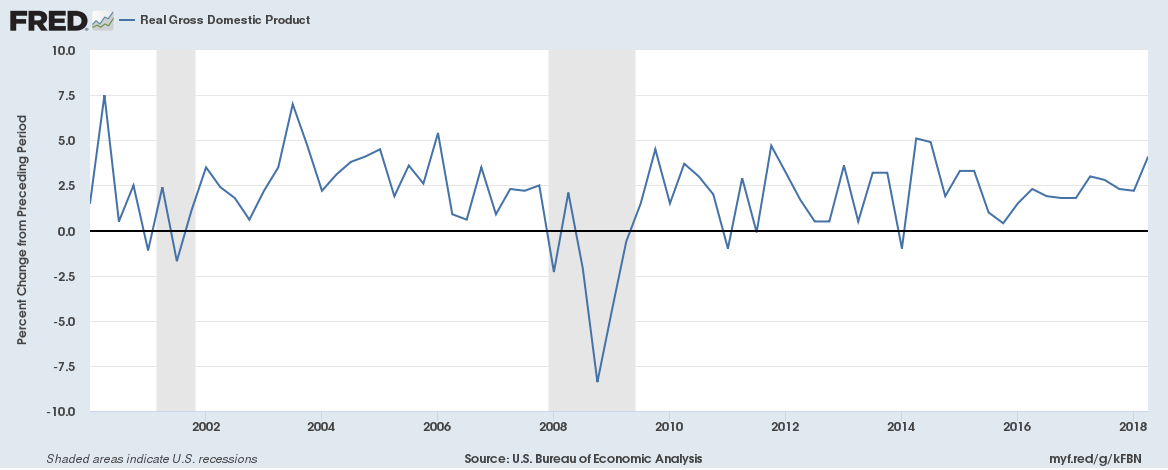

Real gross domestic product for the United States increased at an annual rate of 4.1% in Q2 2018 according to the advance estimate released by the Bureau of Economic Analysis.

Why wouldn’t it be?

Real gross domestic product for the United States increased at an annual rate of 4.1% in Q2 2018 according to the advance estimate released by the Bureau of Economic Analysis.

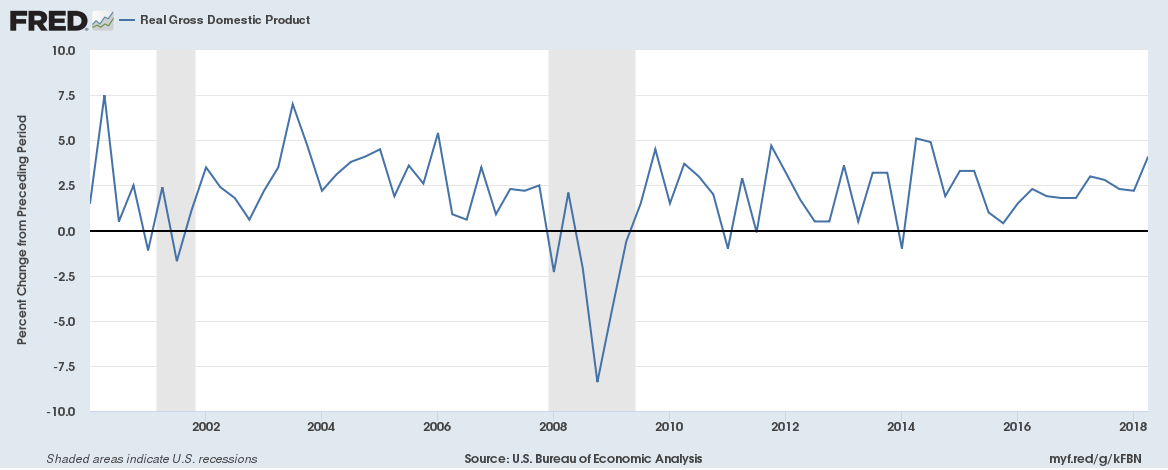

Households in the United Kingdom have seen their outgoings surpass their income for the first time in nearly 30 years as per a release from the Office for National Statistics.

On average, each UK household spent or invested around £900 more than they received in income in 2017. The total amounted to almost £25 billion for all households in the UK. Households’ outgoings last outstripped their income for a whole year in 1988, although the shortfall was much smaller at just £0.3 billion back then.

