US employers added only 103,000 jobs in March as against 185,000 new jobs expected by economists surveyed by Bloomberg. Jobs have been added for 90 straight months, the longest phase on record. January’s job addition number was revised sharply downward from 239,000 to 176,000. Wage growth was 2.7% which was largely down to tax cuts driven wage rises earlier during the year rather than real wage inflation.

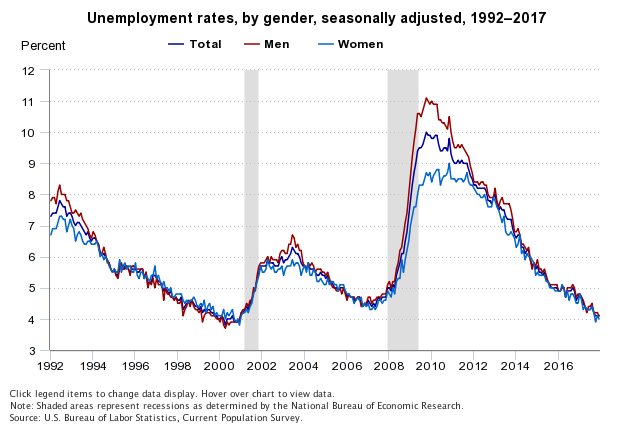

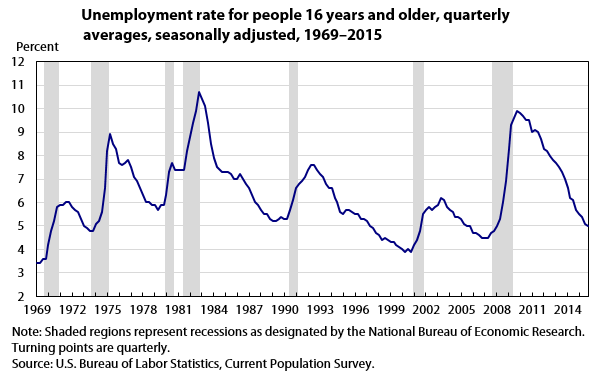

Any addition under 80,000 new jobs a month would cause the unemployment rate to rise. As we covered earlier, unemployment has always hit record multi year lows on an average 6 to 12 months before the start of a recession.

The graphs below might help visualise it better,

Meanwhile, bond yields are falling globally. The new Federal Reserve Chairman Jerome Powell in his first speech on the US economy since taking over at the central bank has said that growth is strong and more interest rate hikes are necessary. The markets seem to disagree for the moment.

10 year bond yields (as of April, 7, 2018), figures in brackets indicate 1-month changes

US 2.77% (-0.11%)

UK 1.40% (-0.13%)

Japan 0.05% (0.01%)

Germany 0.50% (-0.16%)

France 0.74% (-0.17%)

Netherlands 0.65% (-0.05%)

Italy 1.79% (-0.26%)

Spain 1.23% (-0.21%)

Portugal 1.69% (-0.16%)

Greece 4.01% (-0.77%)

Switzerland -0.01% (-0.06%)

Canada 2.14% (-0.09%)

Australia 2.66% (-0.16%)

Stock markets were very volatile over the week with major indices falling up to 3% over the week. Some are blaming trade tariffs, but other economic indicators are not looking good. Retail failures this year are as bad as 2009 and for the first time in many months retail money seems to be leaving equities.