Where is the biggest property bubble?

Here’s how much the total residential mortgage debt outstanding has grown since 2008 for Australia, Canada, the UK and the US,

Why wouldn’t it be?

Where is the biggest property bubble?

Here’s how much the total residential mortgage debt outstanding has grown since 2008 for Australia, Canada, the UK and the US,

Here are highlights from April 2018,

Our three most read posts in April 2018

1. Alphabet (the parent company of Google) spent the most as a company on lobbying. Facebook’s spend on lobbying increased 5500% since 2009. They spent most lobbying on changes to … data privacy (Click here to read).

2. This is what has happened to the unemployment rate in the US four to eight months before every recession since the 1940s and why it matters now (Click here to read).

3. Not an April Fools’ Day joke – this really is how the US Dollar has performed against each currency of the world over the past one year (Click here to read). Continue reading “Highlights from April 2018”

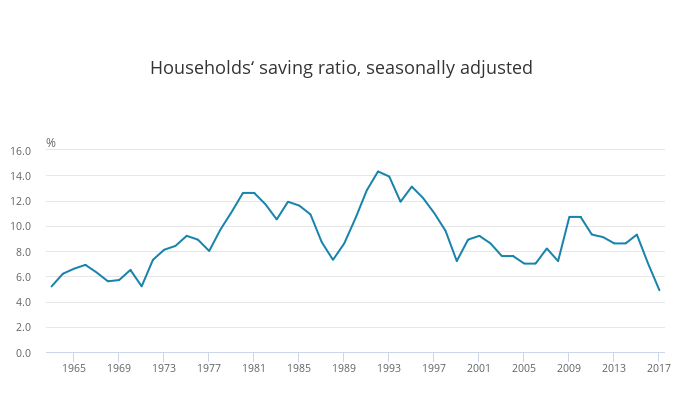

We recently wrote about the UK household savings ratio falling to a record low of 4.9% in 2017 (since comparable records began in 1963) as growth in households’ spending exceeded the growth of households’ income. (Read more here).

We also wrote about the household savings rate in the US falling to a multi-year low of 3.1% as household expenditure grew quicker than income (Read more here). Continue reading “Household saving rates are falling globally”

The US government has around $20.5 trillion in debt and pays around $558 billion in interest payments a year (an effective interest rate of 2.72%).

Bond yields have been rising recently in the US on the back of a strong economy. The 10-year bond yield topped 3% (up 0.66% over the past year) recently, the highest since January 2014. The 2-year bond yield topped 2.5% (up a massive 1.18% over the past year), the highest since July 2008 (Read more here). Continue reading “Can the US government really cope with rising bond yields?”

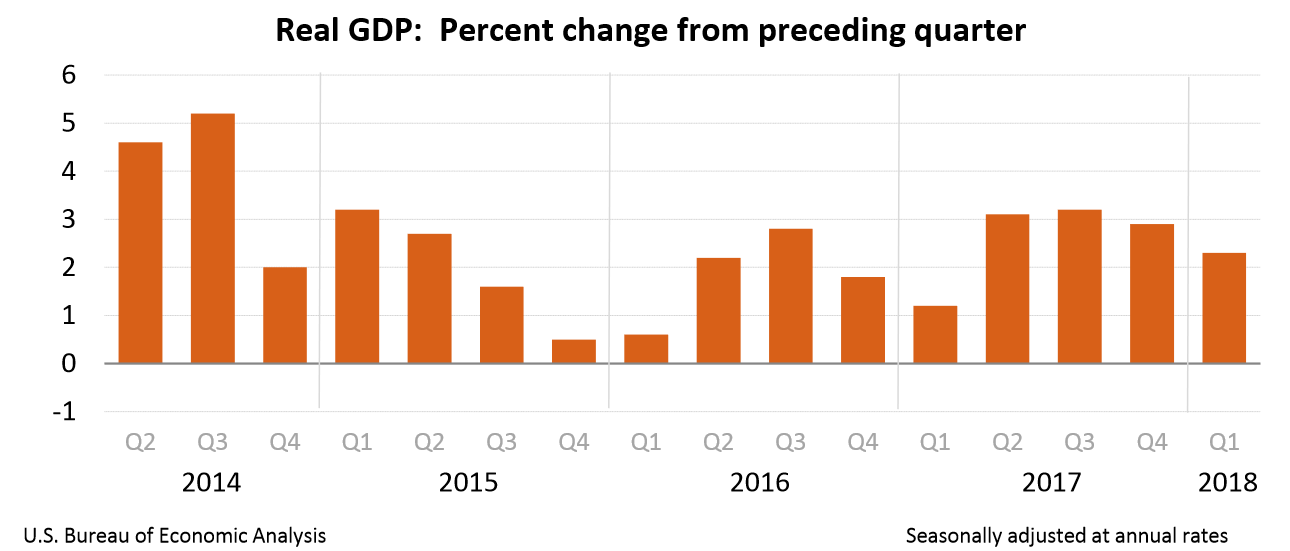

US real GDP increased at an annual rate of 2.3% in the first quarter of 2018 as per an advance estimate released by the Bureau of Economic Analysis.

US bond yields have soared recently with the 10-year bond yield hitting 3% today (up 0.66% over the past year), the highest since January 2014. The 2-year bond yield topped 2.5% (up a massive 1.18% over the past year), the highest since July 2008. Meanwhile, the Greece 10-year bond yield was lower than 4%, closing at 3.99% (down 2.45% over the past year), the lowest since 2005. Continue reading “US 10-year bond yield over 3% as Greece 10-year bond yield falls below 4%; US 2-year bond yield hits 2.5%”

The US Bureau of Labor Statistics data reveals that the US unemployment rate has a hit a new multi-year low four to eight months before the start of every recession since the 1940s. In other words, the economy hits full employment four to eight months before the start of a recession.

