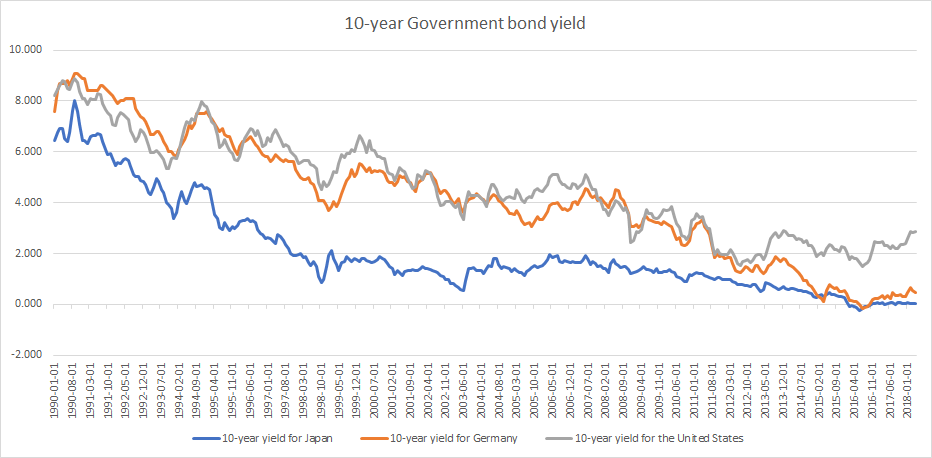

Super low Government bond yields

Government bond yields have never been lower with 2-year yields for most of Europe currently negative. The European Central Bank (ECB) is by far the biggest holder of European bonds and the biggest (almost 90%) buyer of the weaker Eurozone (Italy, Spain, Portugal and Greece) countries debt since 2015. The ECB balance sheet is now over 4.5 trillion Euros, some 45% of Eurozone GDP.

Even 10-year yields for Japan and Switzerland are barely positive.

Yields on government bonds for all maturities over 3 months have never been lower in the history of the world .

Some 80% of 10-year Japanese government bonds are held by the Bank of Japan. And apparently there are days when no one trades those 10-year bonds because there is no point of trading it. Why? Well, because the Bank of Japan has a policy to control yield curves and since they hold majority of it there are hardly any price movements.

An aging world: Babies born in 2018 can expect to live to over 100. In 2015, there were around 600 million people aged 65 or over and that number is expected to rise to over 2 billion by 2050.

Changing demographics: There are currently 8 workers in employment for every retiree today, that number is likely to reduce to 4 workers in employment for every retiree by 2050.

Underfunding: The UK currently has $6.2 trillion in underfunded government and public-sector employee pensions. For the US that amount is over $25 trillion.

Lower bond yields: Previous funding assumed 7% bond yields, the number has been much closer to 2.5% since 2009 which has caused major deficits.

