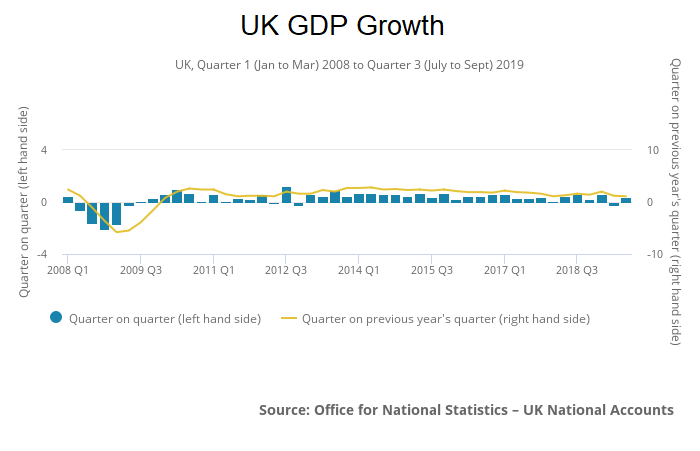

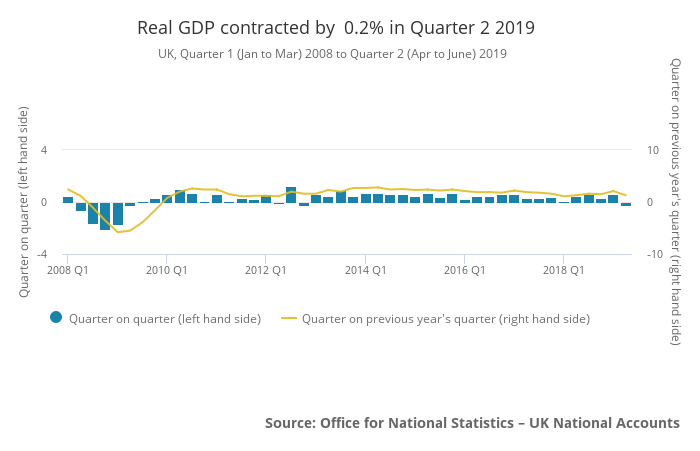

UK Q3 2019 GDP grows by 0.4% (QoQ) and grows 1.1% (YoY); Services, Production and Construction all grow; Business investment flat

Why wouldn’t it be?

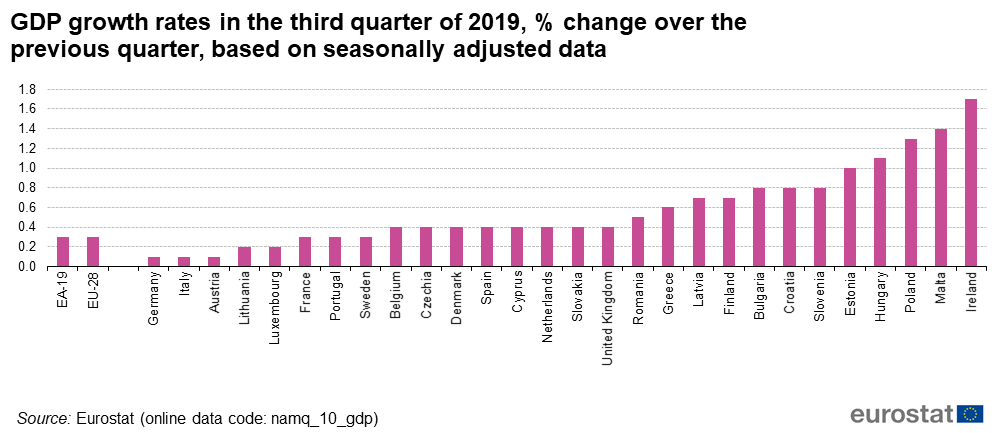

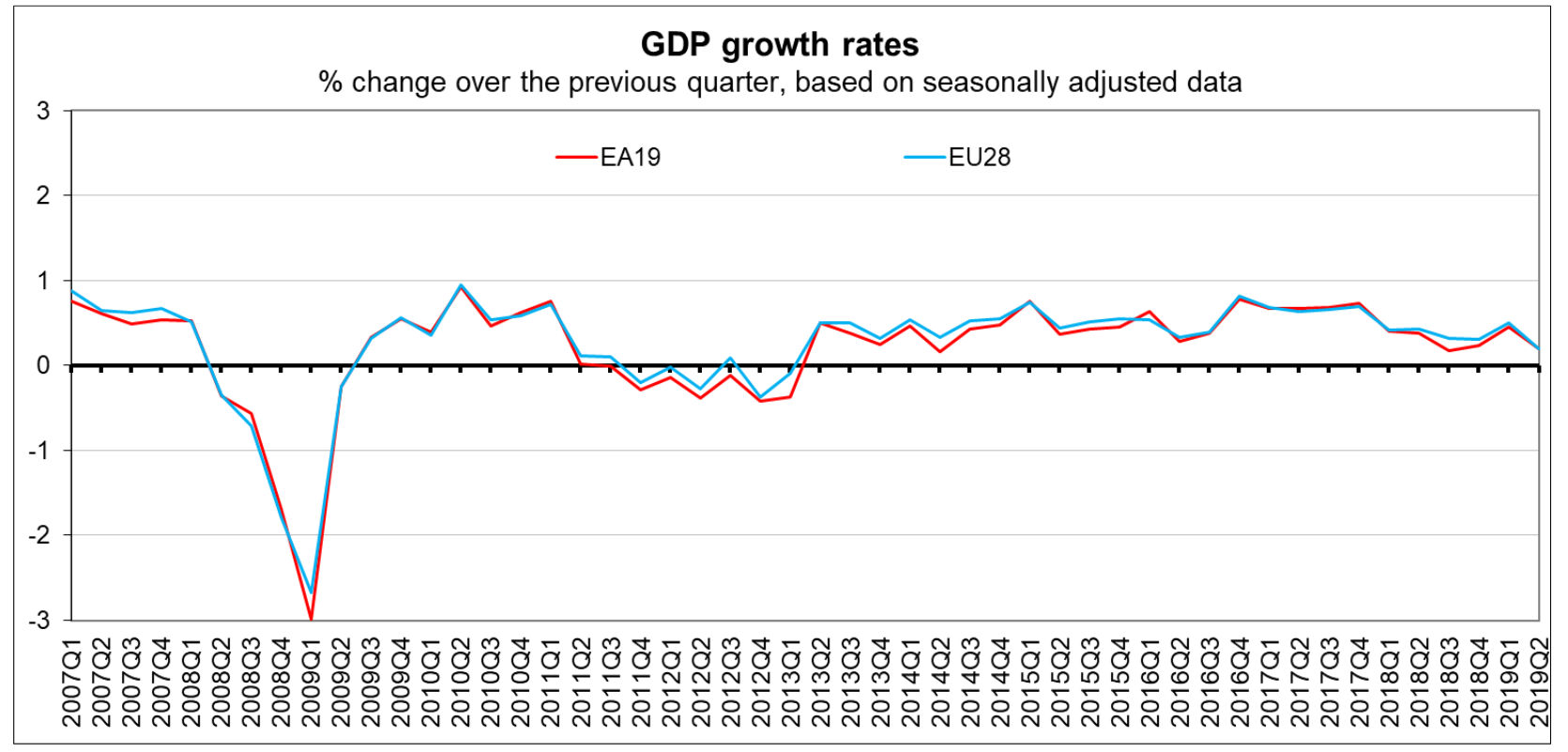

Q3 2019 GDP was up by 0.3 % in both the Eurozone (EA19) and in the European Union (EU28), compared to Q2 2019. In Q2 2019, GDP grew by 0.2 % in the Eurozone (EA19) and in the European Union (EU28). Compared with the Q3 2018 (same quarter of the previous year), seasonally adjusted GDP rose by 1.2 % in the Eurozone (EA19) and by 1.4 % in the European Union (EU28) in Q3 2019.

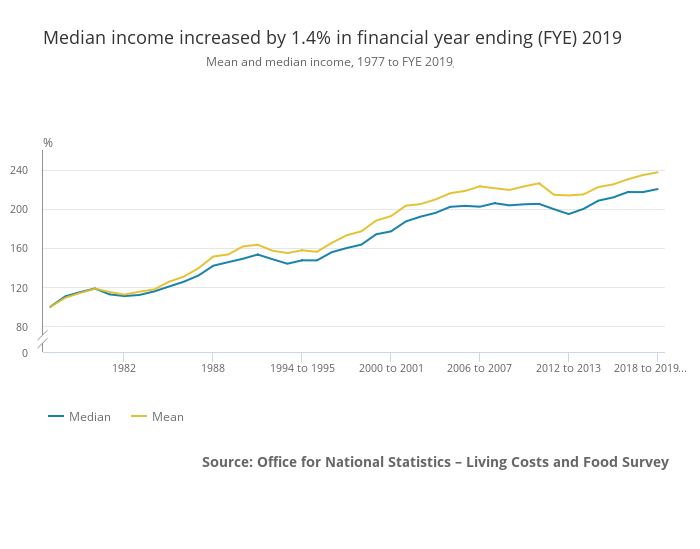

Median household disposable income in the UK was £29,400 at the end of the financial year 2019, up 1.4% or £400 compared to the end of the financial year 2018, after accounting for inflation.

