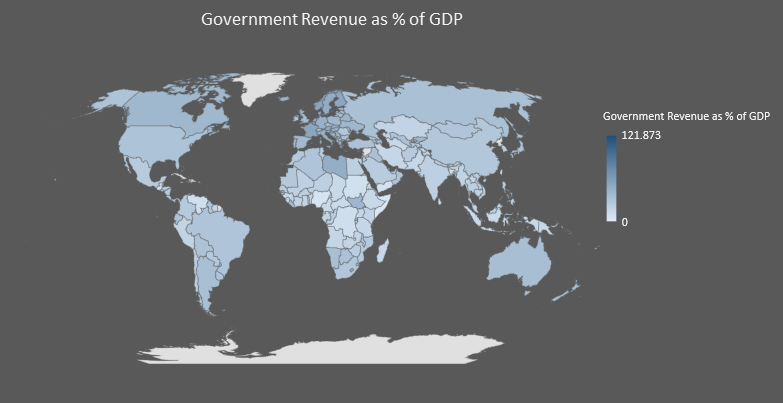

Here is government revenue as percentage of GDP mapped for 2017 (data source: International Monetary Fund),

Continue reading “Government Revenue as percentage of GDP for each country”

Why wouldn’t it be?

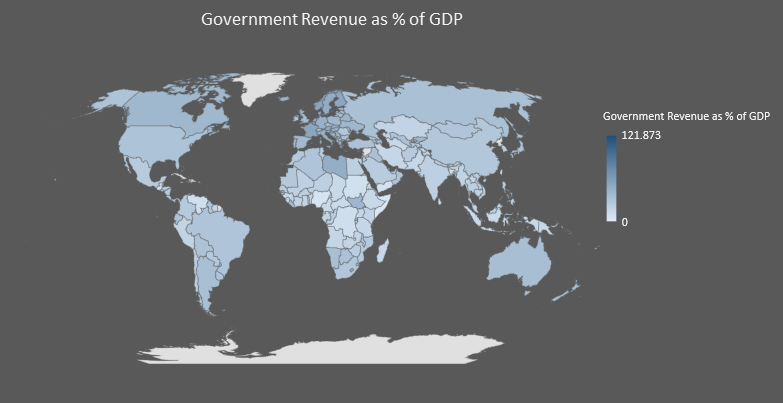

Here is government revenue as percentage of GDP mapped for 2017 (data source: International Monetary Fund),

Continue reading “Government Revenue as percentage of GDP for each country”

Do economic fundamentals matter today? We look at the strange market conditions today. We are living in truly interesting times …

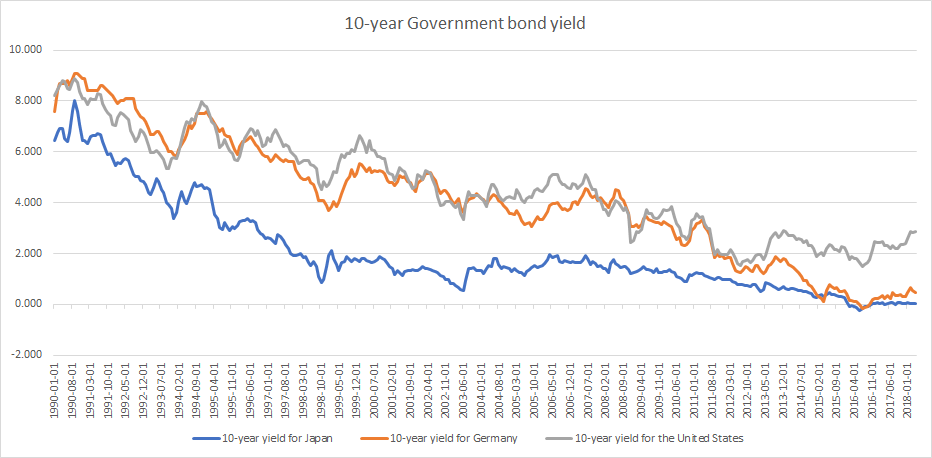

Super low Government bond yields

Government bond yields have never been lower with 2-year yields for most of Europe currently negative. The European Central Bank (ECB) is by far the biggest holder of European bonds and the biggest (almost 90%) buyer of the weaker Eurozone (Italy, Spain, Portugal and Greece) countries debt since 2015. The ECB balance sheet is now over 4.5 trillion Euros, some 45% of Eurozone GDP.

Even 10-year yields for Japan and Switzerland are barely positive.

Yields on government bonds for all maturities over 3 months have never been lower in the history of the world .