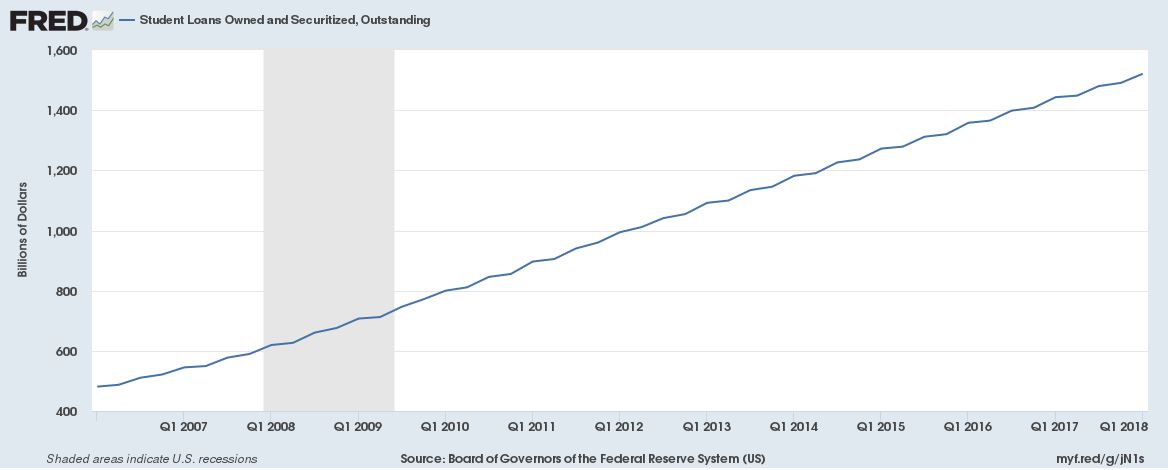

Student loan debt has never been higher

One way to keep unemployment low is to keep more people in education. Student debt around the world has never been higher.

US Student debt has crossed $1.5 trillion. That is more than the GDP of 185 individual countries and more than individual mortgage debt in the US.

