The answer is different on how you look at it – in terms of absolute outstanding debt, growth rates and relative to GDP.

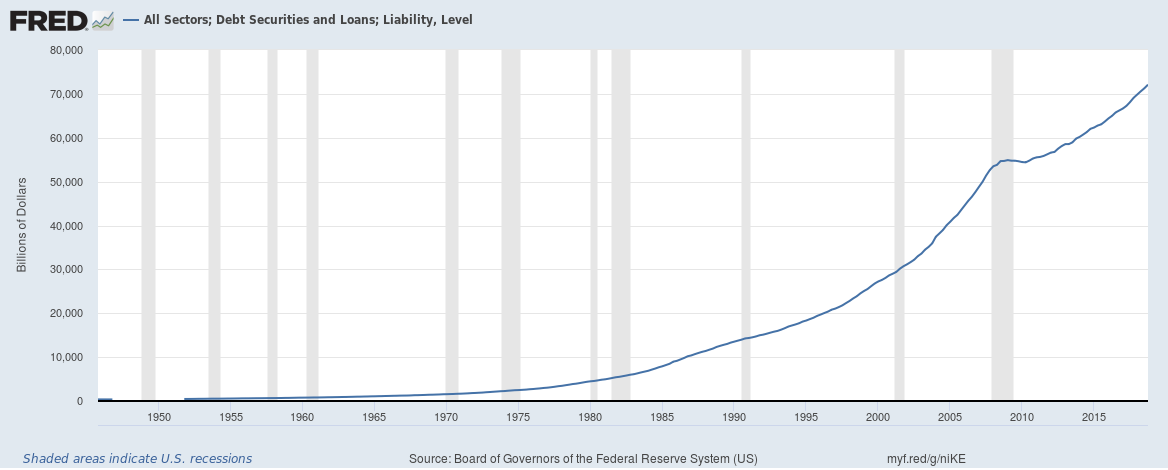

In absolute terms the total credit market or total debt outstanding of the U.S. which includes debt owed by the government (Federal and local), corporations and households stands at $72 trillion.

