Continue reading “Don’t rule out high or hyper inflation in the road ahead”

Why wouldn’t it be?

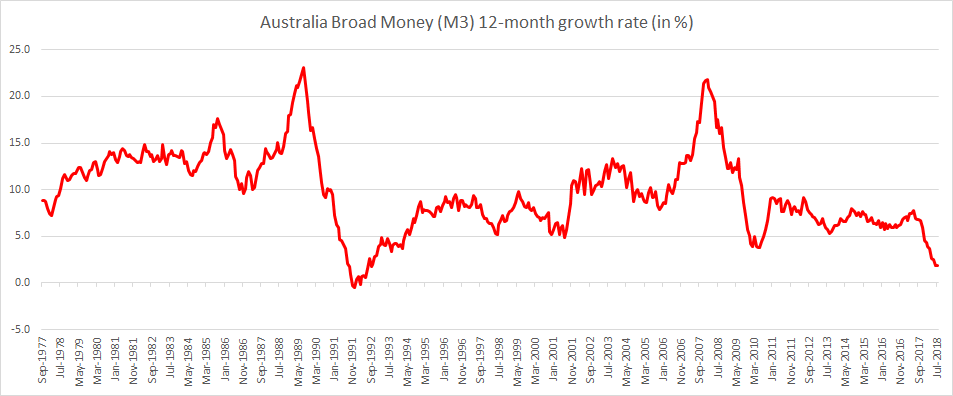

Australian credit growth is slowing but outstanding debt remains at historically high levels. Housing credit growth, personal credit growth, investor housing credit growth and business credit growth are all slowing. But the rather surprising thing is broad money (M3) supply growing at a 12-month rate of just 1.9%, the slowest since 1992 when Australia faced eight consecutive quarters of declining economic growth.

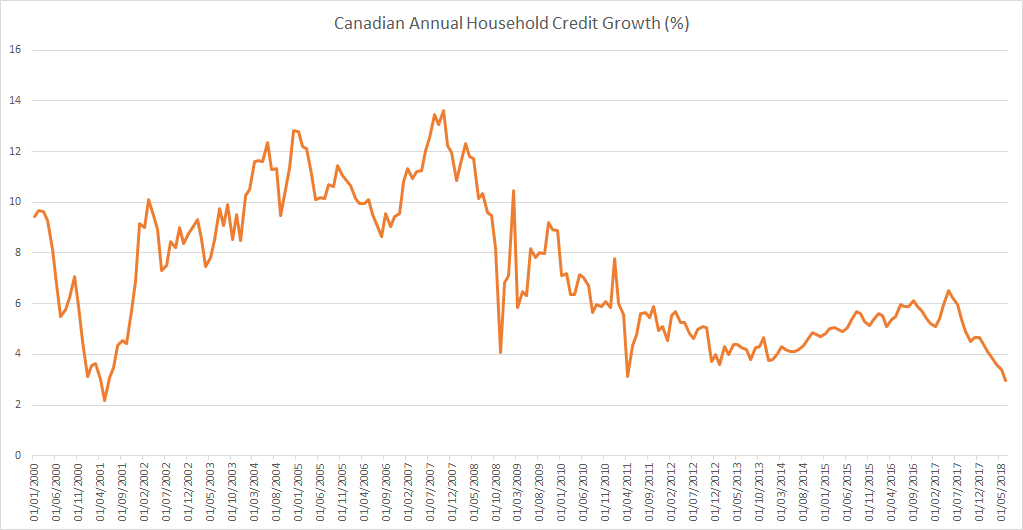

Canadian household credit growth is slowest since 2001 with Household credit (Annualized 3-month growth rate) growing at 2.98% and Household Mortgage credit (Annualized 3-month growth rate) growing at 2.85%.

