It has been 10 years since the collapse of Lehman Brothers triggered the largest economic crash in living memory, how much has really changed since then? A lot has changed since then but not entirely as one would have expected …

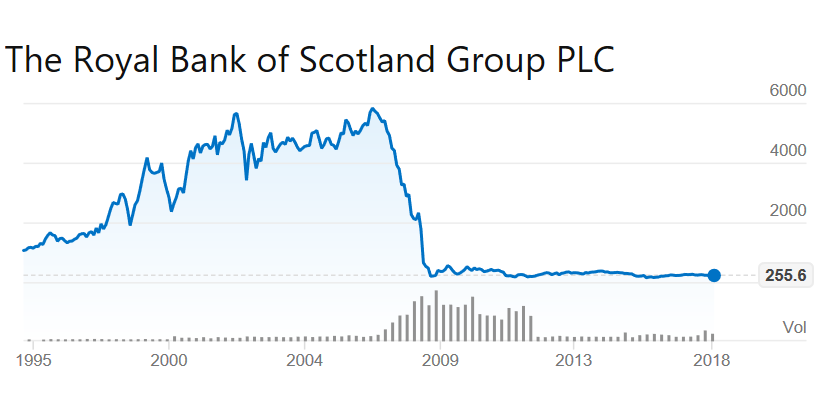

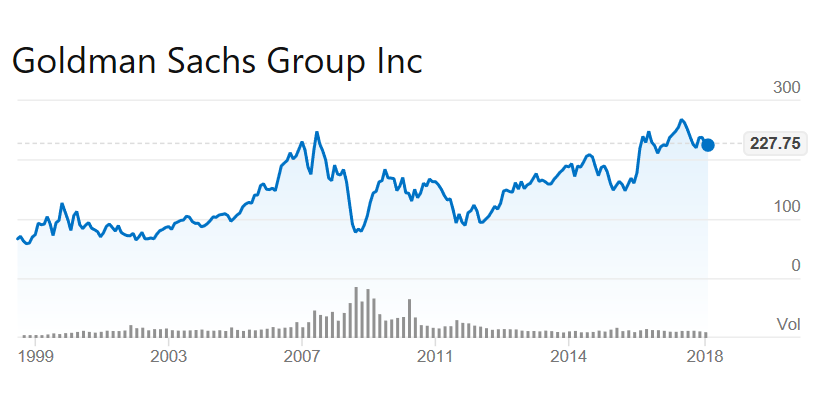

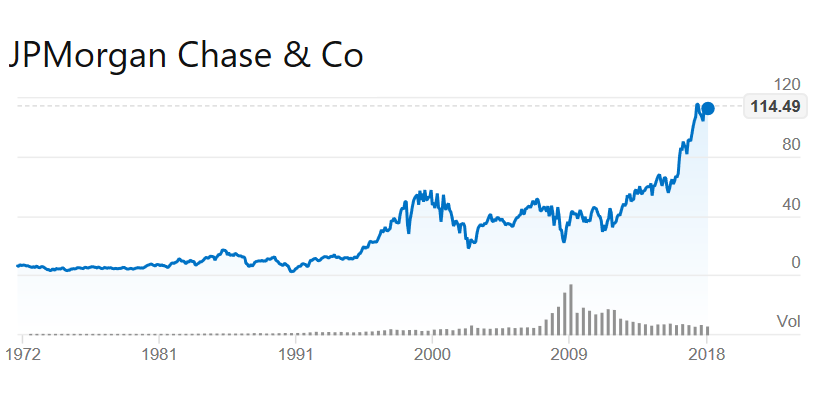

(Most) Bank Stocks have taken a beating

Bank stocks have largely fallen for most European Banks and Citi, but J P Morgan has done rather well

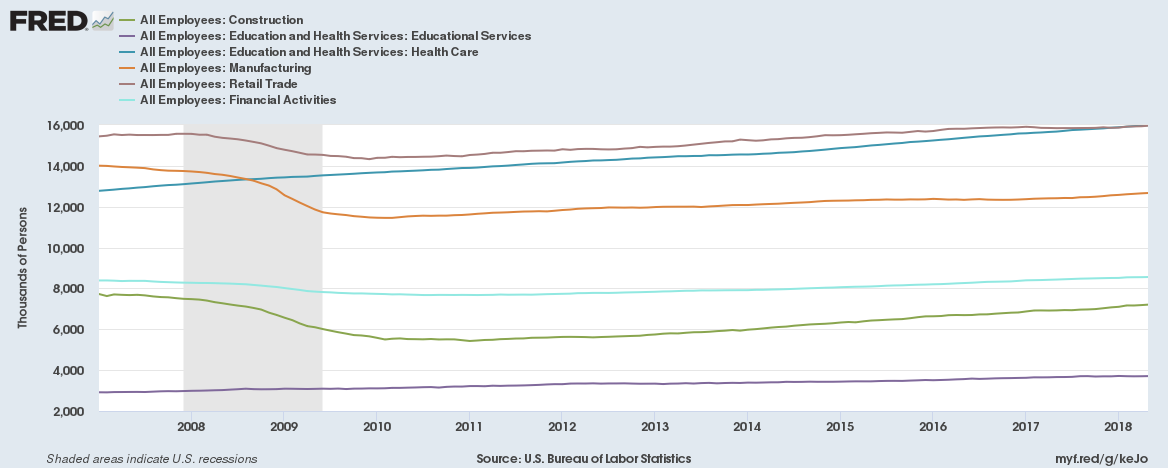

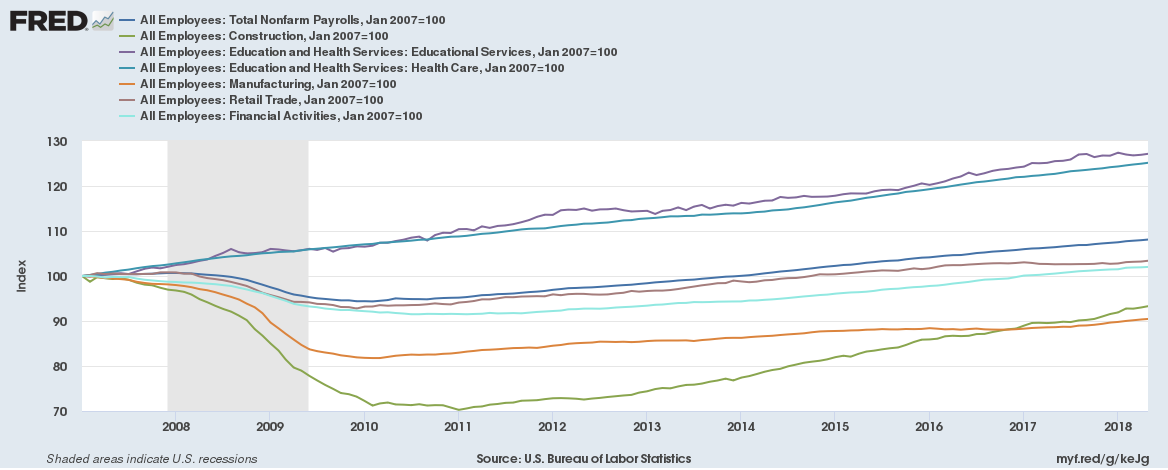

Financial Services jobs have decreased globally and have just been flat in the United States

The crisis has left the world with a smaller financial services industry with jobs falling everywhere and being just about flat in the United States.