Seasonally adjusted Gross Domestic Product (GDP) rose by 0.2% in both the Eurozone (EA19) and the European Union (EU28) during Q2 2019, compared with Q1 2019, according to a preliminary estimate published by Eurostat. Quarterly growth is now slowest in 5 years.

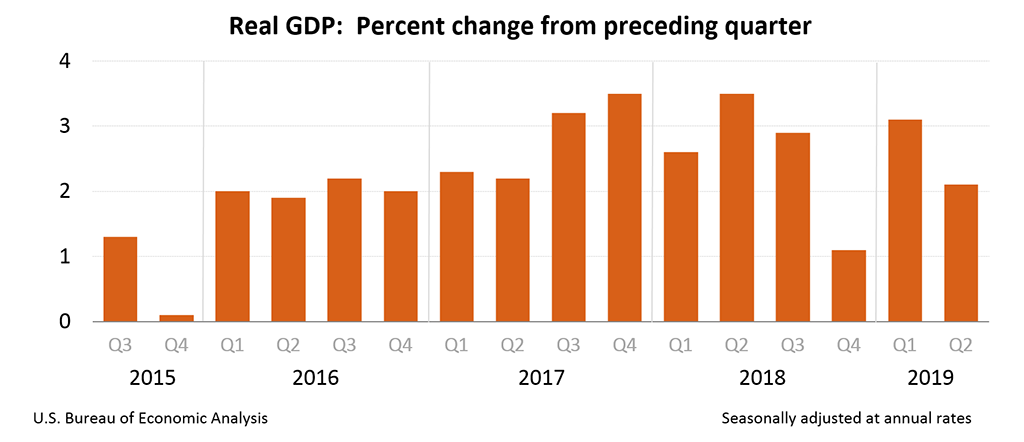

Real gross domestic product (GDP) for the United States increased at an annual rate of 2.1% in the Q2 2019 (vs 3.1% in Q1 2019), according to the advance estimate released by the Bureau of Economic Analysis.

Continue reading “U.S. Q2 2019 GDP growth estimated at 2.1% as personal consumption soars”

Government debt to GDP for the Eurozone stood at 85.9% at the end of Q1 2019 (as against 87.1% at the end of Q1 2018). For the European Union, the number was 80.7% (as against 81.6% at the end of Q1 2018).

The Federal Reserve has unwound its balance sheet by 12% over the past year and reduced it to $3.81 trillion (from a peak of $4.5 trillion in 2017).

It has also increased interest rates since from 0.25% (range of 0% to 0.25%) in 2016 to 2.5% (range of 2.25% to 2.5%) now.

A decade on from the financial crisis, 38 countries currently have interest rates at an all-time low. Ultra-low interest rates seem to be the tool of choice for Central Banks to help stimulate economies globally. But seriously, this a decade on from the financial crisis? Did the world really recover from the financial crisis? Probably not …

Continue reading “38 countries currently have interest rates at an all-time low”

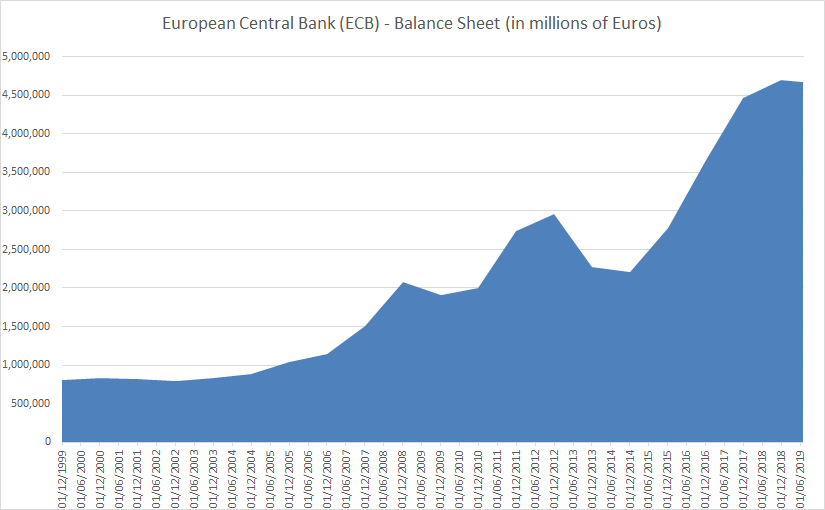

Apparently, the European Central Bank (ECB) balance sheet was meant to shrink significantly in 2019. It has shrunk just 0.5% in 2019 until July 5th (as against 5% for the Federal Reserve in the same period).

At 4.67 trillion Euros (or around 41% of Euro area or Eurozone GDP), it doesn’t look like things are going to change quickly.