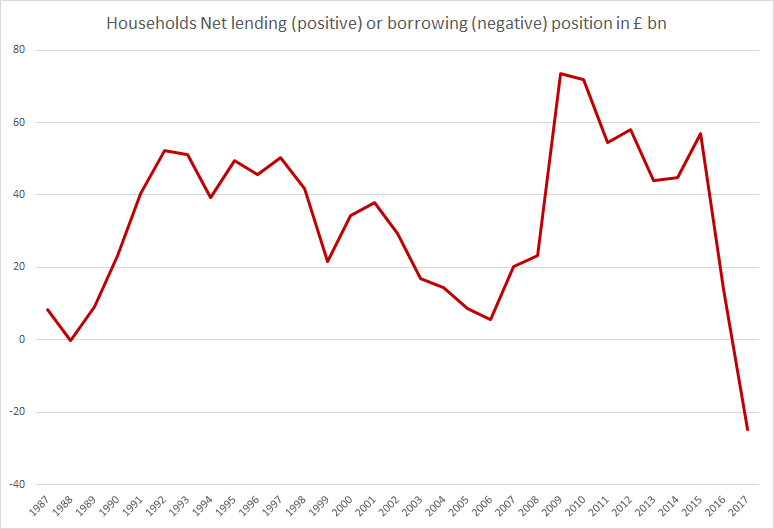

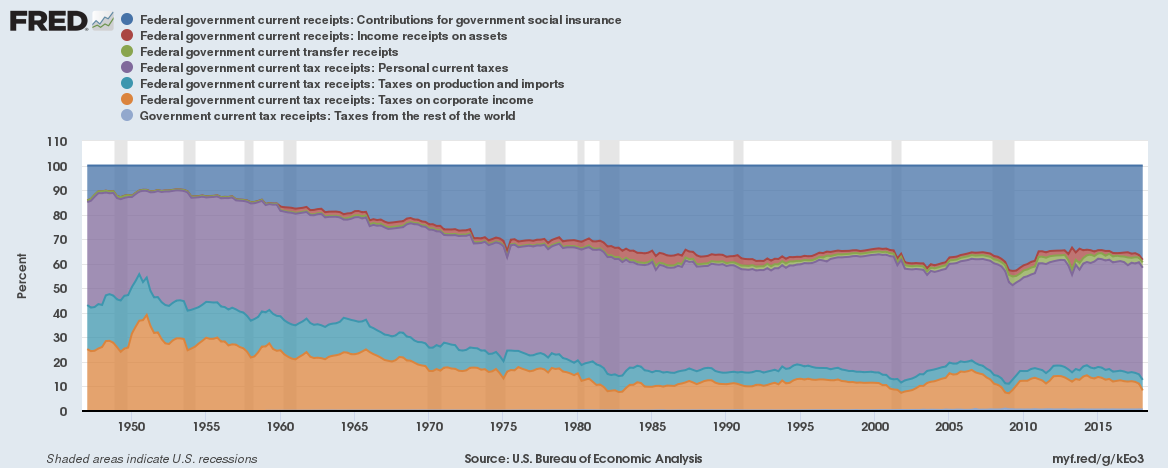

Personal taxes now contribute a multi-year record 45.7% of total Federal government receipts.

