This Time it is Different. No graphs, no charts and no data. Just some food for thought questions. Answers welcome on a postcard in the comments section.

Why wouldn’t it be?

This Time it is Different. No graphs, no charts and no data. Just some food for thought questions. Answers welcome on a postcard in the comments section.

2018 has seen a lot of activity for changes in Sovereign Credit Ratings for countries. Here are the countries for which ratings changed in 2018 followed by the complete data set including maps,

Continue reading “Sovereign Credit Ratings for each Country”

We wrote about the economics behind the 25% tariff on Steel imports and 10% tariff on Aluminium imports to the United States earlier this year. One of the main justifications of the tariffs were that they will increase domestic production. Some statistics released earlier this week provide an answer to whether the tariffs have really increased domestic production.

Restricted Stock Units (RSU) are company stock (or shares by another name) granted to employees as a form of compensation. Employers save some tax, and it generally aligns the long-term interest of employees (and shareholders) as it normally carries a vesting period. 2017 was great for technology company share prices and technology companies granted an eye-watering amount of Restricted Stock Units by value leaving banks way behind …

The reasons aren’t what you think …

Continue reading “Here’s why the Federal Reserve increasing interest rates could be a problem”

The International Monetary Fund (IMF) published one of its most comprehensive studies of the state of banking and markets since the financial crisis titled, “Global Financial Stability Report – A Decade after the Global Financial Crisis: Are We Safer?” The October 2018 Global Financial Stability Report finds that global near-term risks to financial stability have increased somewhat, reflecting mounting pressures in emerging market economies and escalating trade tensions.

“Geography has made us neighbors. History has made us friends. Economics has made us partners, and necessity has made us allies.” – John F. Kennedy

