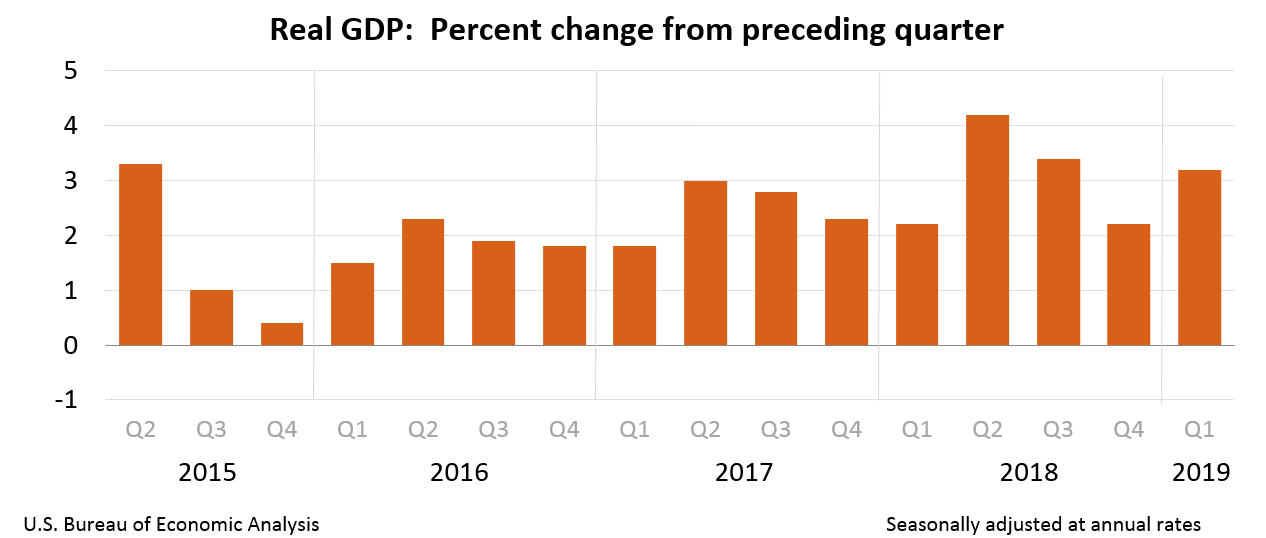

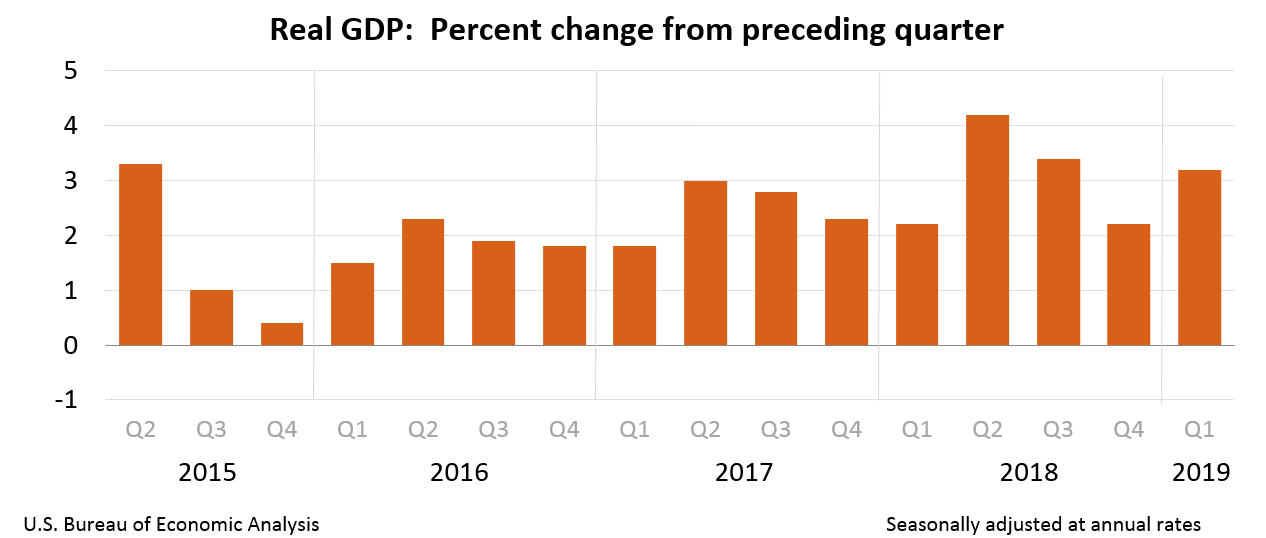

Real gross domestic product (GDP) for the U.S. increased at an annual rate of 3.2% in the first quarter (Q1) of 2019, according to the advance estimate released by the Bureau of Economic Analysis (BEA).

