Here is the debt outstanding for all commercial banks in the US (all data as of March 31, 2018),

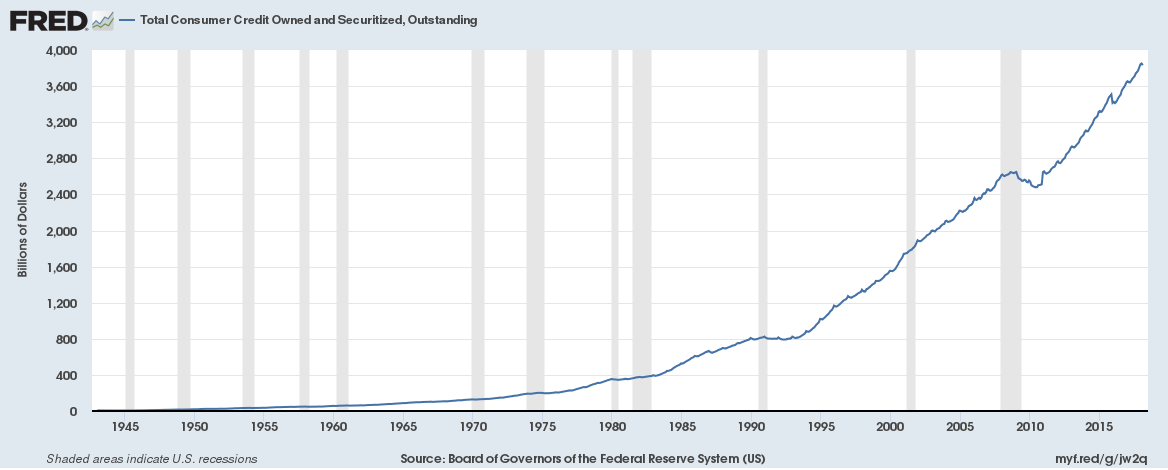

Total consumer credit including student loans $3.9 trillion (up from $2.6 trillion in 2008)

Total commercial and industrial loans $2.15 trillion (up from $1.5 trillion in 2008)

Commercial real estate loans $2.1 trillion (up from $1.6 trillion in 2008)

Mortgage Backed Securities $1.76 trillion (up from $800 billion in 2009)

Student loans $1.5 trillion (up from $500 billion in 2008)

Consumer credit cards and other revolving credit $775 billion (up from $400 billion in 2008)

Mortgage debt $1.32 trillion (down from $1.42 trillion in 2008)

Total Consumer Credit Outstanding: