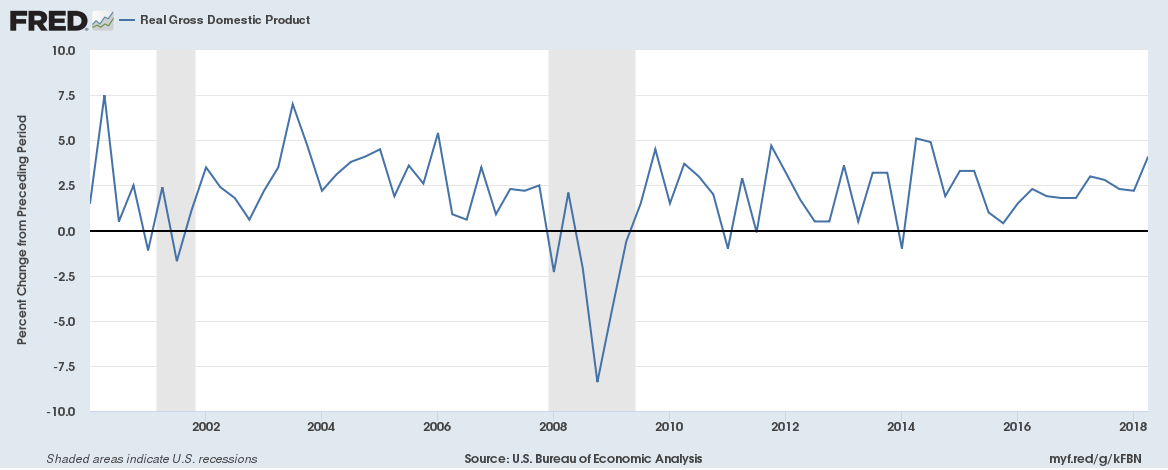

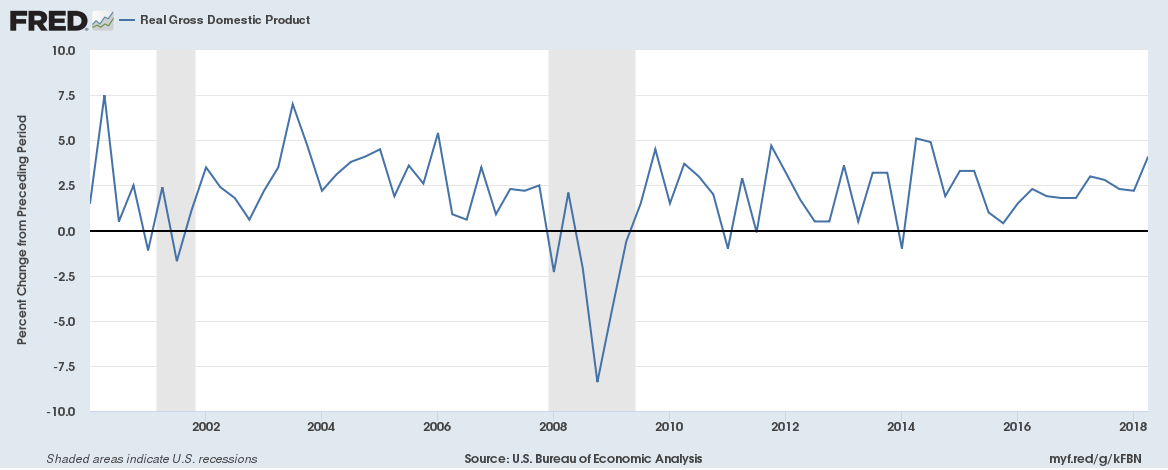

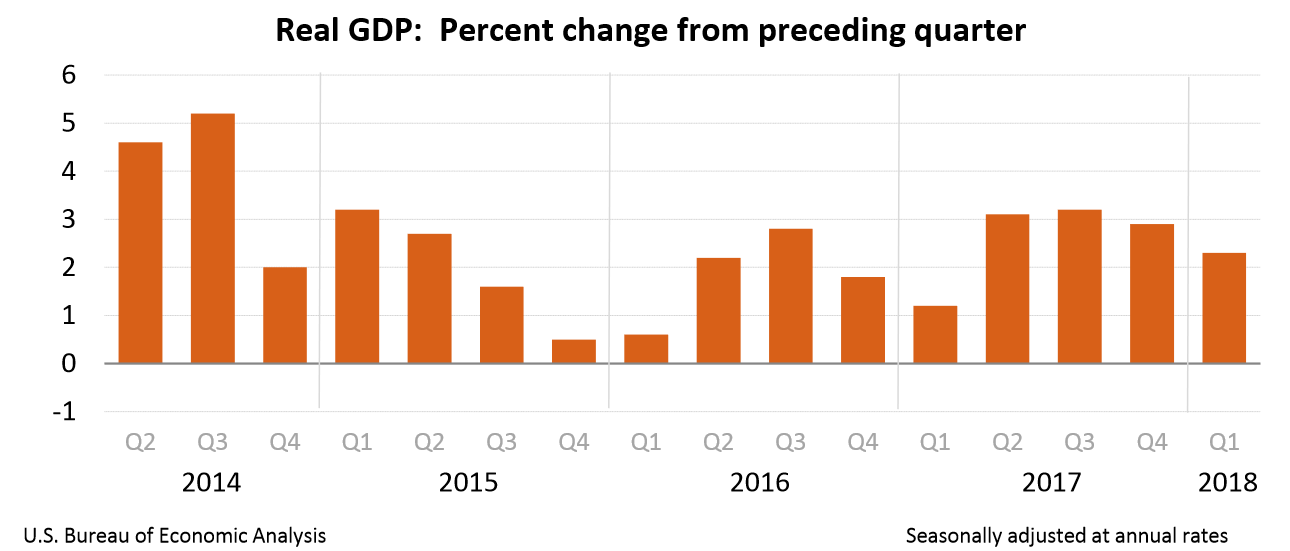

Real gross domestic product for the United States increased at an annual rate of 4.1% in Q2 2018 according to the advance estimate released by the Bureau of Economic Analysis.

Why wouldn’t it be?

Real gross domestic product for the United States increased at an annual rate of 4.1% in Q2 2018 according to the advance estimate released by the Bureau of Economic Analysis.

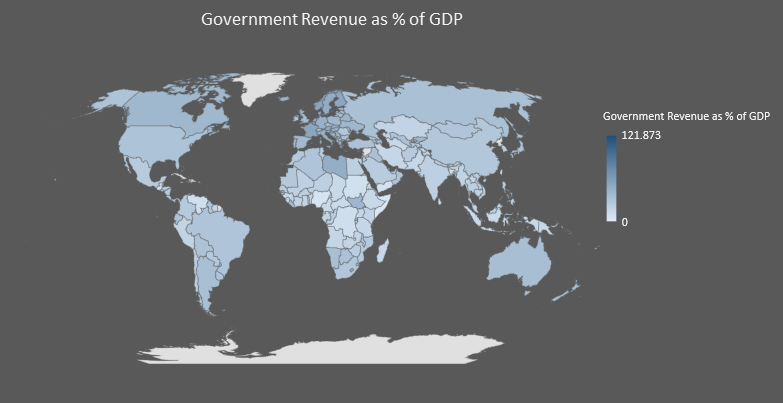

