The Federal Reserve cut interest rates for again (the second time this year). Will Central Banks elsewhere follow?

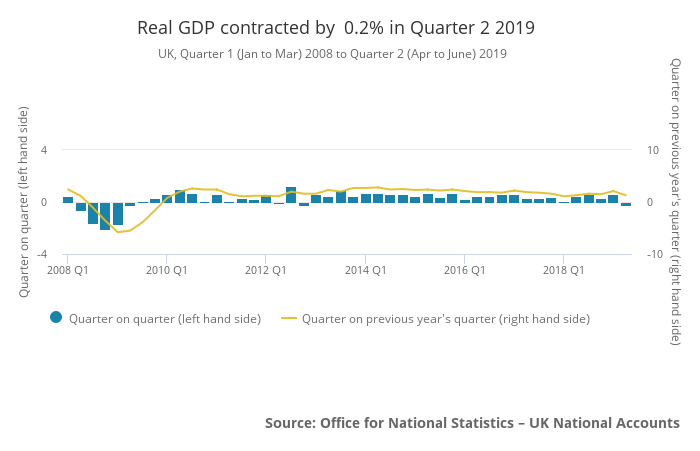

UK Q2 2019 GDP contracts by 0.2% (QoQ) and grows 1.8% (YoY); Services grows; Private Consumption falls

Highlights from August 2019 – Big Swings in Stock Markets; The Yield Curve inversion and the Bond market yield collapse

The Stock Markets made big swings in August thanks to trade tensions heating (and then cooling) between the U.S. and China and the yield curve inverting.

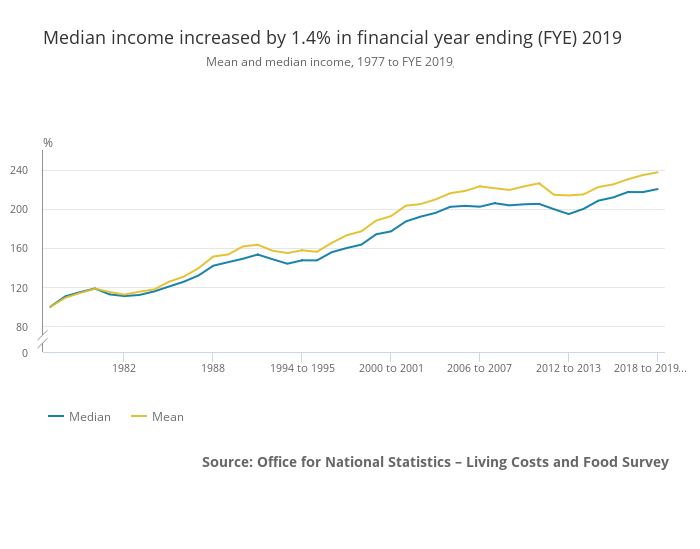

UK median household income now stands at £29,400; Mean household income at £35,300

Median household disposable income in the UK was £29,400 at the end of the financial year 2019, up 1.4% or £400 compared to the end of the financial year 2018, after accounting for inflation.

Highlights from July 2019 – The Fed cuts interest rates, Singapore economy contracts, China records slowest growth in 30 years