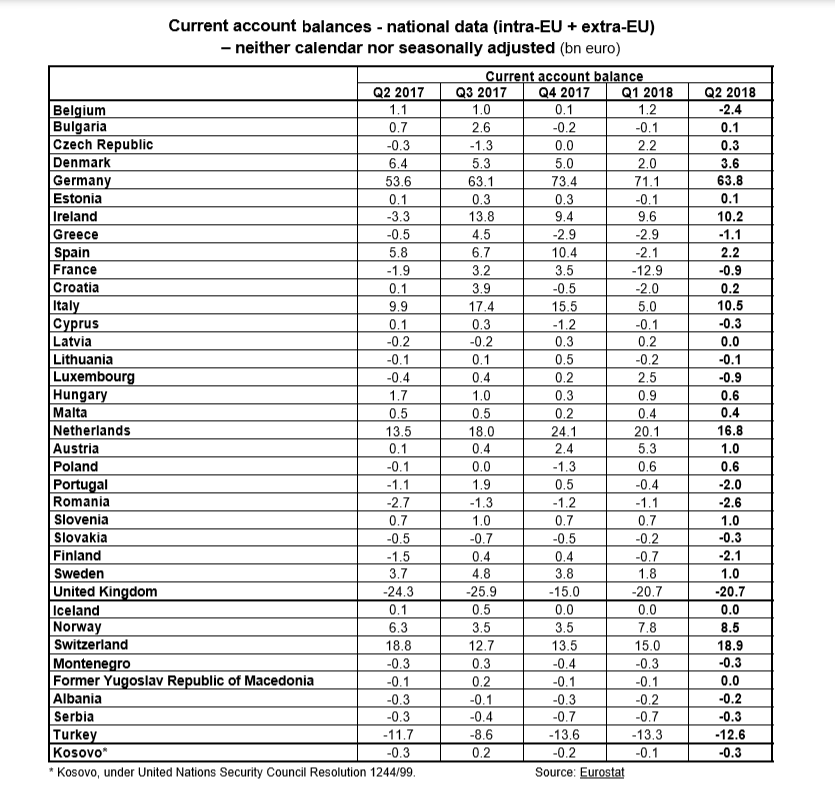

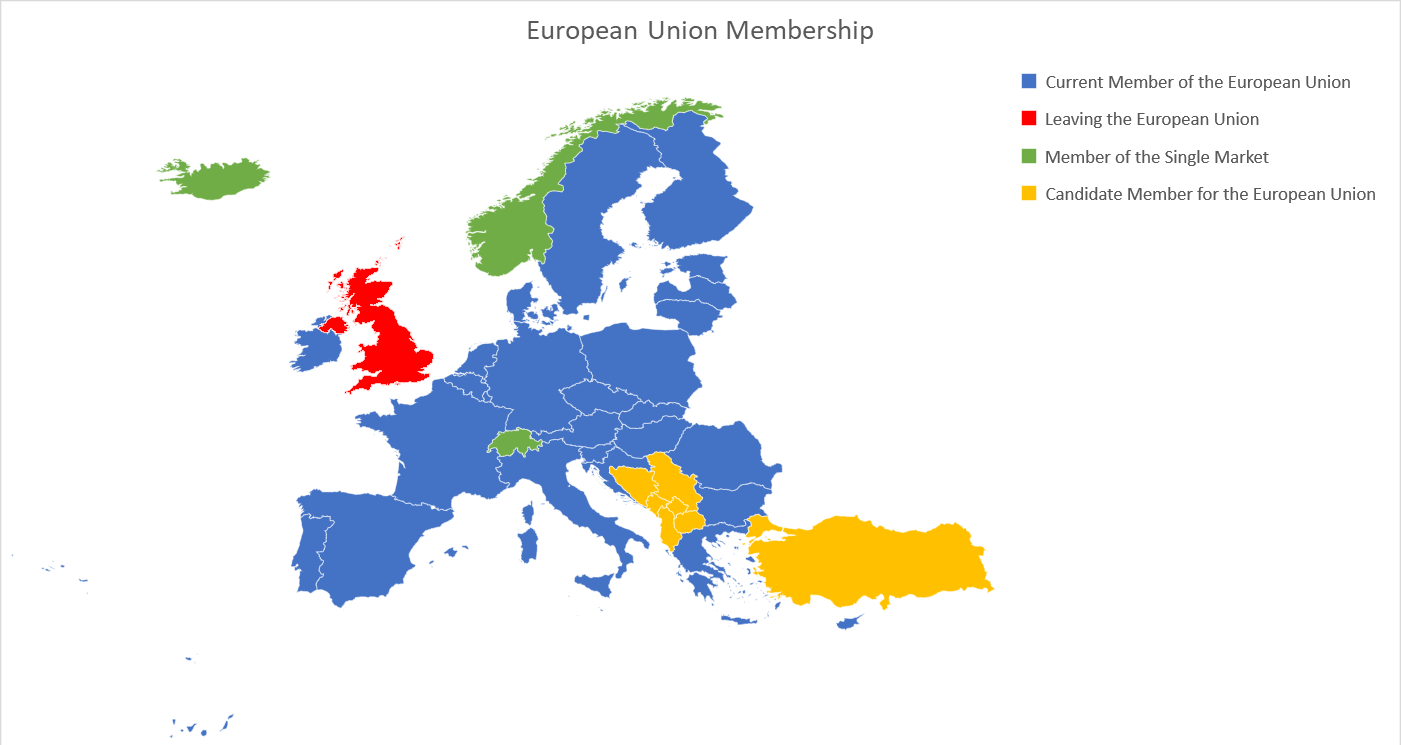

Sixteen members of the European Union recorded current account surpluses, eleven current account deficits and one was in current account balance in the second quarter of 2018 for the total (intra-EU plus extra-EU) current account balances of the European Union (EU28) Member States.

The highest surpluses were observed in Germany (+€63.8 bn), the Netherlands (+€16.8 bn), Italy (+€10.5 bn), Ireland (+€10.2 bn) and Denmark (+€3.6), and the largest deficits in the United Kingdom (-€20.7 bn), Romania (-€2.6 bn) and Belgium (-€2.4 bn).