Why wouldn’t it be?

Real gross domestic product (GDP) for the U.S. increased at an annual rate of 3.2% in the first quarter (Q1) of 2019, according to the advance estimate released by the Bureau of Economic Analysis (BEA).

The IMF reckons that global economic activity slowed notably in the second half of 2018. According to the IMF, the escalation of US–China trade tensions, credit tightening in China, macroeconomic stress in Argentina and Turkey, disruptions to the auto sector in Germany, and financial tightening alongside the normalization of monetary policy in the larger advanced economies have all contributed to a significantly weakened global expansion.

Continue reading “The IMF lowers global growth forecast again”

Is the global economy slowing? We look at four charts – lumber prices, iron ore prices, aluminium prices and the Baltic Dry index.

Continue reading “Is the Global Economy Slowing? Four Commodity Charts”

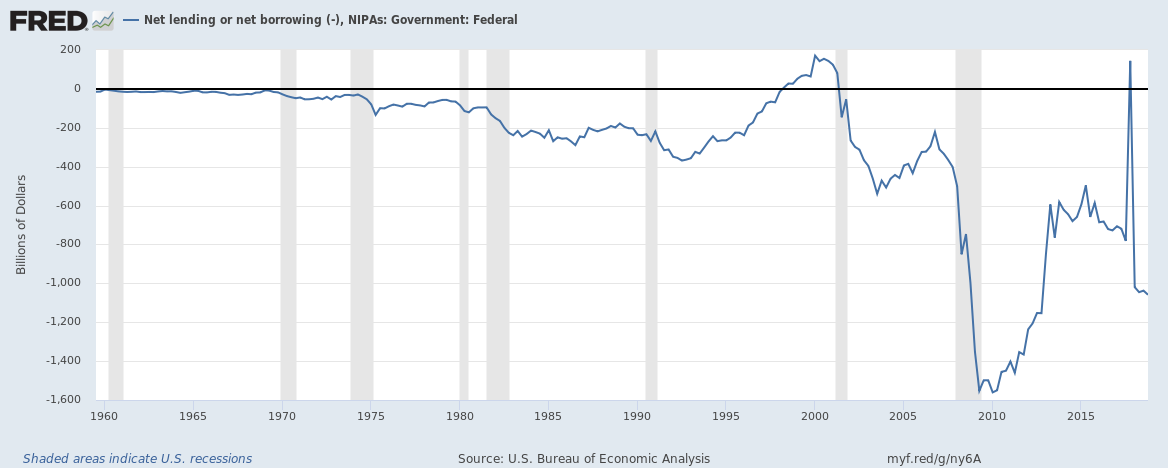

The U.S. fiscal deficit hit an annualized $1.06 trillion in 2018 but relatively speaking it isn’t that bad. The fiscal deficit had hit $1.5 trillion in 2009 in the aftermath of the financial crisis and the current level is the most since 2012.

Continue reading “The U.S. fiscal deficit hit $1.06 trillion in 2018 but is it really that bad?”