Here is government revenue as percentage of GDP mapped for 2017 (data source: International Monetary Fund),

Continue reading “Government Revenue as percentage of GDP for each country”

Do economic fundamentals matter today? We look at the strange market conditions today. We are living in truly interesting times …

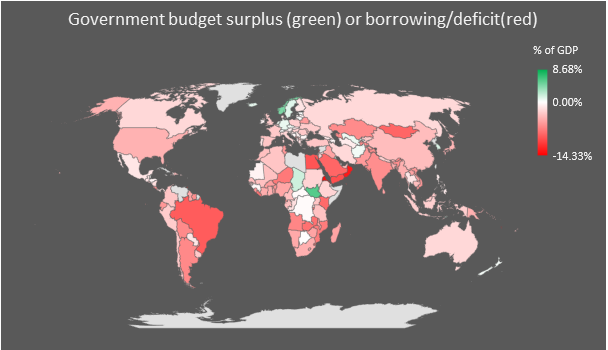

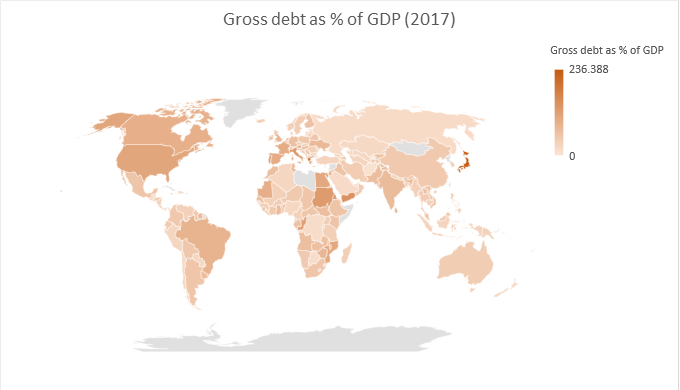

Soaring Government Debt

Just 30 out of the 193 countries that report data to the IMF reported a budgetary surplus in 2017. Only 2 of the 20 G20 nations reported a budgetary surplus. These were South Korea (1.21% of GDP) and Germany (0.69% of GDP).