Some 80% of 10-year Japanese government bonds are held by the Bank of Japan. And apparently there are days when no one trades those 10-year bonds because there is no point of trading it. Why? Well, because the Bank of Japan has a policy to control yield curves and since they hold majority of it there are hardly any price movements.

Continue reading “Do economic fundamentals matter anymore? Part 3 of 3”

Do economic fundamentals matter today? We look at the strange market conditions today. We are living in truly interesting times …

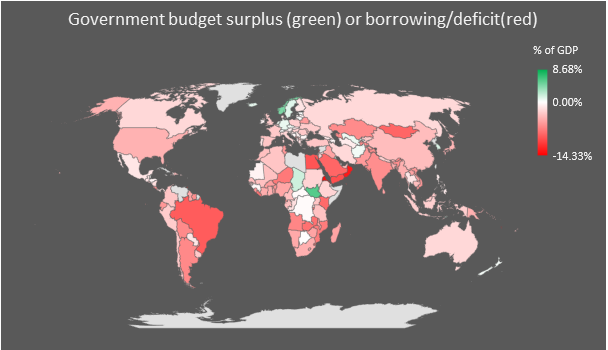

Soaring Government Debt

Just 30 out of the 193 countries that report data to the IMF reported a budgetary surplus in 2017. Only 2 of the 20 G20 nations reported a budgetary surplus. These were South Korea (1.21% of GDP) and Germany (0.69% of GDP).

Continue reading “Do economic fundamentals matter anymore? Part 2 of 3”

Do economic fundamentals matter today? We look at the strange market conditions today. We are living in truly interesting times …

Stock Market Valuations

Equities globally have never been more valuable with market capitalization hitting $90 trillion.

Amazon trades at what a Price to Earnings ratio of some 200. Apple is worth some $900 billion. Even Tesla which makes no profit and is unlikely to make any profit any time soon is worth some $55 billion, more than Ford or General Motors.

Netflix is valued at $159 billion (13.6 times revenues of $11.7 billion) with 110 million paid (and 117 million total) subscribers. Netflix trades at a price to earnings ratio of 220. The company expects free cash flow of -$3 to -$4 billion in 2018 (yes, that is negative cash flow). Yet Netflix’s market cap is now greater than Disney’s and Comcast’s.

Don’t mention fundamentals …

Continue reading “Do economic fundamentals matter anymore? Part 1 of 3”

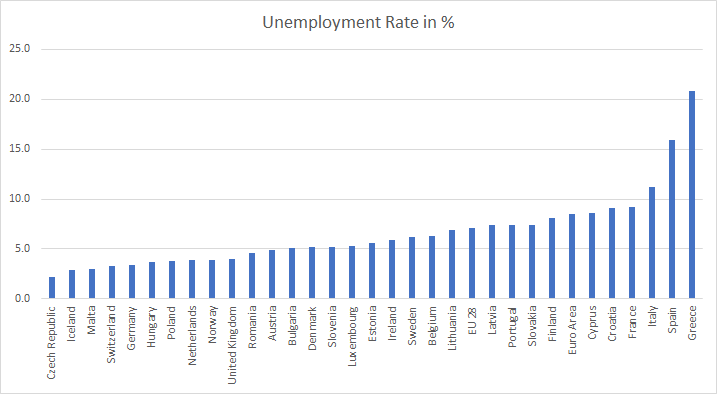

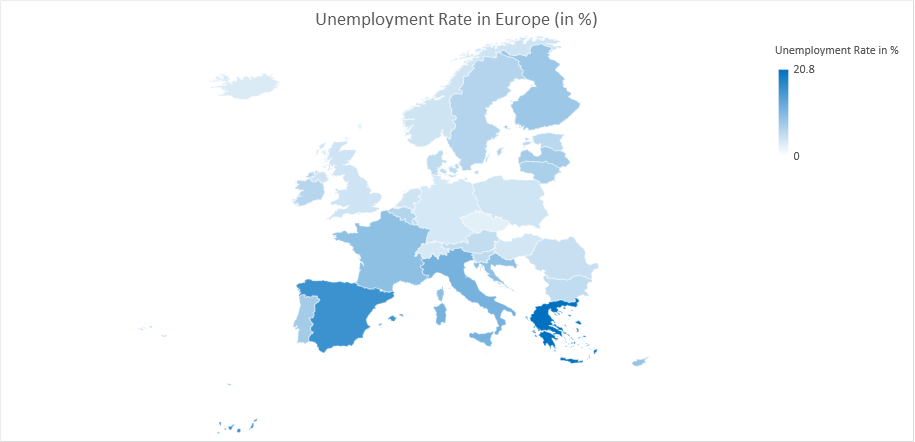

The Euro Area unemployment rate was 8.5% in April 2018, down from 8.6% in March 2018 and from 9.2% in April 2017. This is the lowest since December 2008 but still more than double of the US unemployment rate of 3.9% reported in April (the US unemployment rate further fell to 3.8% in May). The EU28 unemployment rate was 7.1% in April 2018, stable compared with March 2018 and down from 7.8% in April 2017. This remains the lowest rate recorded in the EU28 since September 2008.