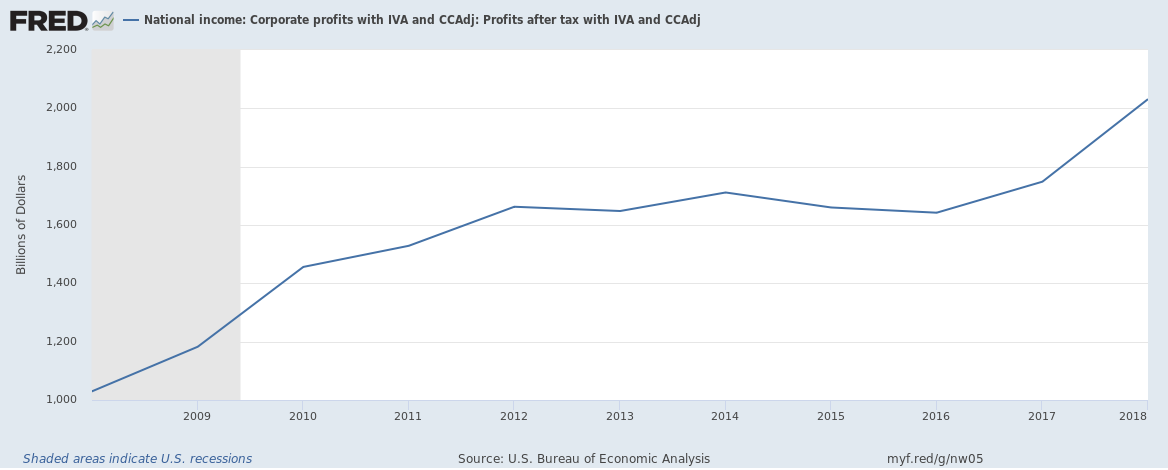

U.S. corporations made a record $2.03 trillion in profits after taxes in 2018,

Continue reading “U.S. corporate profitability accelerated in 2018 growing at 16% … or 8%”

Think the global economy is slowing? The equity markets don’t think so. The S&P 500 rose 13.1% in Quarter 1 (January to March), the largest quarterly gain since 2009 and the best start to a year since 1998.

The technology heavy NASDAQ index gained 17% as the S & P technology sector gained 19.3% during the quarter. Apple and Microsoft both gained over 16% during the quarter.

With interest rate rises on hold and signs of a slowing global economy, there have been a lot of noises that house prices globally are falling. We look at how U.S. house prices are looking compared to a year ago.

Continue reading “Are house prices in the U.S. really falling? March 2019 Edition”

We wrote about three slightly different U.S. recession indicators that have been predictive of the past few recessions and have been tracking how near or far are those from being invoked, here’s where we are in March 2019,

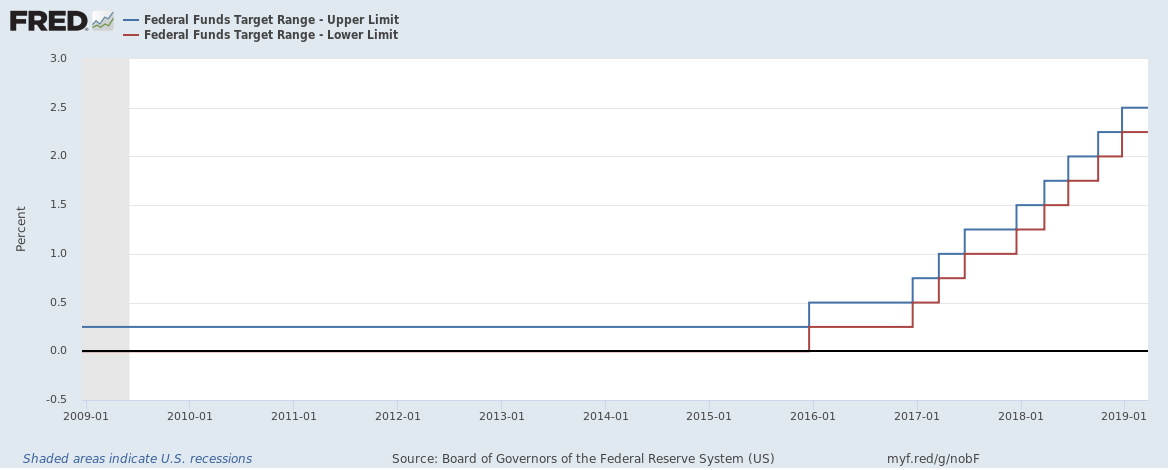

At the start of 2019 we wrote that 2019 will be a year that will be different with interest rate hikes slowing or interest rates even reversing.

Earlier this month the European Central Bank said interest rates would remain at record lows at least until the end of the year and then last week this was followed by the Federal Reserve saying that it does not expect an interest rate rise for the U.S. for the rest of 2019.

The Federal Open Market Committee (FOMC) announced during the week that it had decided to maintain the target range for the federal funds between 2.25% to 2.5%.