This is a consolidated and slightly edited version of the series on economic fundamentals we ran last month.

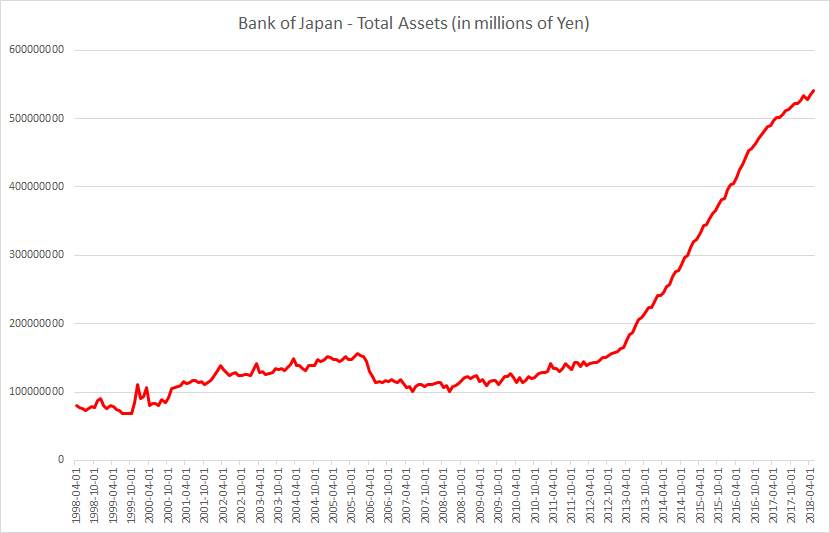

Do economic fundamentals matter today? We look at the strange market conditions today. We are living in truly interesting times …

Stock Market Valuations

Equities globally have never been more valuable with market capitalization hitting $90 trillion.

Amazon trades at what a Price to Earnings ratio of some 200. Apple is worth some $900 billion. Even Tesla which makes no profit and is unlikely to make any profit any time soon is worth some $55 billion, more than Ford or General Motors.

Netflix is valued at $159 billion (13.6 times revenues of $11.7 billion) with 110 million paid (and 117 million total) subscribers. Netflix trades at a price to earnings ratio of 220. The company expects free cash flow of -$3 to -$4 billion in 2018 (yes, that is negative cash flow). Yet Netflix’s market cap is now greater than Disney’s and Comcast’s.

Don’t mention fundamentals …

Continue reading “Do economic fundamentals matter anymore?”