Did interest rates rise or fall globally in 2018?

Continue reading “Here are interest rates for every country and how much they changed in 2018”

Why wouldn’t it be?

Did interest rates rise or fall globally in 2018?

Continue reading “Here are interest rates for every country and how much they changed in 2018”

Sweden’s Central Bank, the Riksbank raised interest rates for the first time in seven years on Thursday which might cause further European monetary tightening. Riksbank’s benchmark repo rate was raised 25 bps from -0.5% earlier to -0.25%. It still remains negative though.

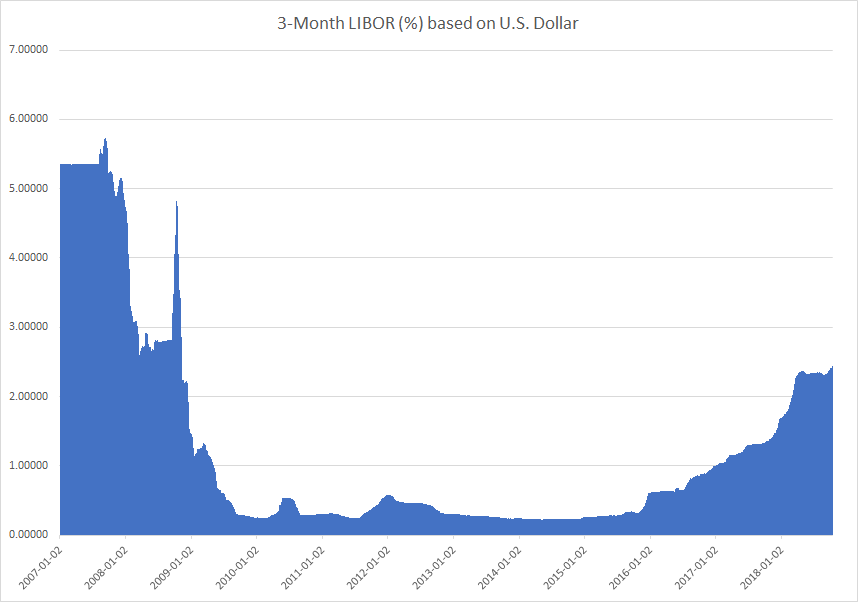

Three-month U.S. Dollar London interbank offered rate (LIBOR) that serves as the basis for trillions of dollars in loans and floating-rate securities globally hit a 10-year high of 2.45%, the highest level since November 2008.

The reasons aren’t what you think …

Continue reading “Here’s why the Federal Reserve increasing interest rates could be a problem”

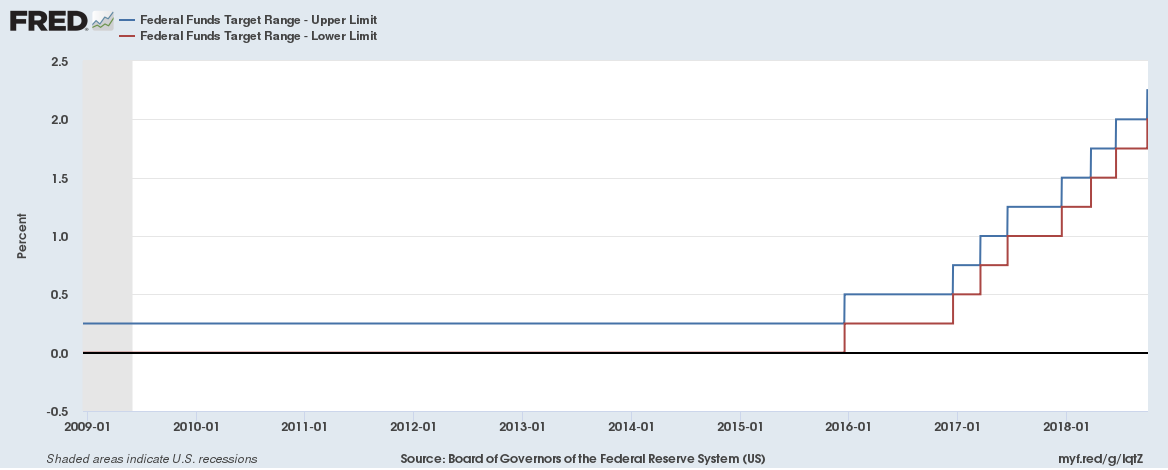

The Federal Reserve increased the target for the bank’s benchmark rate by 0.25% (to a range of 2% to 2.25%) last week, the eighth rate rise since 2015. Are rising interest rates really having any impact on mortgage or saving rates?