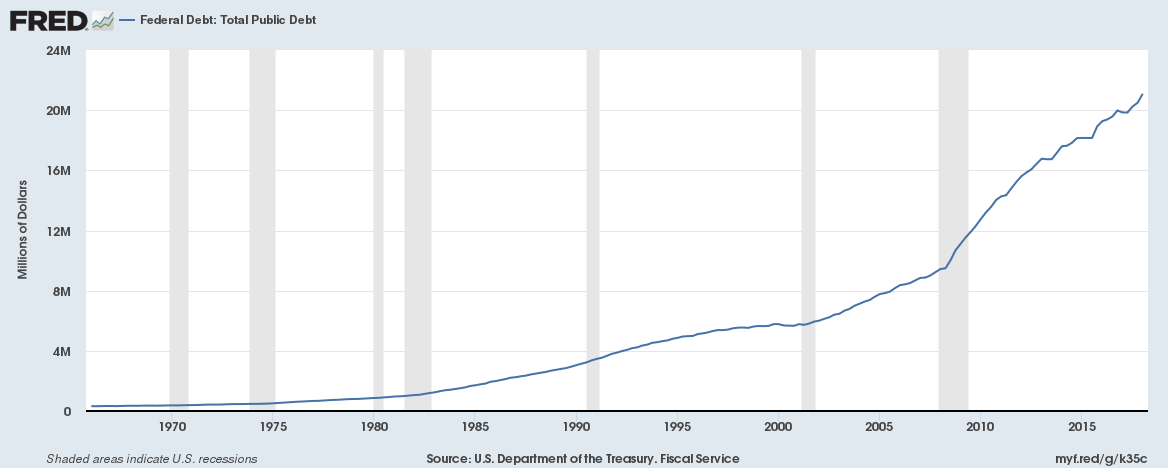

The United States government is likely to run a record fiscal deficit this year due to lower tax receipts. And given deficits since 2001, Federal debt is soaring (chart below). In the immediate aftermath of the last recession, the Federal Reserve was a major buyer of U.S. Treasury bonds.

Since 2014 though, the Fed isn’t really a buyer of Treasury bonds. The question is who is buying federal government debt?

The first estimate for the European Union exports of goods in May 2018 was €160.9 billion, down by 2.7% compared with May 2017 (€165.4 bn). Imports from the rest of the world stood at €160.7 bn, down by 1.4% compared with May 2017 (€163.0 bn). As a result, the European Union recorded a €0.2 bn surplus in trade in goods with the rest of the world in May 2018, compared with a surplus of €2.3 bn in May 2017. Intra-European Union trade rose to €294.7 bn in May 2018, +1.6% compared with May 2017.

In January to May 2018, the European Union exports of goods rose to €786.6 bn (an increase of 1.5% compared with January-May 2017), while imports rose to €795.7 bn (an increase of 1.6% compared with January-May 2017). As a result, the European Union recorded a deficit of €9.1 bn, compared with a deficit of €8.1 bn in January-May 2017. Intra-European Union trade rose to €1457.3 bn in January-May 2018, +4.6% compared with January-May 2017.