Real unemployment

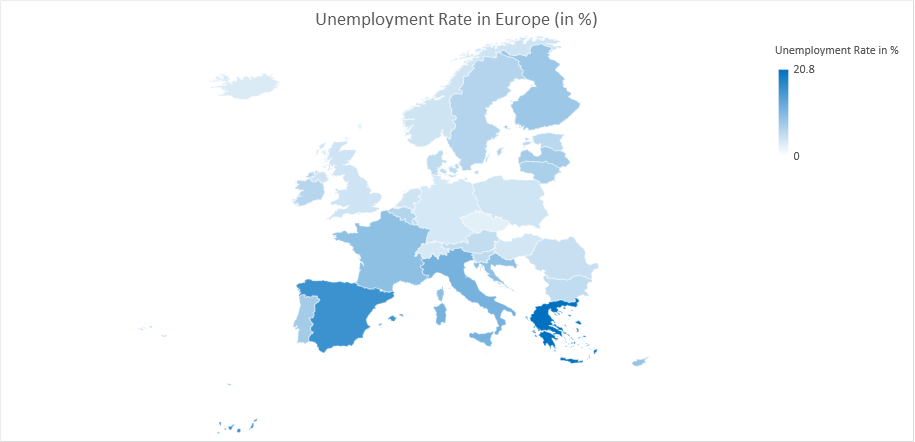

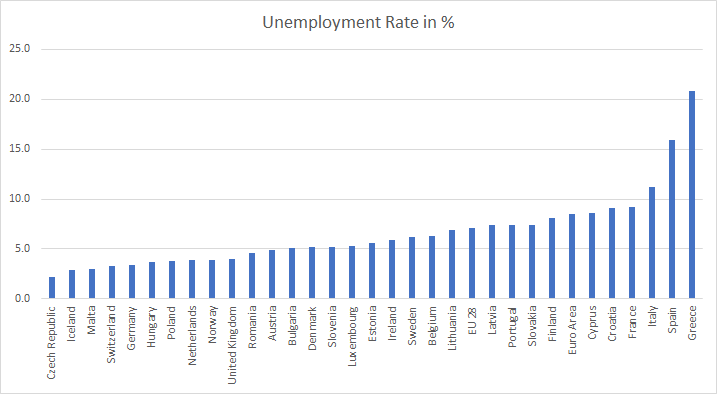

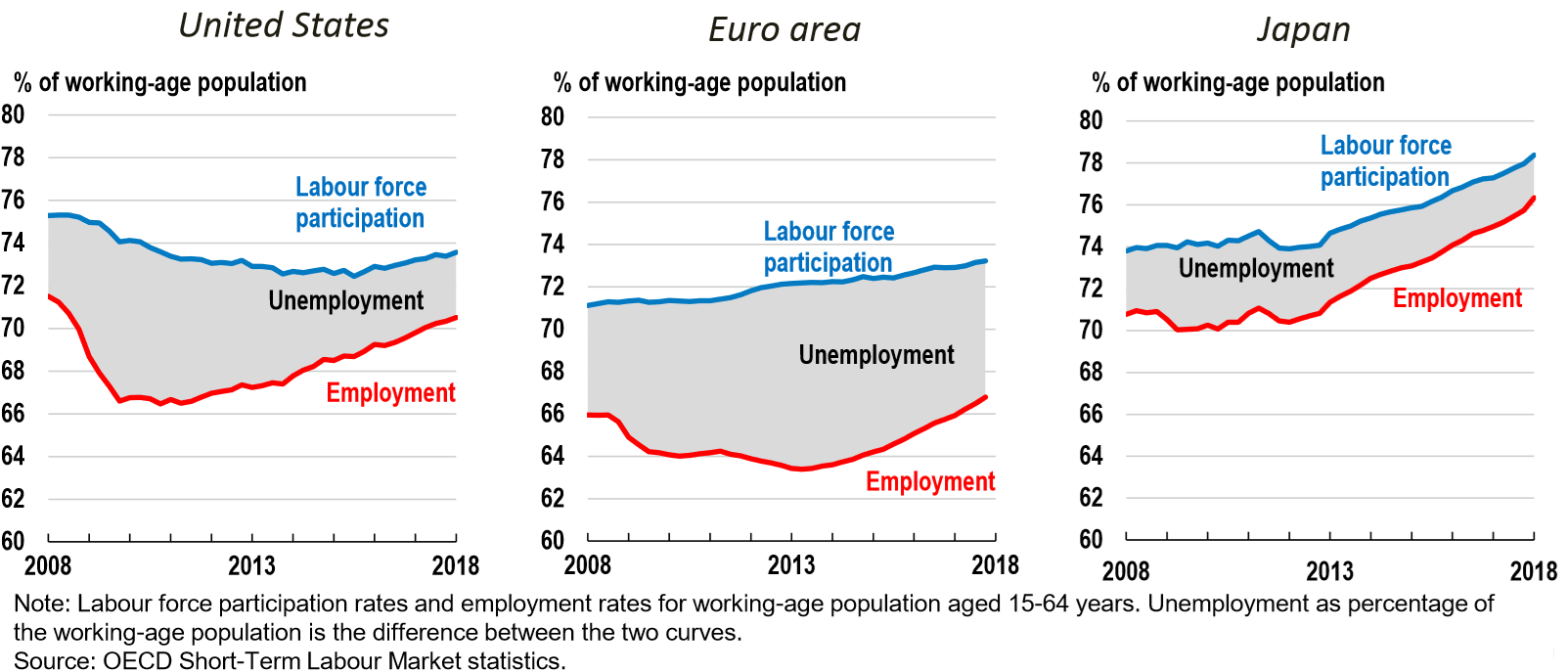

Unemployment in Europe is lowest since 2008 but is still twice that of the United States.

The Euro Area unemployment rate was 8.5% in April 2018, down from 8.6% in March 2018 and from 9.2% in April 2017. This is the lowest since December 2008 but still more than double of the US unemployment rate of 3.9% reported in April (the US unemployment rate further fell to 3.8% in May).

Greece with unemployment at 20.8%, Spain with unemployment at 15.9% and Italy with unemployment at 11.2% remain the three countries with the highest unemployment in Europe.