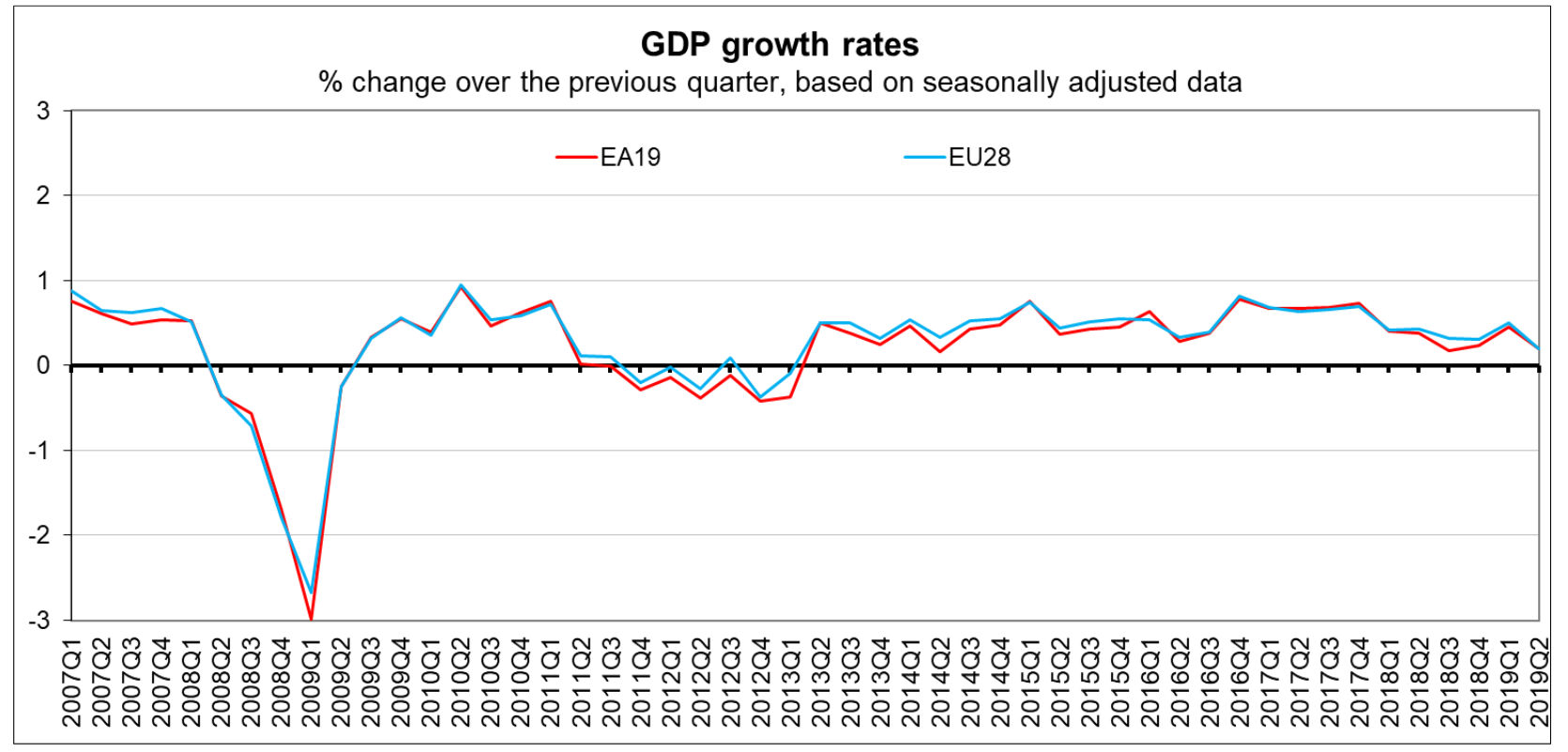

Eurozone and European Union Q2 2019 growth slows to just to 0.2% (QoQ); Quarterly growth slowest in 5 years

Seasonally adjusted Gross Domestic Product (GDP) rose by 0.2% in both the Eurozone (EA19) and the European Union (EU28) during Q2 2019, compared with Q1 2019, according to a preliminary estimate published by Eurostat. Quarterly growth is now slowest in 5 years.