The graph below might help visualise it better (the shaded areas indicate recessions),

Why does this matter now? Continue reading “This is what has happened to the unemployment rate in the US four to eight months before every recession since the 1940s and why it matters now”

ECB sells yet another bond after spotting an error

The European Central Bank (ECB) via Bundesbank has sold yet another bond issued by Telefonica Deutschland a year after it bought it. The bond which was due to mature in 2021 breached an ECB rule that they should not hold bonds that pay a step-up coupon (one that could go up in value if certain conditions are met – in this case if the company was acquired).

This was the fourth time they found an error in 2018 and sold a corporate bond. When this happened a couple of weeks ago, we reported it here and asked how many more errors will the ECB find? Well, it would appear traders have taken notice. The ECB sold this bond just after a sharp fall in the price of the bond, implying traders know what all bonds the ECB has bought in error and is likely to sell. Continue reading “Weekly Overview: ECB sells yet another corporate bond after spotting an error; US Banks report Q1 results; Facebook moves user data from Ireland to the US”

Here is the debt outstanding for all commercial banks in the US (all data as of March 31, 2018),

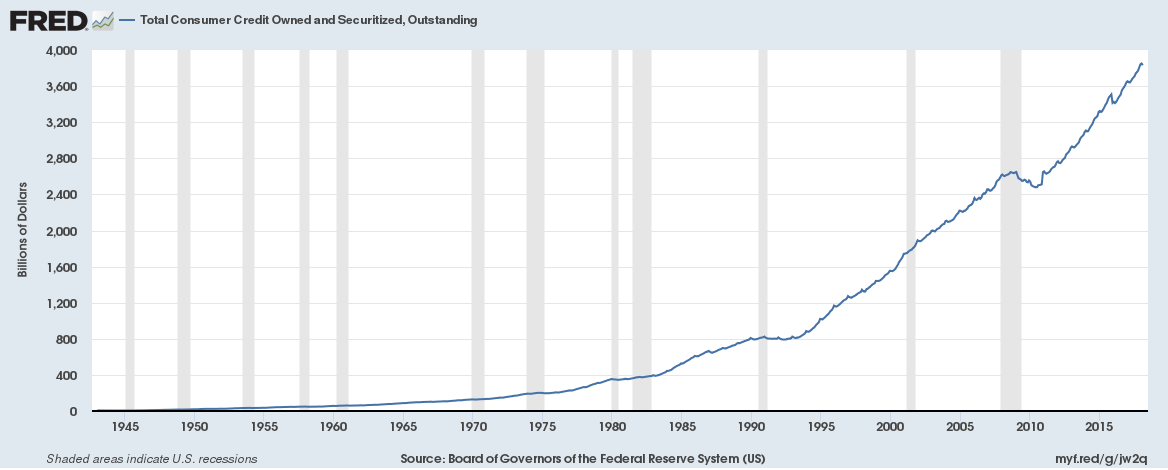

Total consumer credit including student loans $3.9 trillion (up from $2.6 trillion in 2008)

Total commercial and industrial loans $2.15 trillion (up from $1.5 trillion in 2008)

Commercial real estate loans $2.1 trillion (up from $1.6 trillion in 2008)

Mortgage Backed Securities $1.76 trillion (up from $800 billion in 2009)

Student loans $1.5 trillion (up from $500 billion in 2008)

Consumer credit cards and other revolving credit $775 billion (up from $400 billion in 2008)

Mortgage debt $1.32 trillion (down from $1.42 trillion in 2008)

Total Consumer Credit Outstanding:

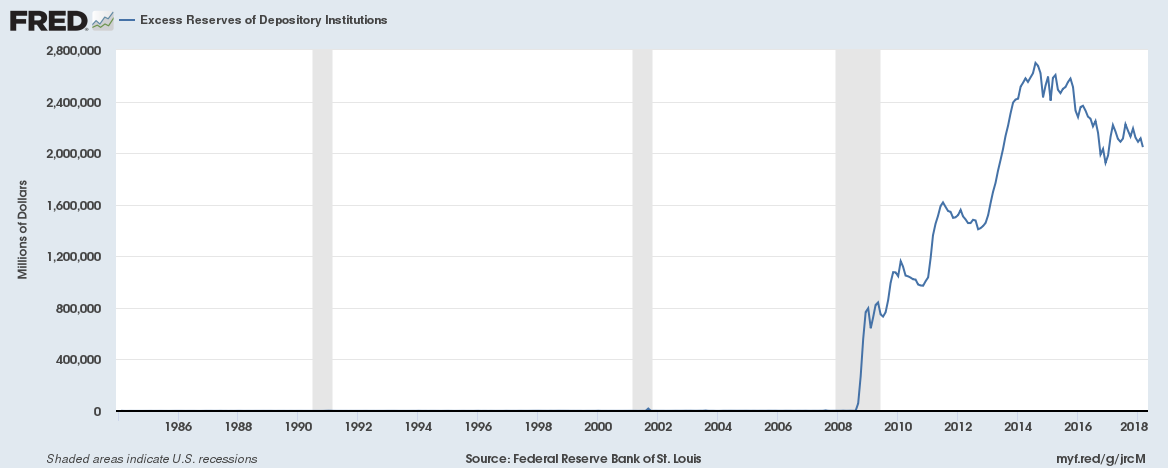

Banks in the US can hold excess reserves with the Federal Reserve. In 2008, as part of the Emergency Economic Stabilization Act of 2008 it was mandated that interest would be paid on reserve balances held with the Federal Reserve. What is of significance is the interest rate on excess reserves.

Since 2015, the Federal Reserve has set the interest rate on excess reserves equal to the top of the target range for the federal funds rate. Why is this important? Look at the graphs below.