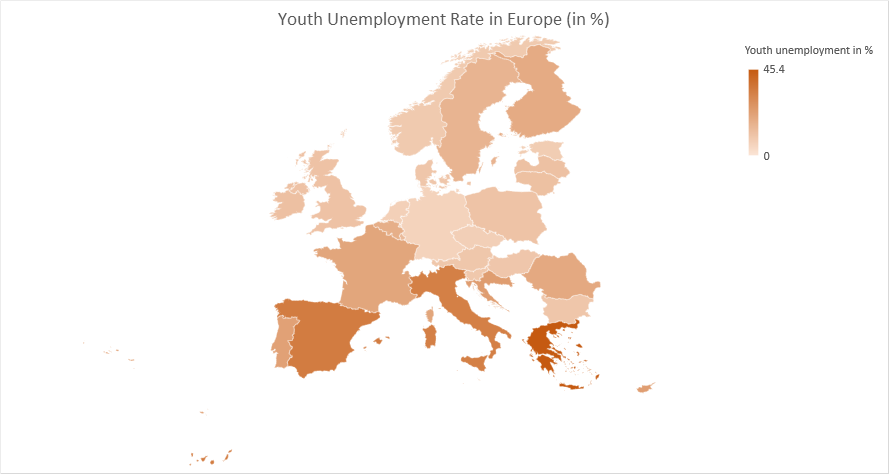

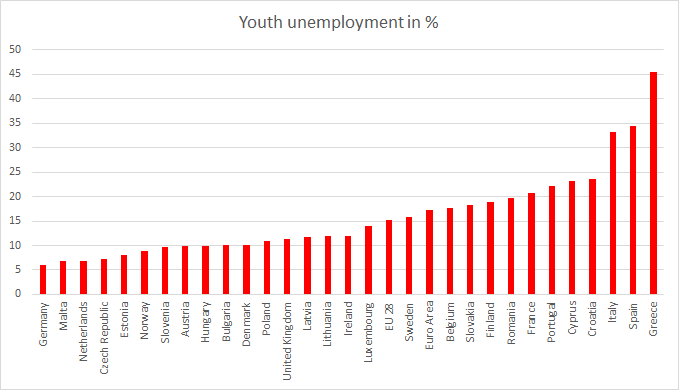

What is more intriguing is youth unemployment at 15.3% for the EU28 and 17.2% for Euro Area. Portugal, Cyprus, Croatia, France, Italy, Spain and Greece all have youth unemployment of more than 20%.