Continue reading “Do economic fundamentals matter anymore? Part 2 of 3”

Do economic fundamentals matter today? We look at the strange market conditions today. We are living in truly interesting times …

Stock Market Valuations

Equities globally have never been more valuable with market capitalization hitting $90 trillion.

Amazon trades at what a Price to Earnings ratio of some 200. Apple is worth some $900 billion. Even Tesla which makes no profit and is unlikely to make any profit any time soon is worth some $55 billion, more than Ford or General Motors.

Netflix is valued at $159 billion (13.6 times revenues of $11.7 billion) with 110 million paid (and 117 million total) subscribers. Netflix trades at a price to earnings ratio of 220. The company expects free cash flow of -$3 to -$4 billion in 2018 (yes, that is negative cash flow). Yet Netflix’s market cap is now greater than Disney’s and Comcast’s.

Don’t mention fundamentals …

Continue reading “Do economic fundamentals matter anymore? Part 1 of 3”

Emerging Markets are being routed with rising oil and a soaring US dollar

Here is the performance of the US dollar against emerging market currencies (figures in brackets are 1-month % change),

USD/MXN – Mexico 19.9450 (+8.17%)

USD/INR – India 67.9850 (+3.23%)

USD/TRY – Turkey 4.4894 (+10.07%)

USD/BRL – Brazil 3.7375 (+10.33%)

USD/ZAR – South Africa 12.7550 (+6.71%) Continue reading “Weekly Overview: Emerging Market Rout; New Italian Government; Japan GDP; Oil surge continues”

US and emerging market bond yields

The US 10-year bond yield soared to 3.09% today (up 75 bps over the past year and 25 bps over the past month), the highest since 2011. The 2-year yield hit 2.59%, the highest since August 2008 (read more here on the financial impact of rising yields for the US Government).

The bigger story is of emerging markets though. Brazilian and Indian 10-year yields have soared 33 bps in just a week. The Brazilian 10-year bond yield topped 10.12% while the Indian 10-year bond yield topped 7.91%. The US dollar has gained 7% against the Brazilian Real and 4% against the Indian Rupee over the past month.

Canadian bond yields are soaring the most amongst developed nations with the 10-year yield hitting 2.51%, up 94 bps over the past year and 24 bps over the past month. Continue reading “US and emerging market bond yields soar; UK retail; US Student debt; German GDP”

Q1 2018 GDP

The US, the UK, France and Spain all reported GDP numbers over the last week.

US real GDP increased at an annual rate of 2.3% in the first quarter of 2018 as per an advance estimate released by the Bureau of Economic Analysis. Read more about it here.

Personal consumption collapsed, with vehicle sale falling significantly. Business inventories were up significantly too. Total employee compensation (which includes wages and benefits) rose 2.7% over past 12 months, up from 2.4% a year ago and the highest since Q3 2008, while the household savings rate fell to a multi-year low of 3.1%.

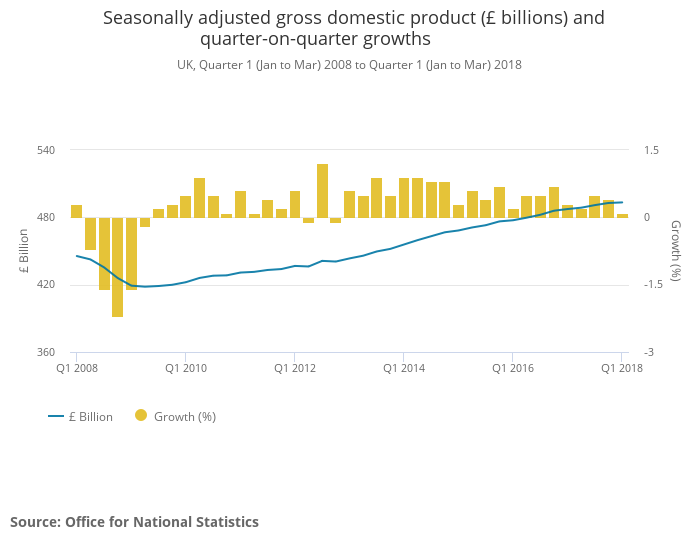

UK GDP was estimated to have increased by 0.1% in Q1 2018 as per the Office for National Statistics. We reported here at the end of March that UK households’ saving ratio fell to the lowest ever on record as mortgage and consumer credit outstanding hit the highest ever.

Continue reading “UK Q1 2018 GDP only increased by 0.1%, growth slowest since Q4 2012”

US real GDP increased at an annual rate of 2.3% in the first quarter of 2018 as per an advance estimate released by the Bureau of Economic Analysis.

Here is the gross debt of every country as percentage of GDP for 2017 (source: International Monetary Fund),

Continue reading “Gross and net debt of every country as percentage of GDP for 2017”