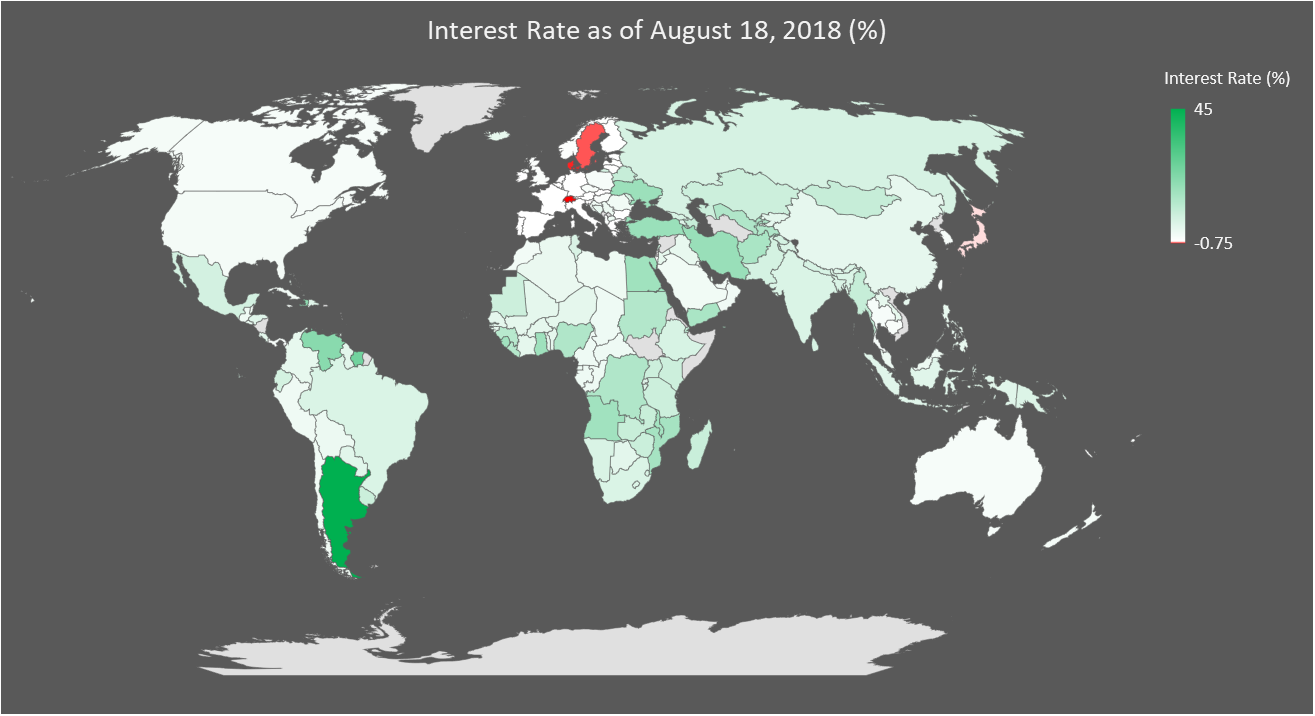

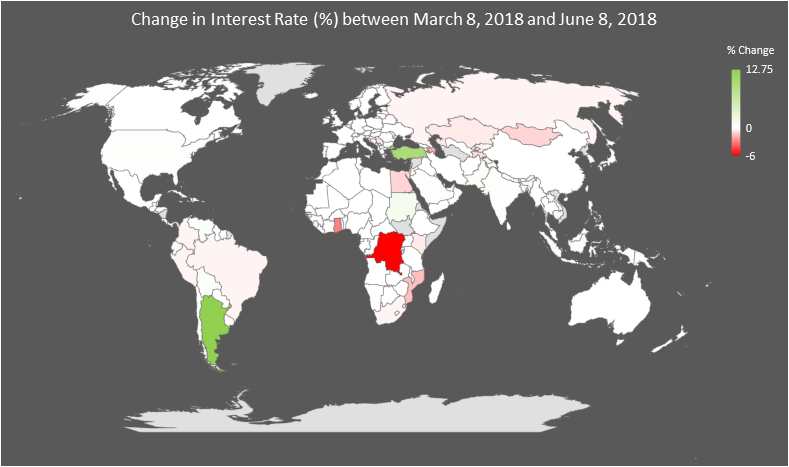

Interest Rates globally are changing (in both directions) at the fastest pace ever in the history of the modern central banking system. Nearly half of the countries in the world have cut interest rates while the other half have hiked them in the past 6 months. The average change for countries with a change in interest rate has been +0.22% in the past 6 months. Take Argentina and Turkey out and the average (global) interest rate has actually fallen.

Continue reading “Interest Rates globally are changing at the fastest pace ever”

Interest Rates

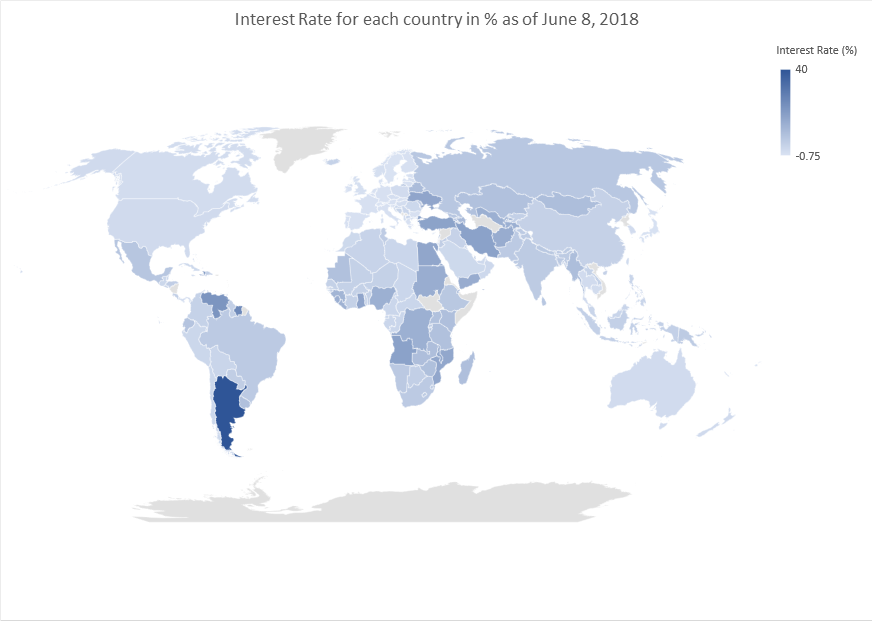

What a difference a year makes. The Federal Reserve has hiked interest rates thrice (in December, March and June) with a target rate range of 1.75% to 2% now. The Eurozone meanwhile maintains its zero-interest rate policy.

Here are the base interest rates for Central Banks as of June 8, 2018 for each country (in increasing order of interest rate),

Continue reading “Interest Rate for each country (as of June 2018)”

Are interest rates rising or falling globally? Well, if the past three months are anything to go by then the world is moving in different directions with regards to interest rates. So much for synchronized increases or decreases in interest rates …

