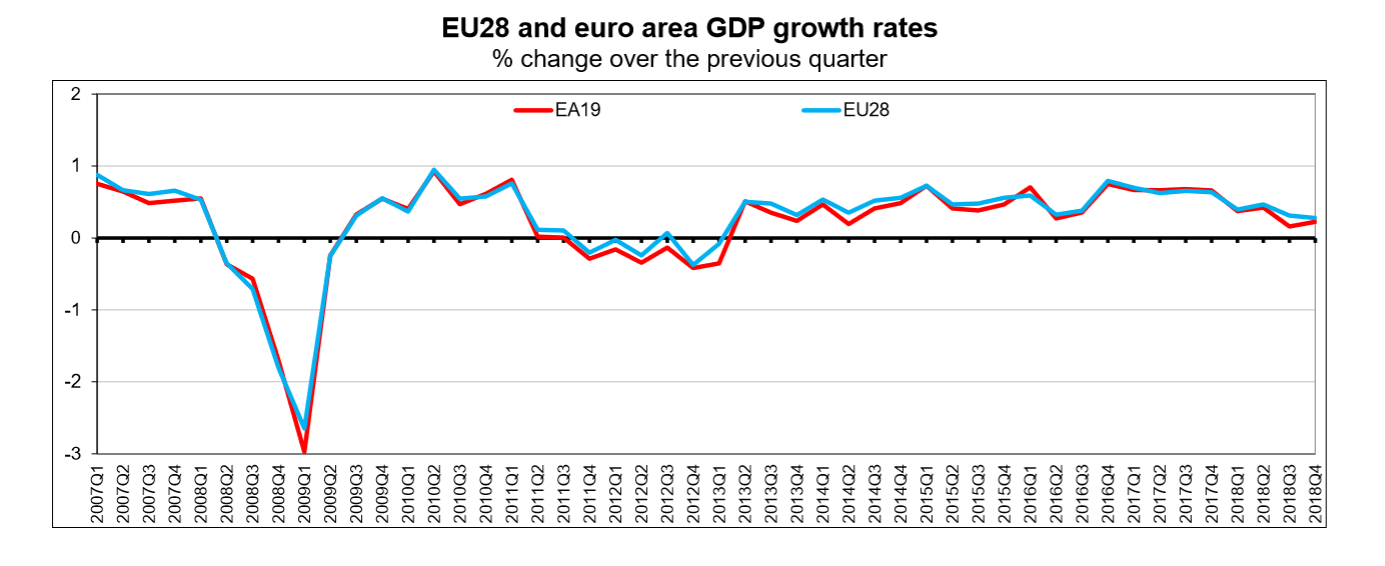

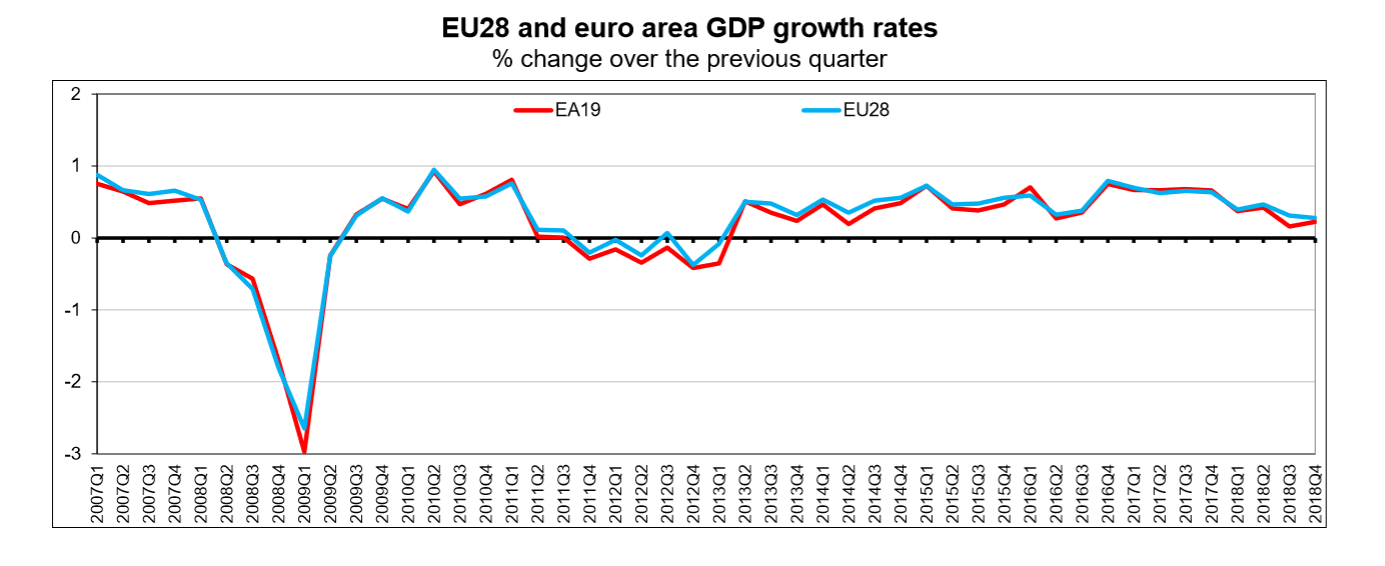

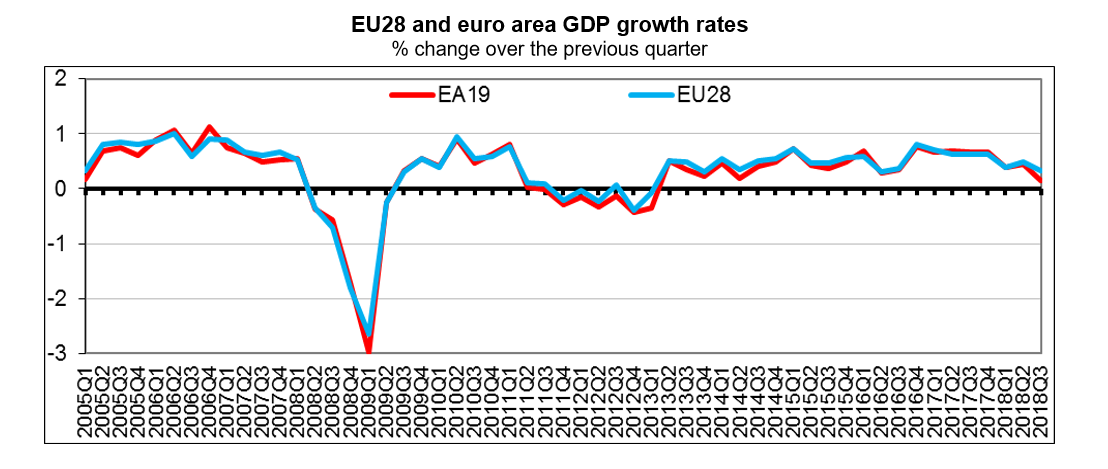

Seasonally adjusted GDP rose by 0.2% in the Euro area or Eurozone (EA) and by 0.3% in the European Union (EU) during Q4 2018, compared with Q3 2018.

Why wouldn’t it be?

Seasonally adjusted GDP rose by 0.2% in the Euro area or Eurozone (EA) and by 0.3% in the European Union (EU) during Q4 2018, compared with Q3 2018.

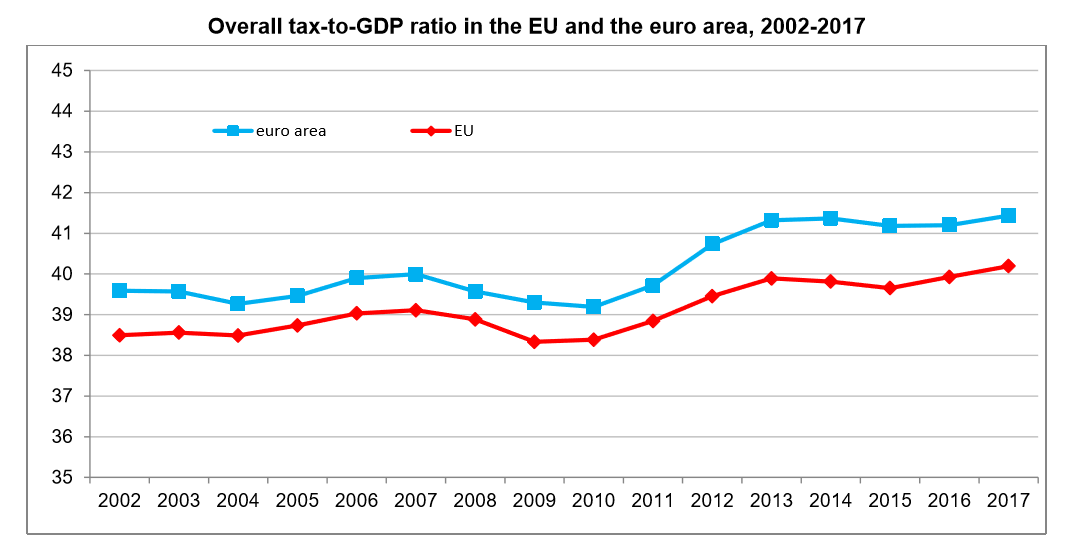

The overall tax-to-GDP ratio, which is the sum of taxes and net social contributions as a percentage of Gross Domestic Product, stood at 40.2% in the European Union (EU) in 2017 and 41.4% of GDP for the Eurozone in 2017. These were the highest ever levels for both the European Union and Eurozone.

Continue reading “EU and Eurozone Tax to GDP ratio at highest ever level”

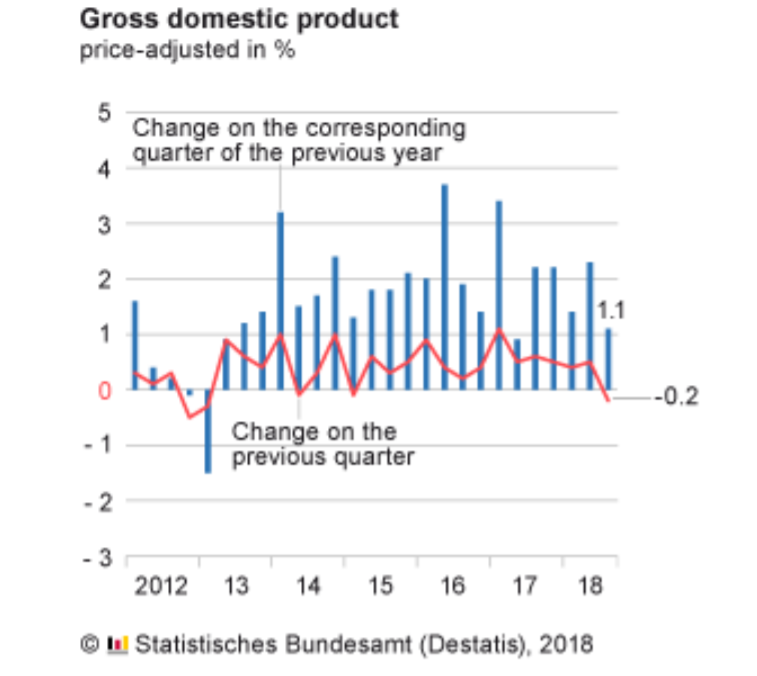

The Federal Statistical Office (Destatis) reported that the German GDP shrank by 0.2% in the third quarter (vs the second quarter) of 2018. Growth was +1.1% on the same quarter a year earlier following increases of 2.3% in the second quarter (calendar adjusted: +2.0%) and 1.4% in the first quarter of 2018 (calendar adjusted: +2.1%).

Both the European Commission and the IMF recently published their forecasts on growth in Europe. Both have lowered forecasts for growth between 2018 and 2020 in Europe.

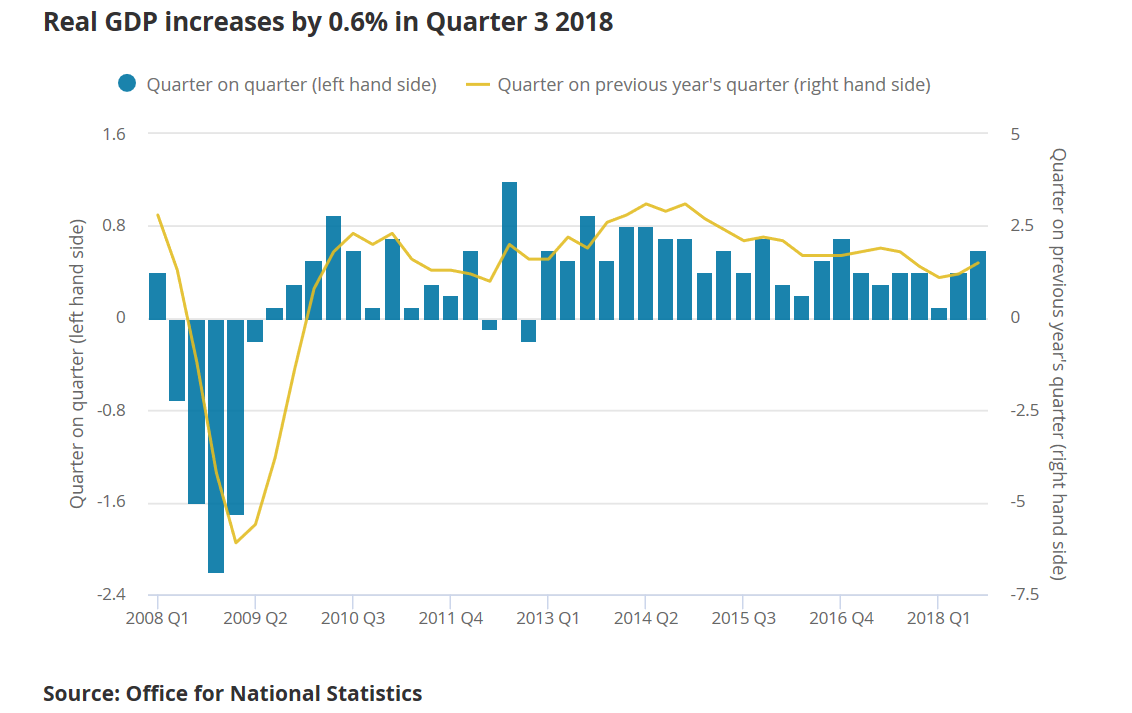

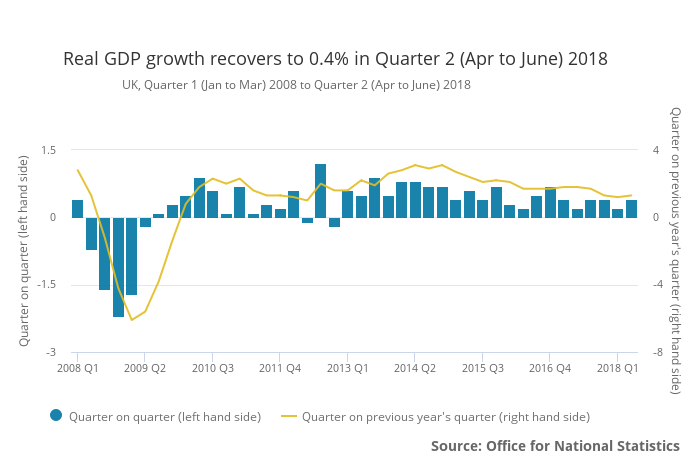

UK gross domestic product (GDP) in volume terms was estimated to have increased by 0.6% between Quarter 2 (Apr to June) 2018 and Quarter 3 (July to Sept) 2018.

In comparison with the same quarter in the previous year, the UK economy has grown by 1.5%, continuing its relatively subdued performance over the last year.

Seasonally adjusted GDP rose by 0.2% in the Eurozone or Euro Area and by 0.3% in the European Union (EU) during the third quarter of 2018, compared with the previous quarter, according to a preliminary flash estimate published by Eurostat, the statistical office of the European Union. In the second quarter of 2018, GDP had grown by 0.4% in the euro area and by 0.5% the European Union.