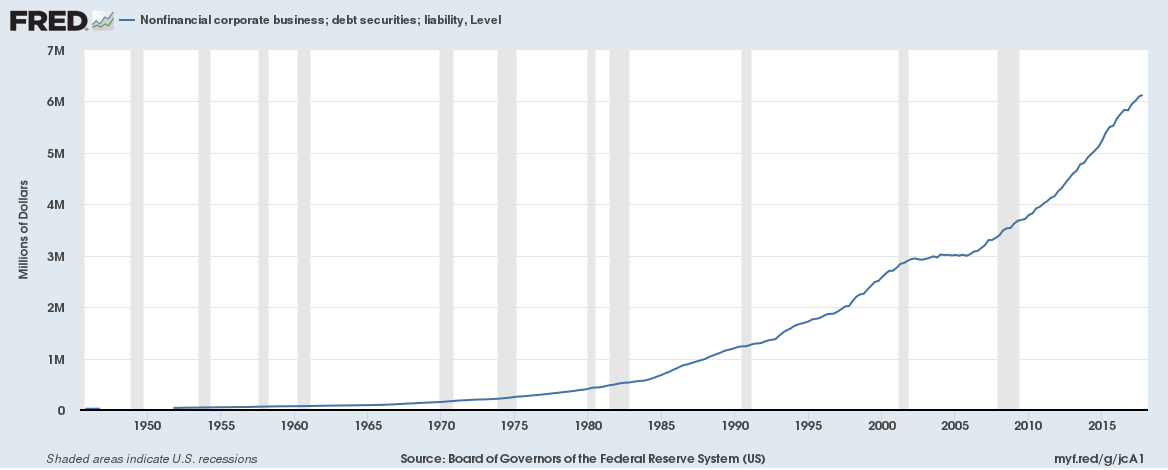

Corporations (non-financial) in the United States have $6.2 trillion in debt and debt has doubled in the past decade,

Continue reading “Corporate debt is soaring in the U.S. even as corporate bond yields are rising”

Continue reading “Corporate debt is soaring in the U.S. even as corporate bond yields are rising”

US and emerging market bond yields

The US 10-year bond yield soared to 3.09% today (up 75 bps over the past year and 25 bps over the past month), the highest since 2011. The 2-year yield hit 2.59%, the highest since August 2008 (read more here on the financial impact of rising yields for the US Government).

The bigger story is of emerging markets though. Brazilian and Indian 10-year yields have soared 33 bps in just a week. The Brazilian 10-year bond yield topped 10.12% while the Indian 10-year bond yield topped 7.91%. The US dollar has gained 7% against the Brazilian Real and 4% against the Indian Rupee over the past month.

Canadian bond yields are soaring the most amongst developed nations with the 10-year yield hitting 2.51%, up 94 bps over the past year and 24 bps over the past month. Continue reading “US and emerging market bond yields soar; UK retail; US Student debt; German GDP”

Where is the biggest property bubble?

Here’s how much the total residential mortgage debt outstanding has grown since 2008 for Australia, Canada, the UK and the US,

Here is the debt outstanding for all commercial banks in the US (all data as of March 31, 2018),

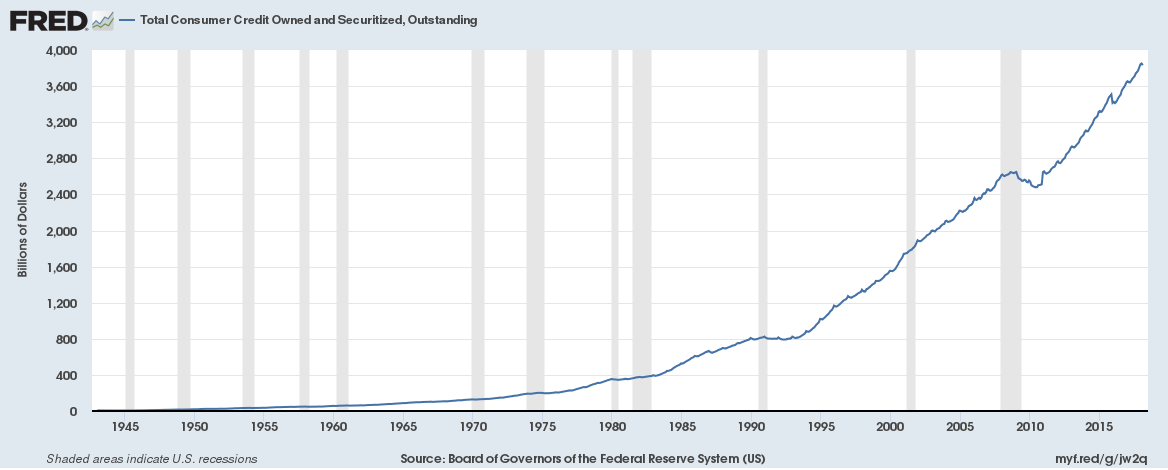

Total consumer credit including student loans $3.9 trillion (up from $2.6 trillion in 2008)

Total commercial and industrial loans $2.15 trillion (up from $1.5 trillion in 2008)

Commercial real estate loans $2.1 trillion (up from $1.6 trillion in 2008)

Mortgage Backed Securities $1.76 trillion (up from $800 billion in 2009)

Student loans $1.5 trillion (up from $500 billion in 2008)

Consumer credit cards and other revolving credit $775 billion (up from $400 billion in 2008)

Mortgage debt $1.32 trillion (down from $1.42 trillion in 2008)

Total Consumer Credit Outstanding:

The Office for National Statistics (ONS) and the Bank of England (BoE) both released UK data on March 29 and the data doesn’t look good. Key highlights include:

Governments around the world have close to $80 trillion in debt. As interest rates begin to rise globally we explore if governments around the world can really afford higher interest rates. We will write about the impact of rising interest rates on individuals/households and corporates/businesses later. Continue reading “Can Governments really afford higher interest rates?”