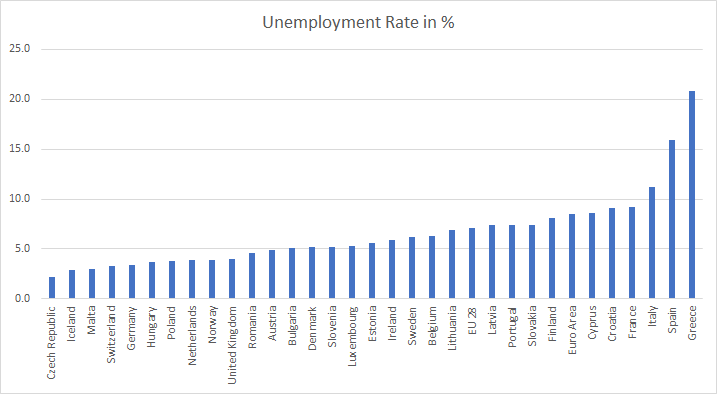

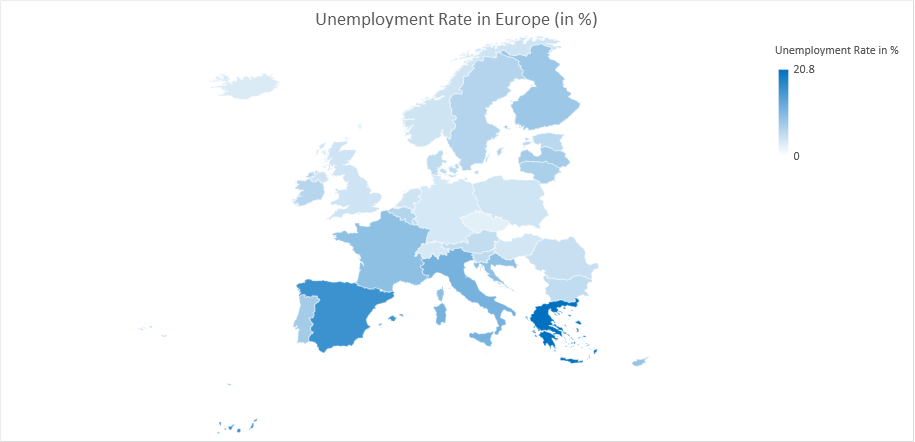

The Euro Area unemployment rate was 8.5% in April 2018, down from 8.6% in March 2018 and from 9.2% in April 2017. This is the lowest since December 2008 but still more than double of the US unemployment rate of 3.9% reported in April (the US unemployment rate further fell to 3.8% in May). The EU28 unemployment rate was 7.1% in April 2018, stable compared with March 2018 and down from 7.8% in April 2017. This remains the lowest rate recorded in the EU28 since September 2008.