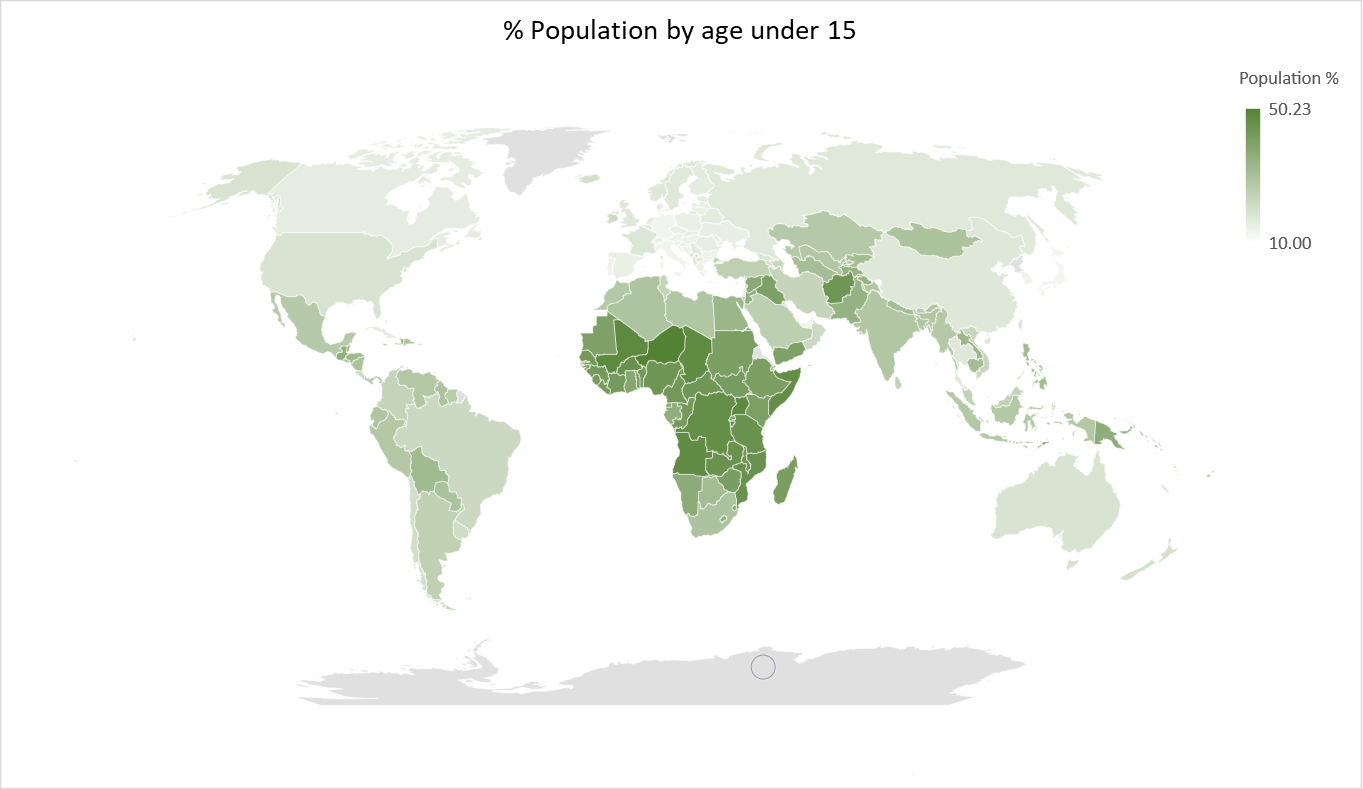

We recently posted about population percentage for each country by age. The data was for 2016 from the World Bank and is the latest set of available data. We also wrote about the business of aging – how changing demographics are shaping the economic future in more ways than one. Here we explore if the youth economic dividend that many economists point to exists in the current world order.

Here is a map of population percentage for age below 15:

Continue reading “The youth economic dividend – does it really exist for the current day world?”

This time it is different. Here are some good quotes on money, finance and investing:

“We live by the Golden Rule. Those who have the gold make the rules.” – Buzzie Bavasi

“What we learn from history is that people don’t learn from history.” – Warren Buffett

“A banker is a fellow who lends you his umbrella when the sun is shining but wants it back the minute it begins to rain.” – Mark Twain

“Sometimes your best investments are the ones you don’t make.” – Donald J. Trump

“Credit is a system whereby a person who can’t pay, gets another person who can’t pay, to guarantee that he can pay.” – Charles Dickens, Little Dorrit

Continue reading “Some good quotes on money, finance and investing”

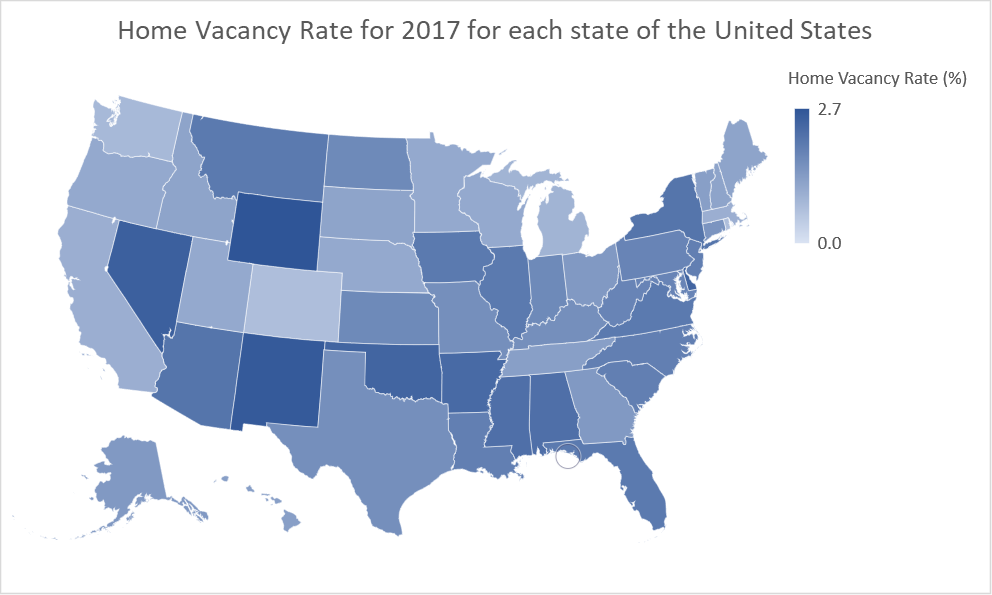

The home vacancy rate is the proportion of the homeowner inventory that is vacant for sale.