Manufacturing has been in focus recently in the United States with trade tariffs being discussed and the talk of bringing back some manufacturing to the United States.

U.S. manufacturing has been growing but it isn’t generating too many new jobs.

The reasons are simple:

Here are some graphs,

Indexed Number of manufacturing jobs vs Indexed manufacturing output (Both indexed to January 2012 = 100)

Deutsche Bank

Apparently, the new CEO of Deutsche Bank is “sick and tired of bad news”. Here are some recent events,

April 8: Christian Sewing is appointed new CEO of Deutsche Bank.

April 15: The European Central Bank (ECB) asks Deutsche Bank to estimate the cost of winding down its investment bank.

Thursday, May 31: The Financial Times reported that Deutsche Bank’s US subsidiary was added to the Federal Deposit Insurance Corporation’s list of “problem banks,” or those with weaknesses that threaten their financial survival.

Thursday, May 31: Deutsche Bank shares hit an all-time low.

Friday, June 1: Standard & Poor’s cut Deutsche Bank’s credit rating from A- to BBB+. The ratings agency also questioned whether Deutsche Bank’s new CEO Christian Sewing would be able to return the bank to profit.

Friday, June 1: Deutsche Bank is going to face new cartel and criminal charges in Australia.

Friday, June 1: Deutsche Bank shares hit new all-time low.

Continue reading “Weekly Overview: Deutsche Bank; Italy; US Unemployment”

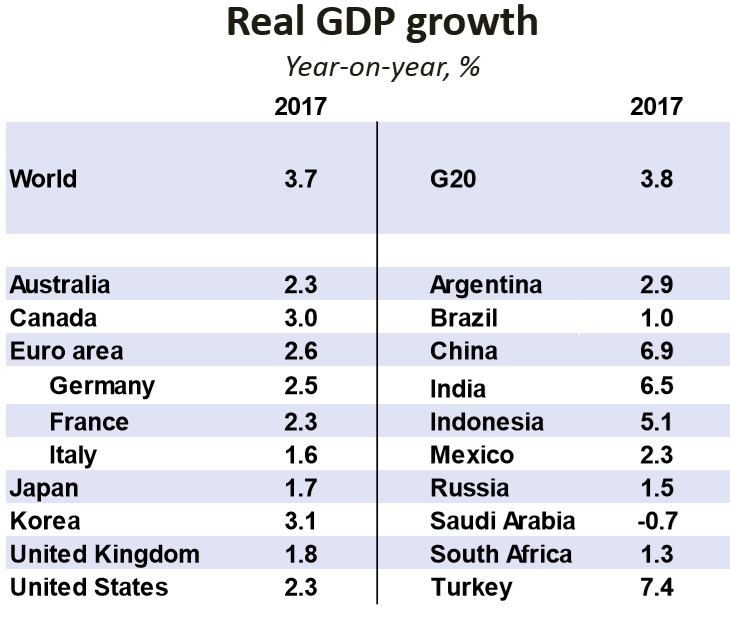

The IMF, OECD and many economists believe that the world is in a phase of synchronised global growth, a time when economies globally grow simultaneously.

Continue reading “The downsides of synchronised global growth”