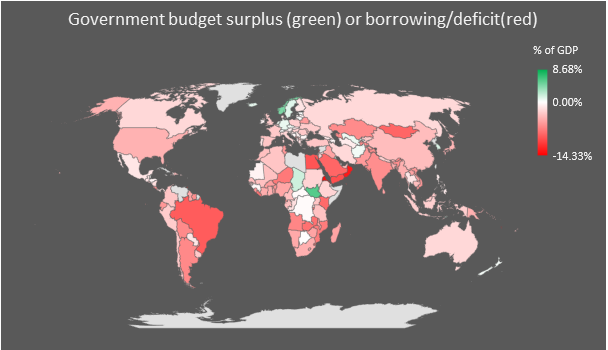

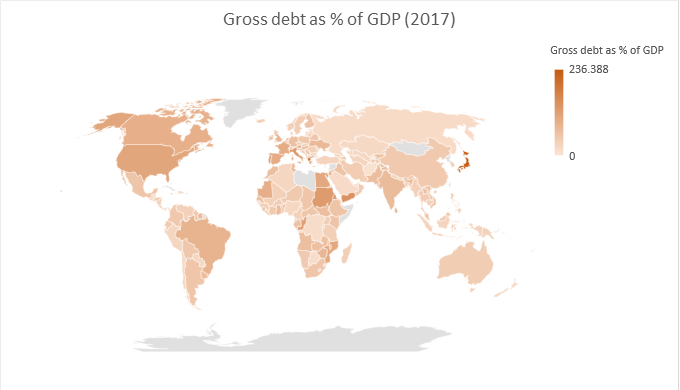

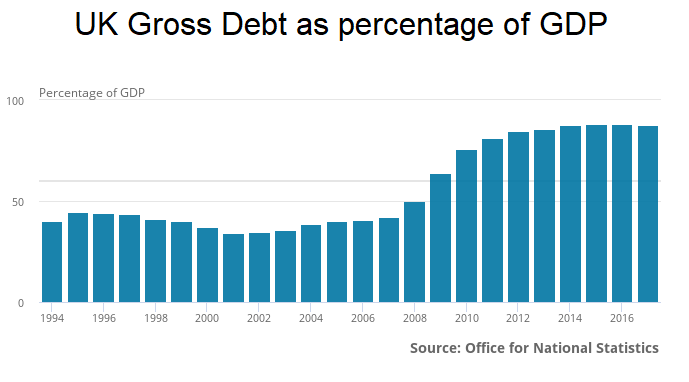

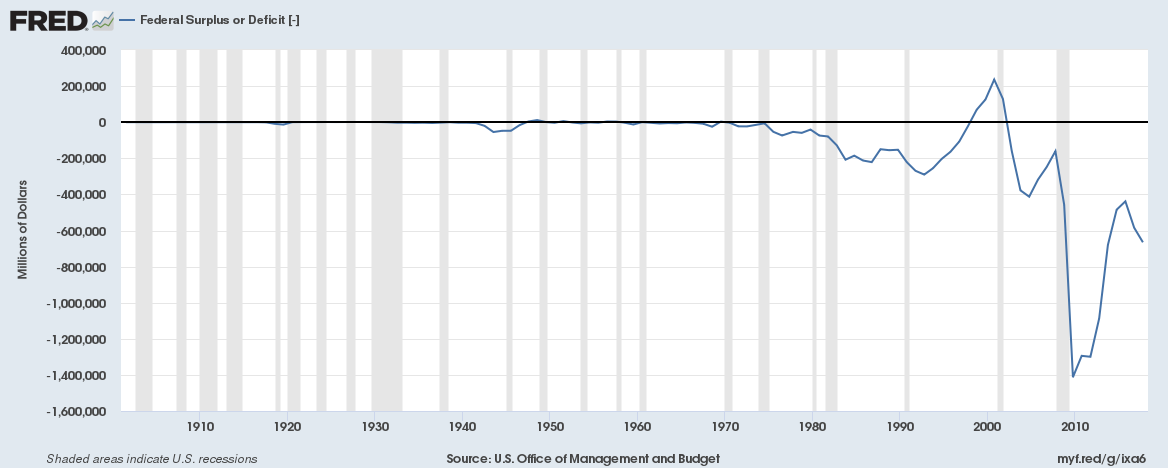

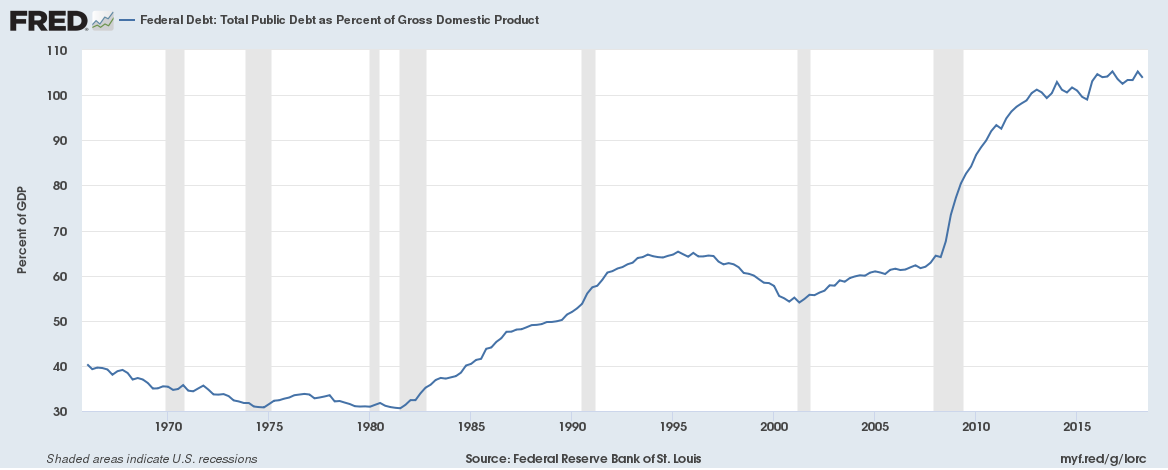

Government Debt has soared (specially for the United States)

Just 30 out of the 193 countries that report data to the IMF reported a budgetary surplus in 2017. Only 2 of the 20 G20 nations reported a budgetary surplus. These were South Korea (1.21% of GDP) and Germany (0.69% of GDP).

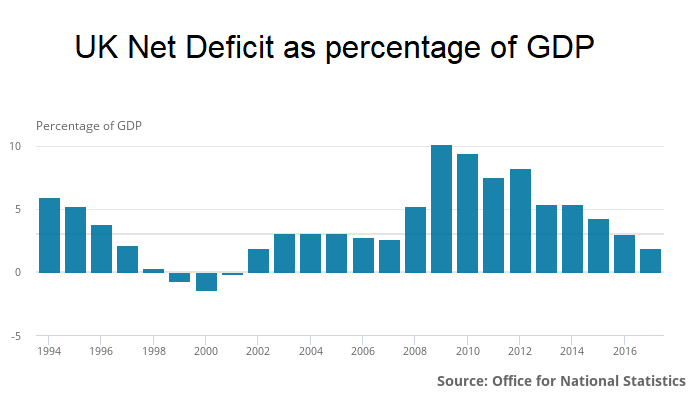

For the United States and the United Kingdom debt (actual and as a percentage of GDP) has doubled.

For the United Kingdom the budget deficit is now falling (but debt is still very high)