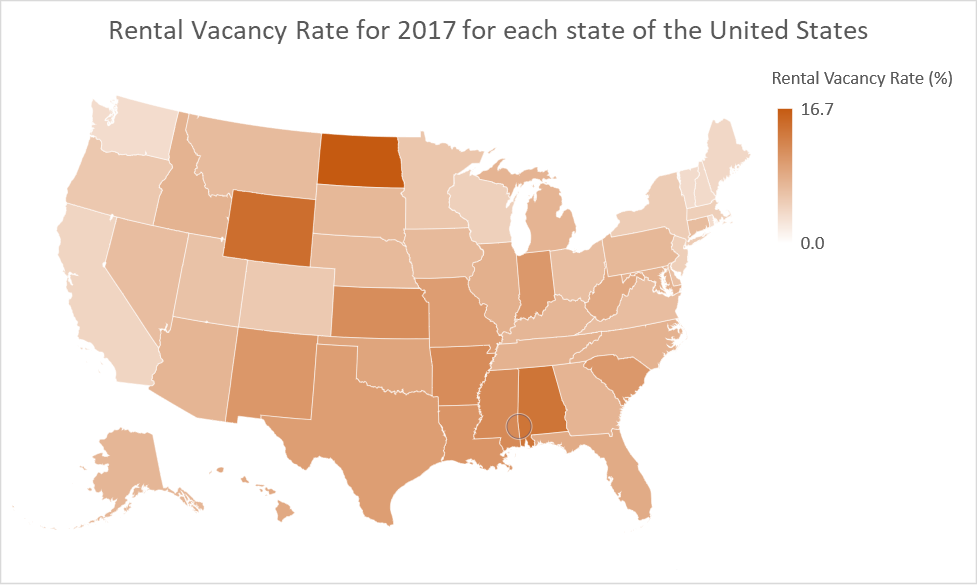

The rental vacancy rate is the proportion of the rental inventory that is vacant for rent.

Here are the home and rental vacancy rates for each state of the United States (Data Source: U.S. Bureau of the Census),

Continue reading “Home and Rental Vacancy Rate for each state of the United States”

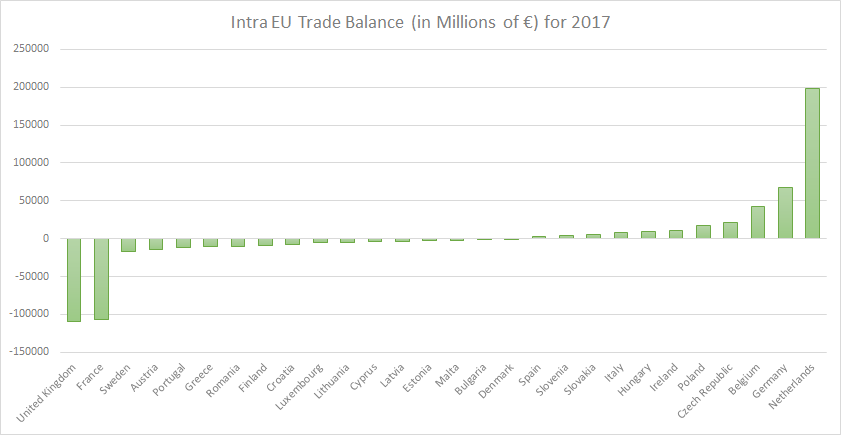

Some surprises in Intra European Union (EU) Trade Statistics for 2017: Germany was the largest exporter as expected but unexpectedly also the largest importer. The Netherlands (and not Germany) had the largest trade surplus. The United Kingdom had the largest trade deficit (no trade deal Brexit still on the table?)

Here is additional information, the complete dataset and maps,

We haven’t written about bond yields for some time. Government bond yields have largely been falling despite Central Banks announcing reductions or end to their bond buying programmes.

The only notable countries where yields are still up over the past year are the United States, Canada, Italy and Emerging Markets.

It wouldn’t appear that the market is anticipating interest rate rises in the short term. We will write about that in a few days but in the meanwhile here are 10-year government bond yields as of 14th July 2018 (figure in brackets indicate absolute 1-year change),