Here is a map of changes,

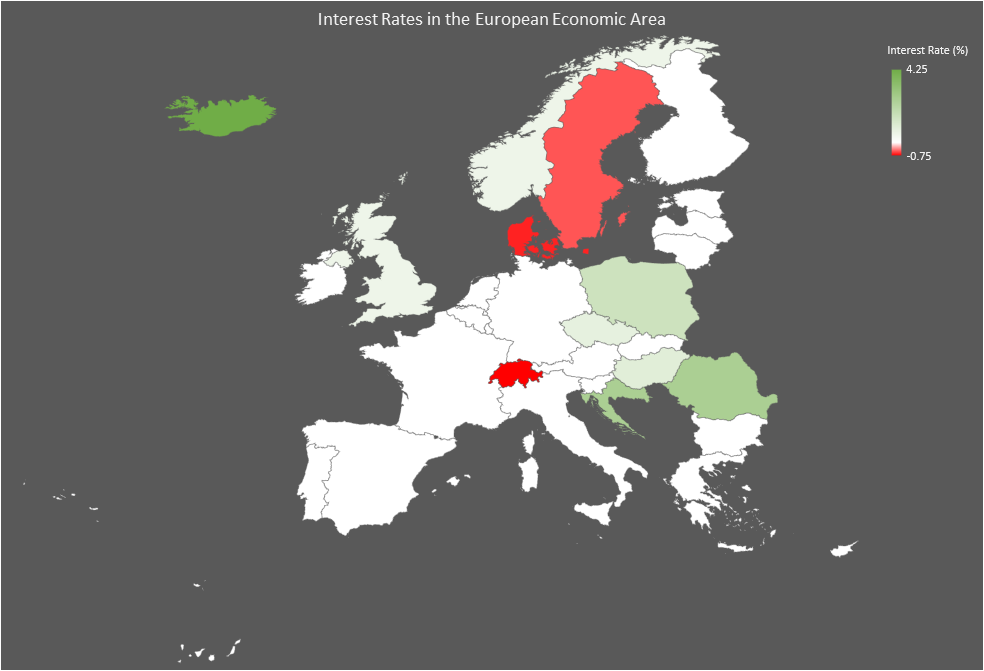

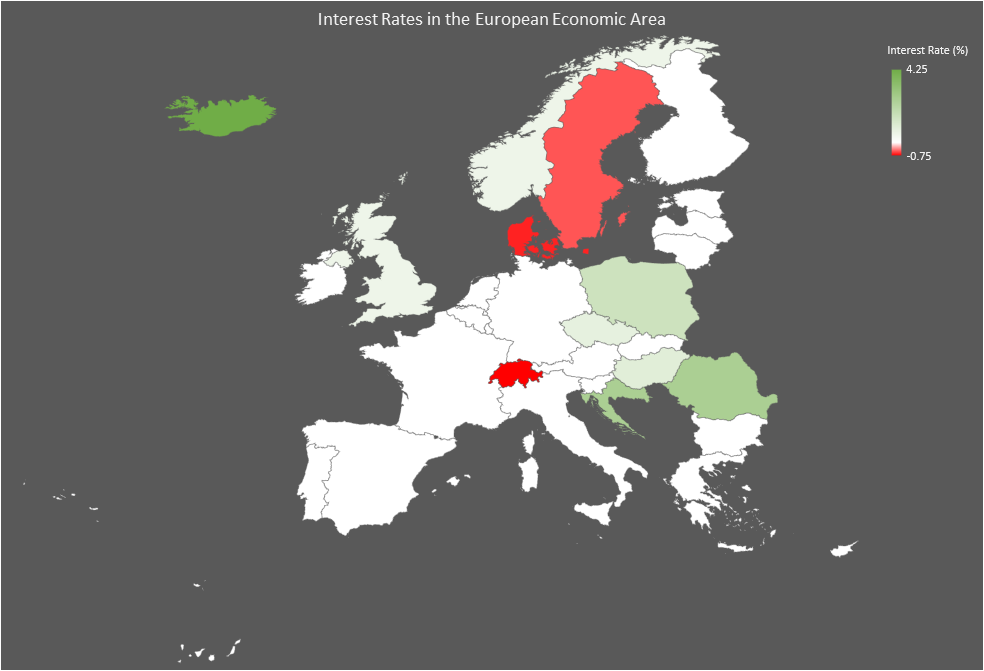

Here are the base interest rates for countries in the European Union plus additionally those in the European Economic Area and Switzerland (as of June 5, 2018),