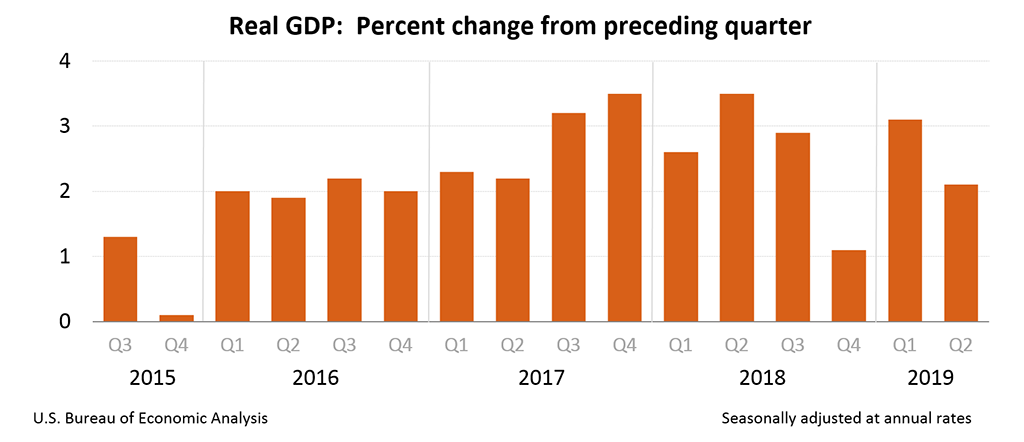

U.S. Q2 2019 GDP growth estimated at 2.1% as personal consumption soars

Real gross domestic product (GDP) for the United States increased at an annual rate of 2.1% in the Q2 2019 (vs 3.1% in Q1 2019), according to the advance estimate released by the Bureau of Economic Analysis.

Continue reading “U.S. Q2 2019 GDP growth estimated at 2.1% as personal consumption soars”

Eurozone government debt to GDP at 86% and European Union government debt to GDP at 81%; Government debt to GDP soars for Cyprus and Greece

Government debt to GDP for the Eurozone stood at 85.9% at the end of Q1 2019 (as against 87.1% at the end of Q1 2018). For the European Union, the number was 80.7% (as against 81.6% at the end of Q1 2018).

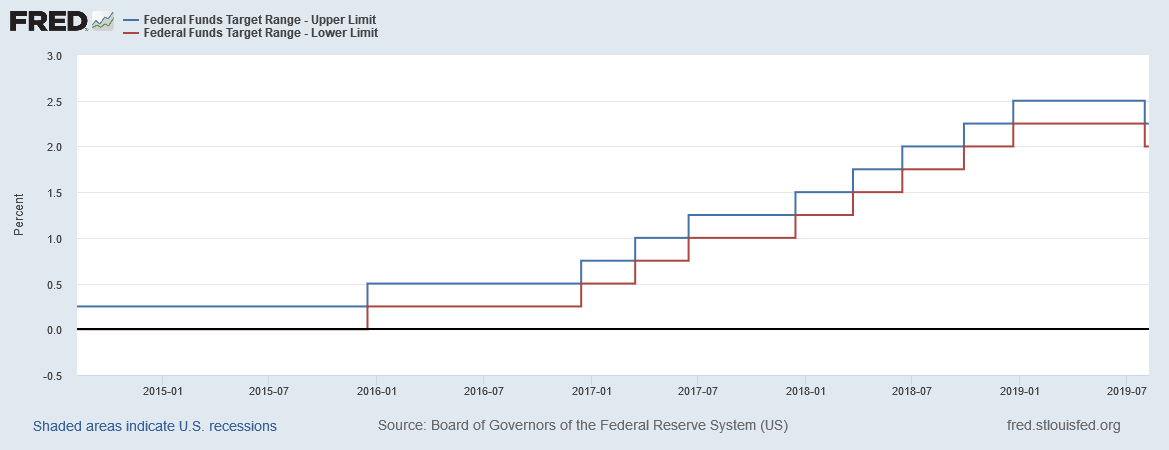

The Federal Reserve has done the right thing by reducing its balance sheet and increasing interest rates to support a thriving economy, why reverse this now?

The Federal Reserve has unwound its balance sheet by 12% over the past year and reduced it to $3.81 trillion (from a peak of $4.5 trillion in 2017).

It has also increased interest rates since from 0.25% (range of 0% to 0.25%) in 2016 to 2.5% (range of 2.25% to 2.5%) now.

38 countries currently have interest rates at an all-time low

A decade on from the financial crisis, 38 countries currently have interest rates at an all-time low. Ultra-low interest rates seem to be the tool of choice for Central Banks to help stimulate economies globally. But seriously, this a decade on from the financial crisis? Did the world really recover from the financial crisis? Probably not …

Continue reading “38 countries currently have interest rates at an all-time low”