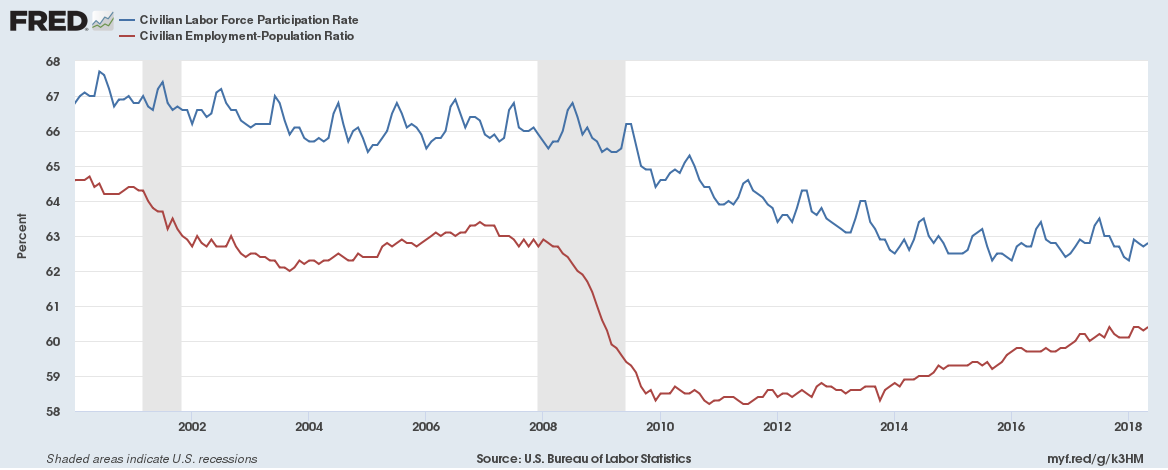

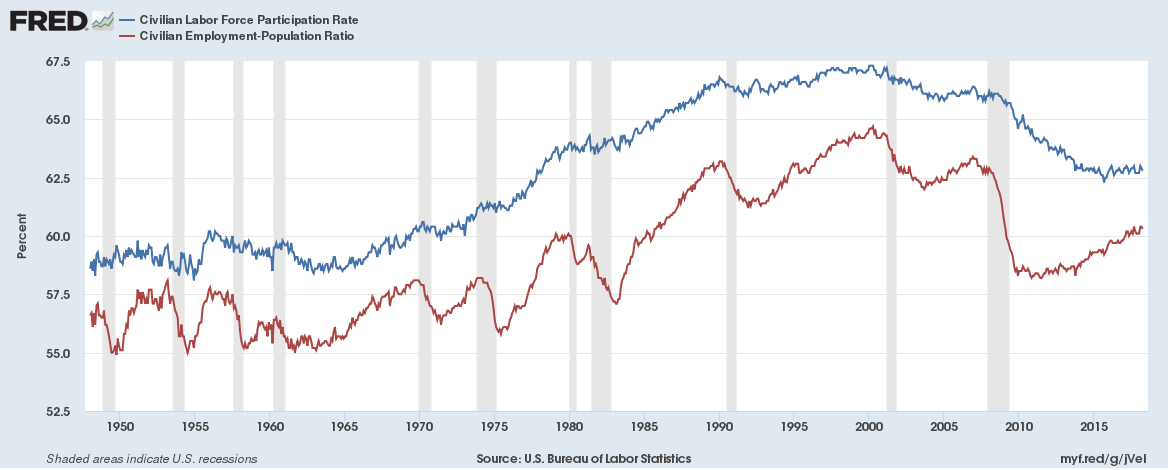

So, is the US doing great with regards to employment or is Europe doing badly? This chart from the OECD tells it all,

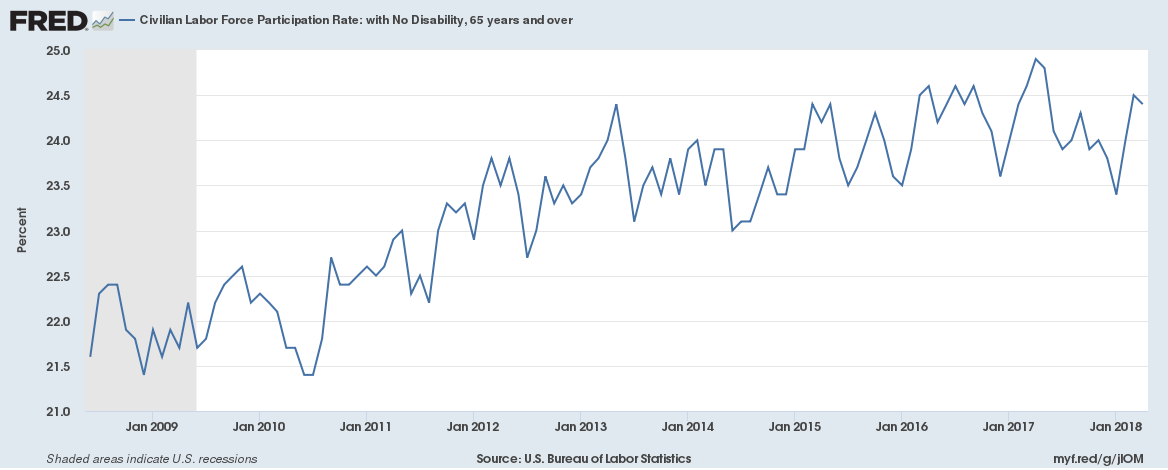

One could attribute the labour force participation rate decline on fewer older people participating in the labour force (by retiring early) but that isn’t the case. Increasingly, more people in the over 55s and over 65s age brackets are participating in the labour force,

What really matters is what benefits the insiders and heavy hitters who manipulate the market. Also important is the movement of millions and millions of lemmings running back and forth between greed and fear.

Economics and the stock market are not sciences like physics or calculus. They operate off the emotions of the people buying and selling. The best thing to do to understand the market would probably be to study the behavior of stupid people in large groups.

Manipulate is a great way to put it. How can a companies stock be trading at such high multiples. I guess if it doesn’t make sense it is senseless. Stock market returns are still generally going up and the value of the US dollar is sinking. Savings are nonexistence among most working and retired. Rents for the new apartments they are building everywhere command very high prices. How can a small family survive. Credit card debt is so high now most can’t begin to pay it down. My feeling is that money is so hard to come by how can governments and utilities charge so much just for basic living needs. We have been told that the great recession was bad but I remember being able to live better mainly because the basic living needs were much more affordable. I felt the country was given back to the people and that Wall Street and big business was not in control like they are now. It is upsetting to see the USA turn in to a debtor nation. I don’t think people are stupid I honestly believe we are being lied to by our governments each and every day.