.. but is soaring for the United States

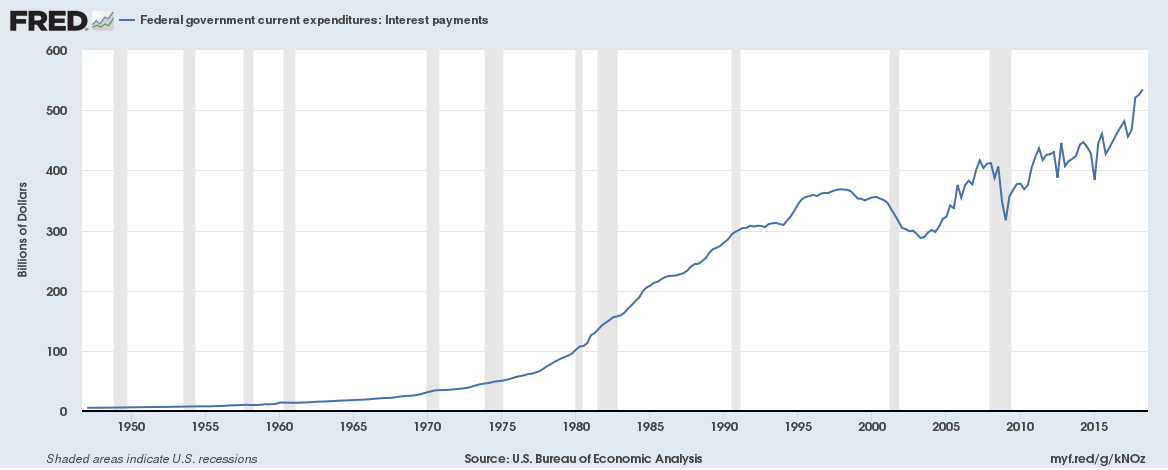

… and interest payments on U.S. government debt are soaring

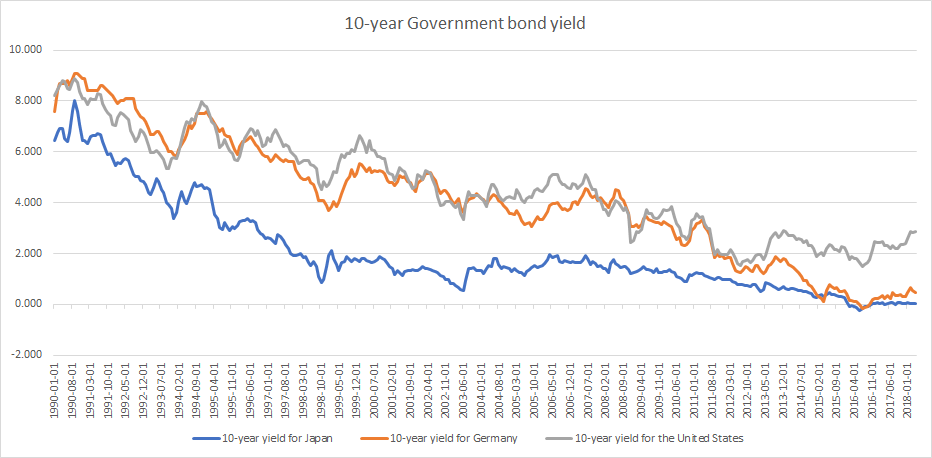

The U.S. and mainland Europe have moved in different directions on financial strategy

Europe – Zero or negative interest rates, almost no interest on government bonds, falling budgetary deficits or surpluses, banks haven’t really recovered from the crisis, equity markets only slightly up since 2008 highs

United States – Rising interest rates, rising yields on government bonds, rising budgetary deficit, banks have recovered from the crisis, equity markets are up 300% from crisis lows

The United States is expected to post a budgetary deficit of over $1 trillion this year. Europe is doing much better with Germany and the Netherlands posting a budgetary surplus while France, Italy and Spain have decreasing budgetary deficits.

The only thing is that countries in Europe have been able to reduce budgetary deficits or post budgetary surpluses because the interest costs on their historic borrowing is at record lows. And interest costs are at record lows because bond yields are at record lows. And bond yields are at record lows because the European Central Bank has by far been the biggest buyer of European bonds since 2015. That is changing though with the European Central Bank expecting to end Quantitative easing or bond buying by the end of the year.

The main thing to note is that the United States and main land Europe have never been so divergent on financial strategy.

Banks in the U.S. suffered huge losses in the aftermath of the financial crisis of 2008, and had major write offs and their share prices fell significantly. The U.S. economy took a major hit between 2008 to 2010. U.S. Banks are currently very healthy with delinquency rates close to record lows and share prices back up. The U.S. is back on its way to normalizing interest rates.

European banks didn’t really take as a major hit in the aftermath of the financial crisis of 2008. The European banking crisis is far from over and share prices of banks are on an average much lower than they were in 2008. The Eurozone (and Sweden, Denmark and the likes) are likely to continue with the zero or negative interest regime for some time.

Super low Government bond yields

Government bond yields have never been lower with 2-year yields for most of Europe currently negative. The European Central Bank (ECB) is by far the biggest holder of European bonds and the biggest (almost 90%) buyer of the weaker Eurozone (Italy, Spain, Portugal and Greece) countries debt since 2015. The ECB balance sheet is now over 4.5 trillion Euros, some 45% of Eurozone GDP.

Even 10-year yields for Japan and Switzerland are barely positive.

Yields on government bonds for all maturities over 3 months have never been lower in the history of the world . Some 80% of 10-year Japanese government bonds are held by the Bank of Japan. And apparently there are days when no one trades those 10-year bonds because there is no point of trading it. Why? Well, because the Bank of Japan has a policy to control yield curves and since they hold majority of it there are hardly any price movements.

Some things never change, they just become different. This time it is different.

Related:

Do economic fundamentals matter anymore?