We recently wrote about the impact of rising interest rates for UK households, read more about it here. We also wrote about the impact of higher bond yields for the US government, read more about it here.

Impact of higher interest rates for the UK Government

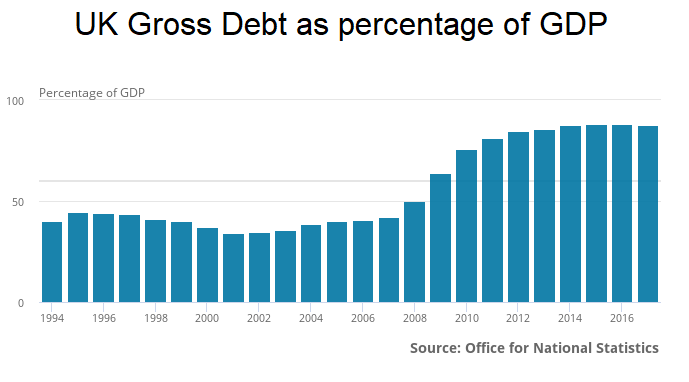

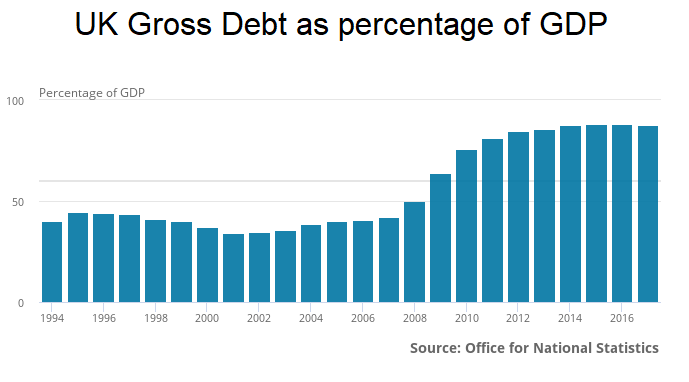

The UK government has around £1.72 trillion in debt and pays around £36 billion in interest payments a year (an effective interest rate of 2%).

The UK tax revenues are around £800 billion a year, which would mean 4.5% of all tax revenues are paid as interest. The UK has paid £540 billion in interest since it last ran a surplus in 2001.

Continue reading “Can the UK Government afford higher interest rates or rising bond yields?”

Continue reading “Can the UK Government afford higher interest rates or rising bond yields?”