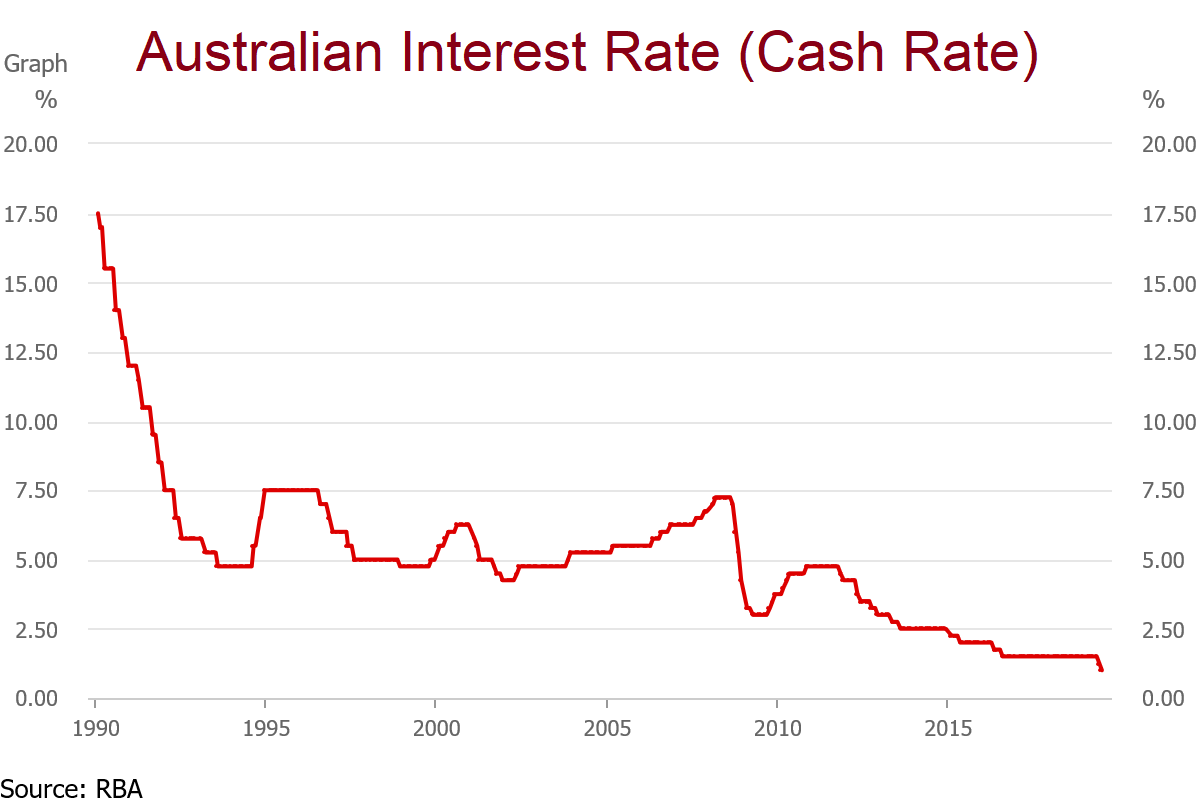

Australia’s Central Bank, the Reserve Bank of Australia (RBA) cut its benchmark cash rate by 25 basis points to an all-time low of 1%. This following a cut of 25 basis points in June. This is the first time since 2012 that the RBA has delivered back-to-back interest rate cuts.

And it added that it could cut rates again if required. In a statement the governor of the RBA, indicated that rates might be pushed even lower if the jobless rate does not fall fast enough and if wages and inflation do not rise to within the target range.

The RBA has an unemployment target of 4.5%, the current rate of unemployment is 5.2%. Consumer spending and wage growth have stalled.

Australia’s property market has been sluggish and that’s the biggest concern. The housing stock in Australia is currently valued at 6.6 trillion Australian dollars ($4.60 trillion), or almost four times the country’s annual GDP. The slowdown in Australia’s property market is being blamed at lower Chinese investment.

Australian 10-year government bonds are currently yielding 1.33% having halved over the past year. The markets are indicating further cuts. What’s next? Negative interest rates like Japan and Switzerland?

Related:

Here’s how Australian Money Velocity has changed over the years