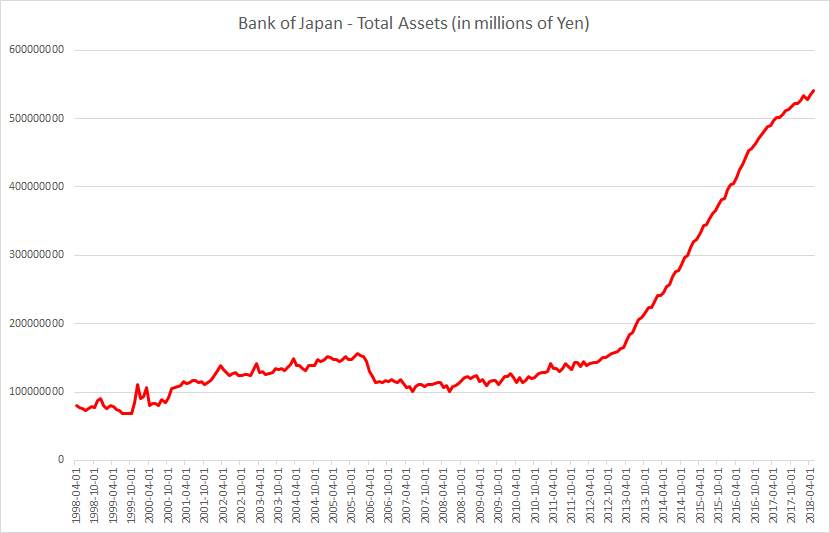

Central Banks have grown their balance sheets significantly in the past 20 years and almost exponentially since the 2008 financial crisis. Here’s how much the balance sheets of the Bank of Japan, the Swiss National Bank, the Federal Reserve and the European Central Bank have grown in the 21st century,

Bank of Japan

Total assets: 540.8036 trillion Yen (JPY) = 4.93 trillion US Dollars (USD)

As of date: May 1, 2018

Asset size as percentage of GDP: 101% of GDP

Interesting information: The Bank of Japan has a target to buy 6 trillion Yen ($54 billion) worth of exchange traded funds a year. It now holds almost 82% of all ETFs in Japan and is indirectly the largest shareholder in many large Japanese companies, almost about half of listed companies in Japan.