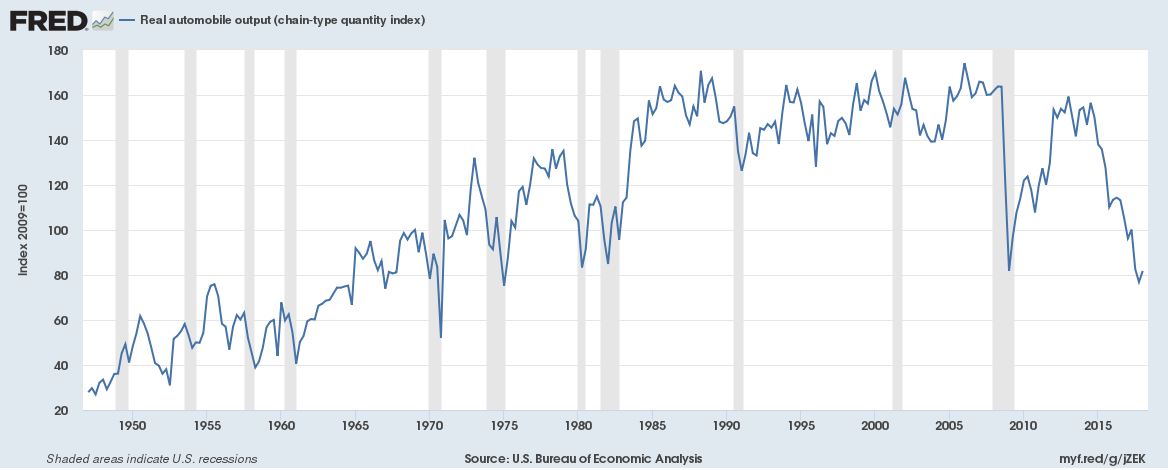

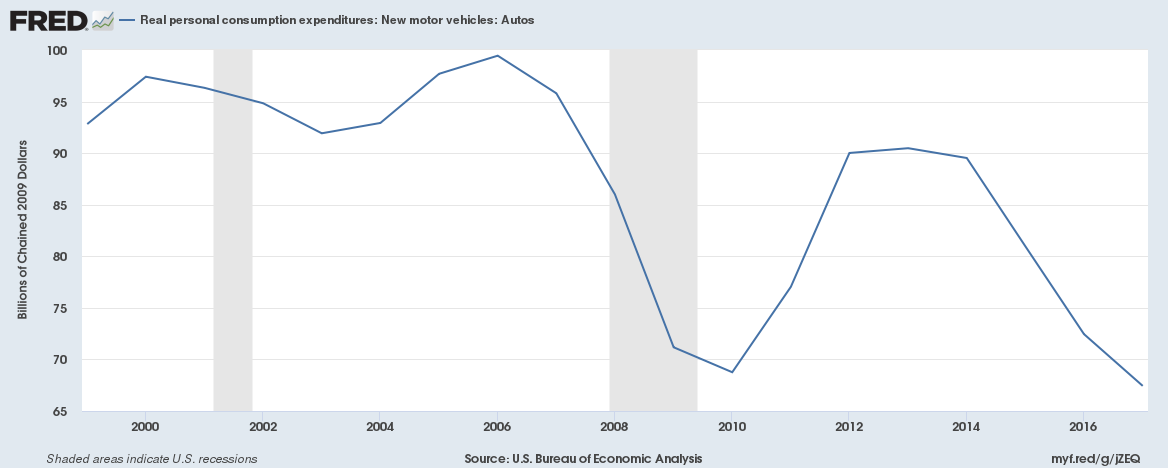

Americans are buying fewer new cars and factories in the U.S. are producing fewer cars. Uber, Lyft and the likes to blame? We will come to that but first output for new cars in the U.S. is close to a 43-year low.

And a chart on spend on new cars,

Continue reading “New car output in the United States is close to a 43-year low”

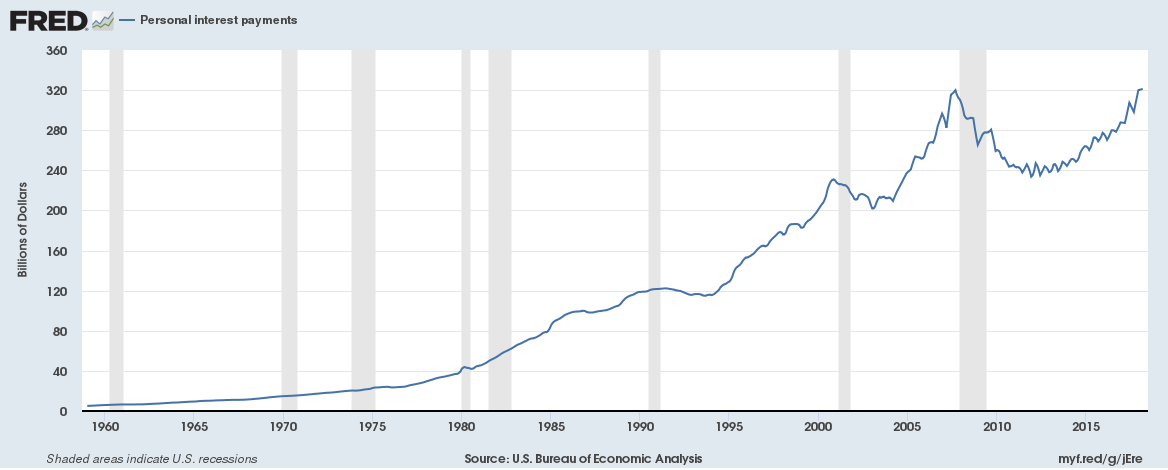

Personal interest payments for households in the United States have hit an all-time high with annualized interest payments now $321 billion, this despite low interest rates currently.

Continue reading “U.S. Personal interest payments hit all time high despite low interest rates”