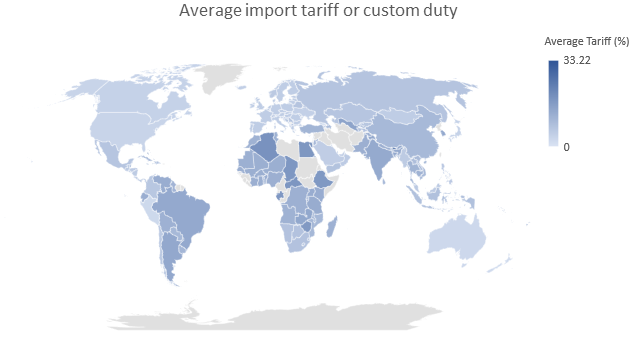

Manufacturing has been in focus recently in the United States with trade tariffs being discussed and the talk of bringing back some manufacturing to the United States.

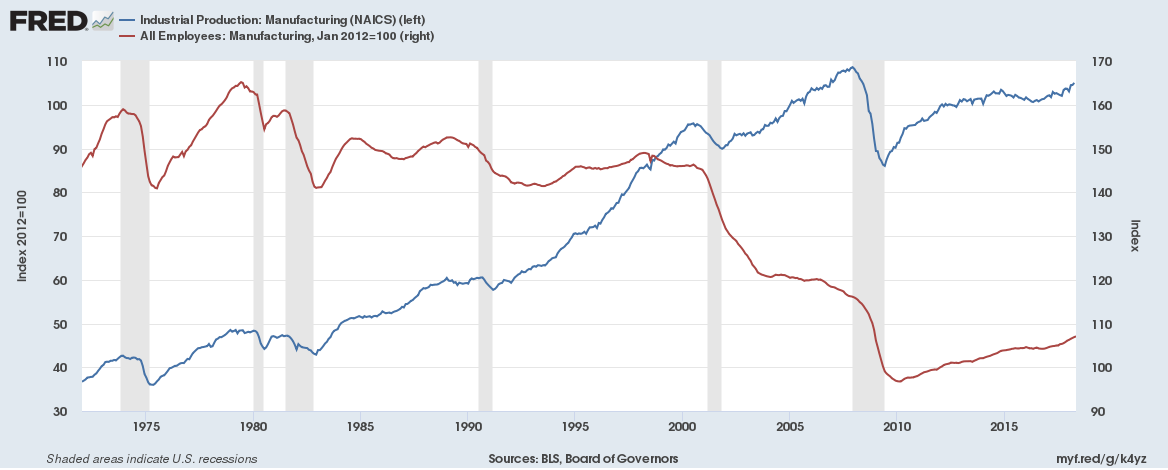

U.S. manufacturing has been growing but it isn’t generating too many new jobs.

The reasons are simple:

- Increase in productivity

- Increase in automation

- Shift towards higher value goods (like aircrafts or high-end electronics)

Here are some graphs,

Indexed Number of manufacturing jobs vs Indexed manufacturing output (Both indexed to January 2012 = 100)