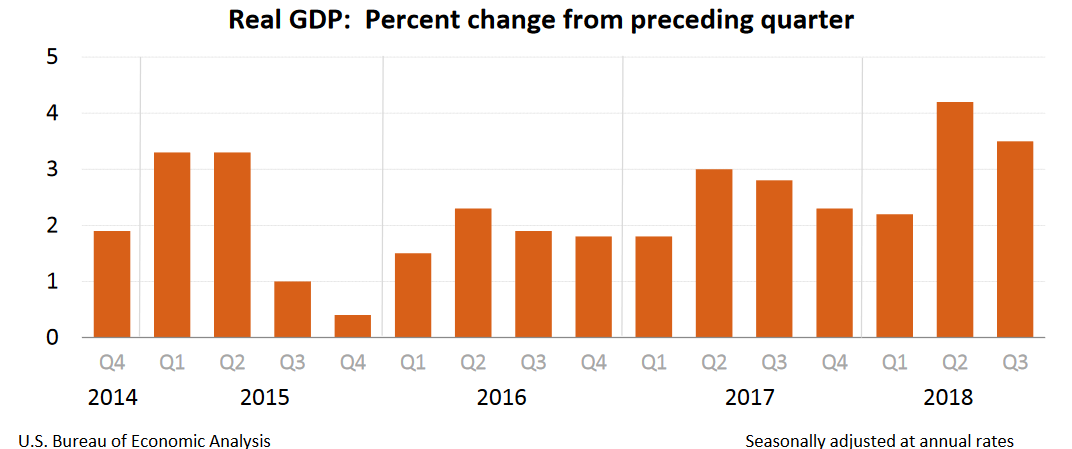

Real gross domestic product (GDP) for the United States increased at an annual rate of 3.5% in the third quarter (Q3) of 2018 according to the advance estimate released by the Bureau of Economic Analysis.

The U.S. economy is doing great and is set to contribute 25% of global Gross Domestic Product (GDP) this year, its highest share since 2007. The rise of the U.S. dollar and increases in interest rates are squeezing emerging economics at an unprecedent pace. But it isn’t just emerging economies that are feeling the squeeze, Europe has its problems with Italian debt (and yields), the Australian dollar which has long been considered a growth asset has been falling this year and elsewhere trade worries and rising oil prices are having a big impact on other nations. Even German factory orders are the weakest in years as the U.S. is truly taking back economic leadership.

UK GDP in volume terms was estimated to have increased by 0.4% between Q1 2018 and Q2 2018. GDP rose by 1.3% in Q2 2018 compared with the same quarter a year ago.

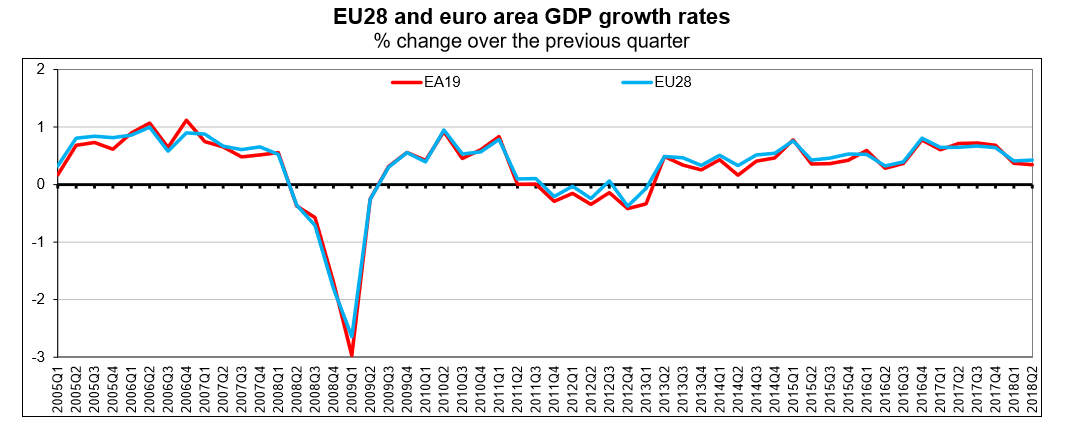

Seasonally adjusted GDP rose by 0.3% in the Eurozone and by 0.4% in the European Union (EU28) during the second quarter (Q2) of 2018, compared with the previous quarter, according to a preliminary flash estimate published by Eurostat, the statistical office of the European Union.