The Fed leads, others follow

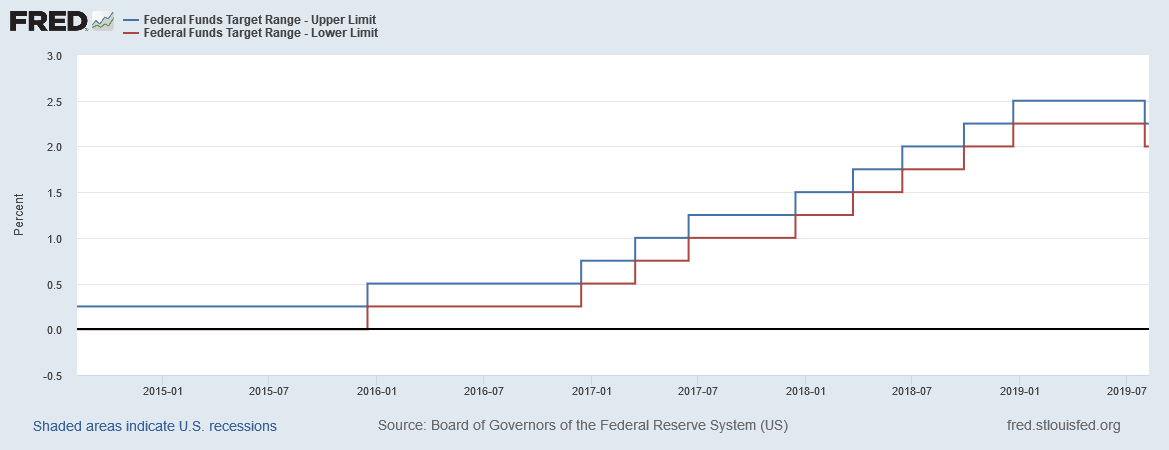

As widely expected by the markets, July ended with the Federal Open Market Committee (FOMC) cutting the target range for federal funds by 25 bps to a range of 2% to 2.25%. A strong labour market was not enough against a gloomy global economic outlook and muted inflation, the main reasons cited for a rate cut.

The Fed leads and others follow? Almost certainly. July ended with 38 countries having their lowest central bank interest rate on record. We will be very surprised if that number isn’t at least 50 by the end of the year.

Singapore economy shrinks

Elsewhere, GDP of Singapore shrank an annualized 3.4% in Q2 2019 vs Q1 2019. The growth was 3.8% in Q1 2019. The main reason for a shrinking economy? Falling exports due to global trade tensions. The standout growth component was Pharma. Well, healthcare is recession proof …

Chinese economic growth slowest in 30 years

Chinese GDP grew at an annualized 6.2% in Q2 2019, the slowest since the current GDP calculation commenced in 1992. “Official” 2018 growth was 6.6%.

9 of the 10 largest economies in the world are seeing slowing growth now. Interest rates are getting cut everywhere but apparently the employment market globally is the most robust in decades. The joy of “official” statistics …

Here’s what we wrote about in July,

Four consumer indicators of the current state of the U.S. economy

Australia’s Central Bank cuts interest rates again to an all-time low of 1%

UK’s trade deficit hit a record in Q1 2019 due to Brexit stockpiling

Germany still accounts for most of the current account surplus of the European Union

Money supply growth for the U.S. has slowed and it isn’t a good sign

Interest Rates for each country and change over the past year – July 2019 Edition

38 countries currently have interest rates at an all-time low

U.S. Q2 2019 GDP growth estimated at 2.1% as personal consumption soars