U.S. Equities Soar

June 2019 saw U.S. equity market records being broken shattered.

The Dow Jones Industrial Average (DJIA) gained 7% in June, its biggest June gain in 9 decades or its best June since 1938.

The S&P 500 jumped 6.9%, its best June performance in 7 decades or its best June since 1955. The S&P 500 is up 17% in 2019 so far, the best start to a year since 1997.

Gains are being attributed to expectations of an interest rate cut rather than strong Q2 corporate earnings expectations.

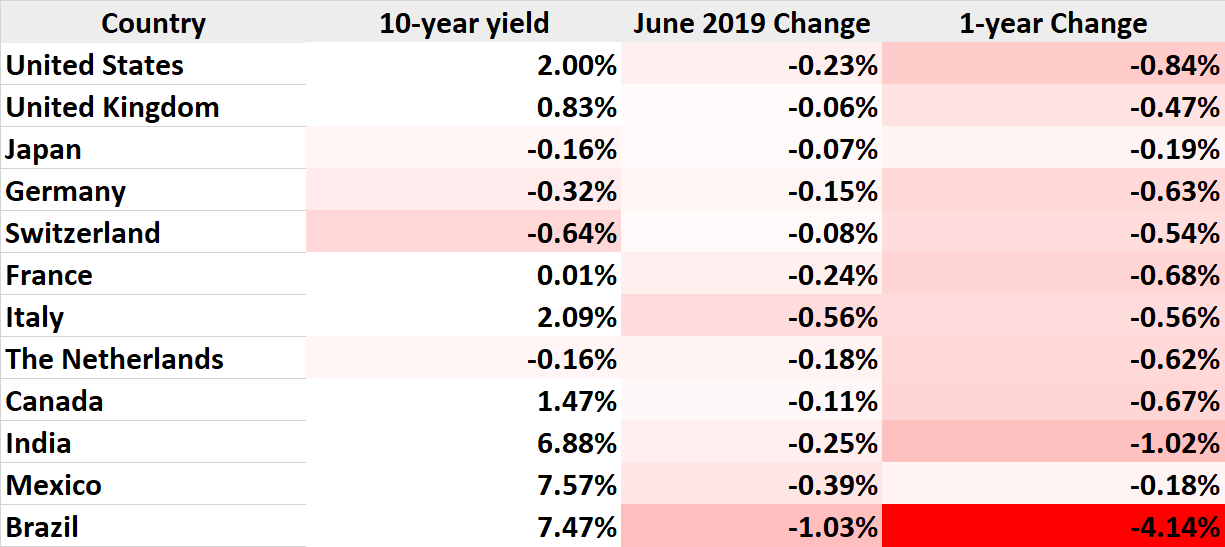

Global Bond Yields continue falling

Continuing its downward trend, bond yields globally fell further in June. Red everywhere with Japan, Germany and Switzerland yielding negative.

What’s next? Cheap money …

Interest Rate cut ahead?

The markets are widely expecting the Federal Reserve to cut rates in July. On one hand they say the U.S. and global economy have never been stronger (record employment and best economic/GDP growth since the financial crisis) and on the other hand they say cheap money/lower interest rates are required to stimulate the economy?

Our take: A strong economy doesn’t need cheap money. The global economy isn’t as great as it has been projected. A July interest rate cut for the U.S. is very likely but not 100% certain.