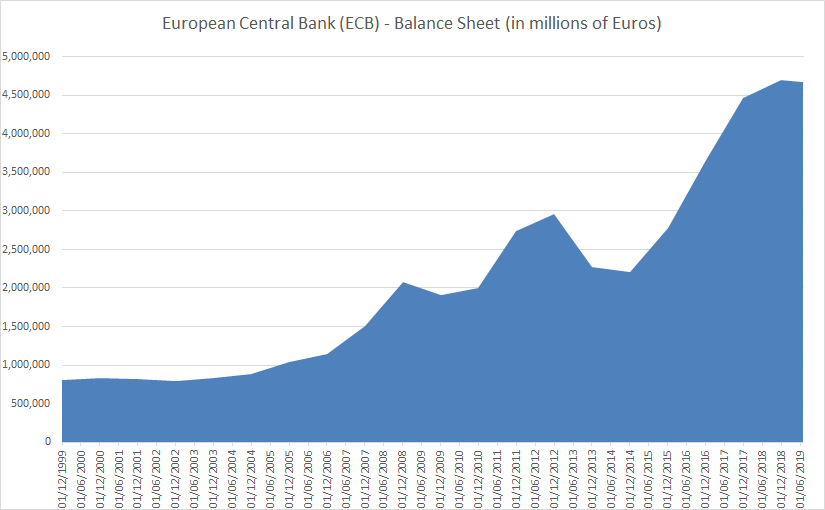

Apparently, the European Central Bank (ECB) balance sheet was meant to shrink significantly in 2019. It has shrunk just 0.5% in 2019 until July 5th (as against 5% for the Federal Reserve in the same period).

At 4.67 trillion Euros (or around 41% of Euro area or Eurozone GDP), it doesn’t look like things are going to change quickly.