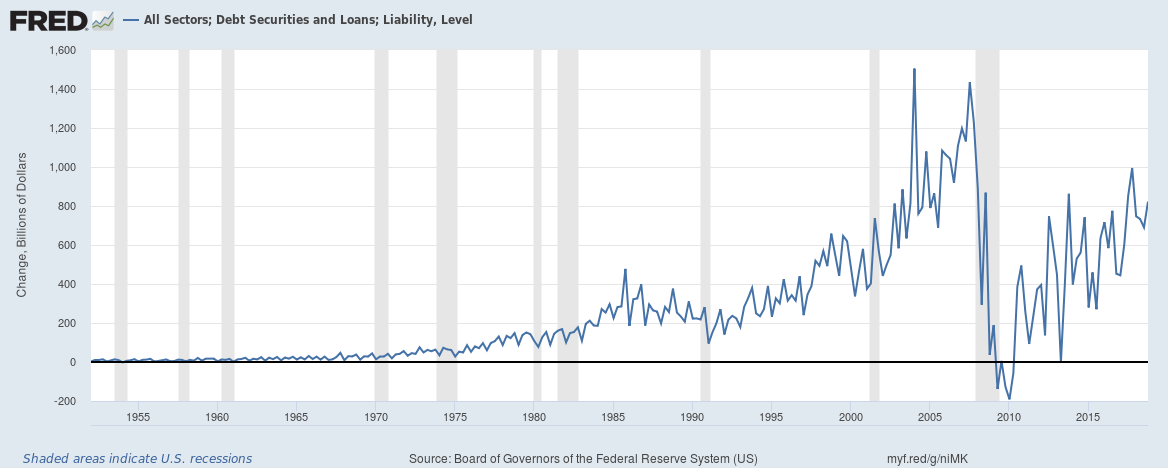

In terms of quarterly growth, debt is growing at around $800 billion a quarter,

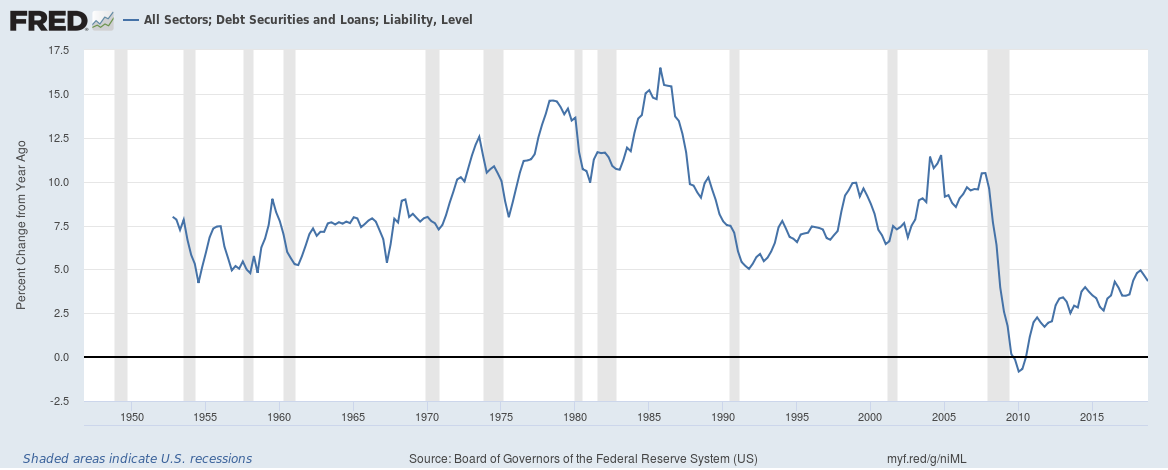

… but in terms of annual growth rate, the growth is between 4.5% to 5%, slower than before the financial crisis of 2008,

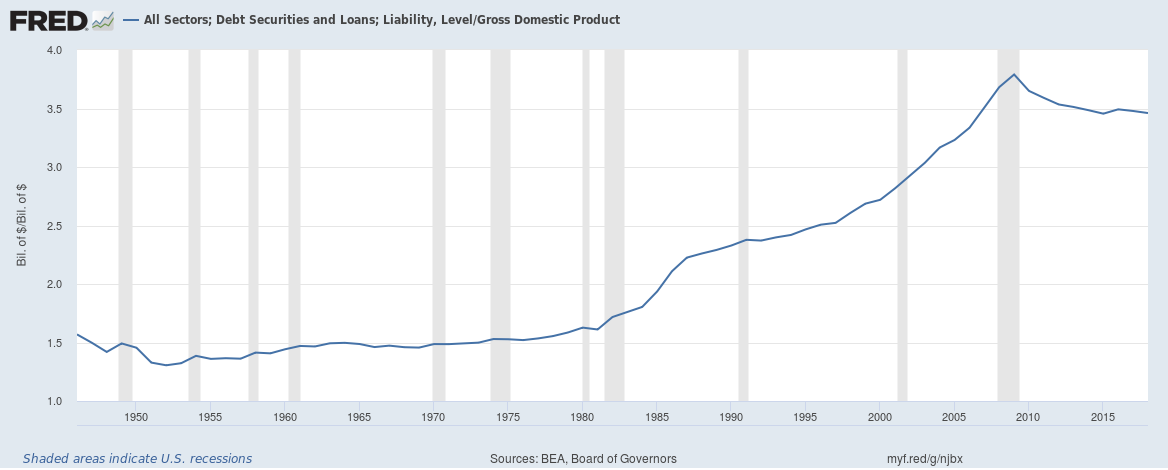

Relative to gross domestic product (GDP), total debt is 3.5 times GDP, down from a peak of 3.8 times hit in 2009. Debt to GDP is falling – albeit very slowly,

Related:

Household Net Worth in the United States saw its worst quarterly fall ever in Q4 2018

Have banks in the U.S. started lending more money recently?

Is Household Debt in the U.S. really a bigger problem than before the financial crisis?

Delinquency and Charge-off rates across banks in the United States remain low (January 2019 edition)

Individuals now consistently contribute over 80% of all U.S. federal taxes