Crude oil at $65.5 a barrel is up 23% over the past year and Brent is up some 27% during the same period. Gasoline prices are up 16% over the past year and we aren’t yet in the US driving season (which pushes up the price and begins in July). Continue reading “Crude oil is up 23% over the past year and it has started making an impact; US 3-year bond yields at a 11-year high”

Apparently, there are days when no one trades some Japanese government bonds; Could China devalue their currency or sell US Treasurys?

Some 80% of 10-year Japanese government bonds are held by the Bank of Japan. And apparently there are days when no one trades those 10-year bonds because there is no point of trading it. Why? Well, because the Bank of Japan has a policy to control yield curves and since they hold majority of it there are hardly any price movements.

But is also claimed that there are days when the 2-year bonds aren’t traded. That is interesting because the Bank of Japan only holds a small proportion of 2-year bonds. How to traders keep their jobs then? They trade bond futures instead. Continue reading “Apparently, there are days when no one trades some Japanese government bonds; Could China devalue their currency or sell US Treasurys?”

The European banking crisis is far from over

Hidden away in the European Central Bank’s supervisory and prudential statistics are metrics for asset quality. It isn’t easy to find and if you do find them then the spreadsheets won’t open without issues. Once If you manage to get them to work you will find some quite stunning statistics.

Here are the numbers and graphs for asset quality as of September 30, 2017 (the latest set of data available), Continue reading “The European banking crisis is far from over”

Weekly overview: US employment numbers; Bond yields fall globally over the past month; Stock markets volatility

US employers added only 103,000 jobs in March as against 185,000 new jobs expected by economists surveyed by Bloomberg. Jobs have been added for 90 straight months, the longest phase on record. January’s job addition number was revised sharply downward from 239,000 to 176,000. Wage growth was 2.7% which was largely down to tax cuts driven wage rises earlier during the year rather than real wage inflation.

Any addition under 80,000 new jobs a month would cause the unemployment rate to rise. As we covered earlier, unemployment has always hit record multi year lows on an average 6 to 12 months before the start of a recession.

The graphs below might help visualise it better, Continue reading “Weekly overview: US employment numbers; Bond yields fall globally over the past month; Stock markets volatility”

The problem Asset Managers have is that they have money that must be invested

The 10 largest asset managers in the world, a list that includes BlackRock, Vanguard, State Street, Fidelity, Allianz, UBS and JP Morgan Asset Management have some $32 trillion assets under management (at the end of 2017). The entire space of asset managers have around $65 trillion of assets under management.

Fund managers have over $3 trillion of new inflows a year, primarily down to private pensions (governments keep pushing it given the looming state pension crisis). These fund managers get paid as long as they invest the money. There lies the problem – they have to invest it. It isn’t as simple as it sounds. Continue reading “The problem Asset Managers have is that they have money that must be invested”

On Equities – Do as they say, not as they do? On Bond Yields – some things from the FOMC minutes

Goldman Sachs computer model warns a bear market is near, but the firm’s analysts don’t believe it (read here). So, if a bear market arrives – they were right (well their computer model was), no bear market – they were still right.

JP Morgan has said investors are ‘overreacting’ and investors should buy the market dip for a big rally ahead (read here). How big? 13%. Which would just about take us back to the highs the market hit at the end of January. Will they do as they say? Who knows.

Meanwhile, 10-year US bond yields have fallen 12 bps (to 2.78%) in the past week since the 0.25% Federal Funds rate target increase. As the Federal Reserve pares back its bond holdings, the US government is bringing more to market, yet yields have been falling.

Here are some interesting things from the FOMC releases (text in italics are our comments), Continue reading “On Equities – Do as they say, not as they do? On Bond Yields – some things from the FOMC minutes”

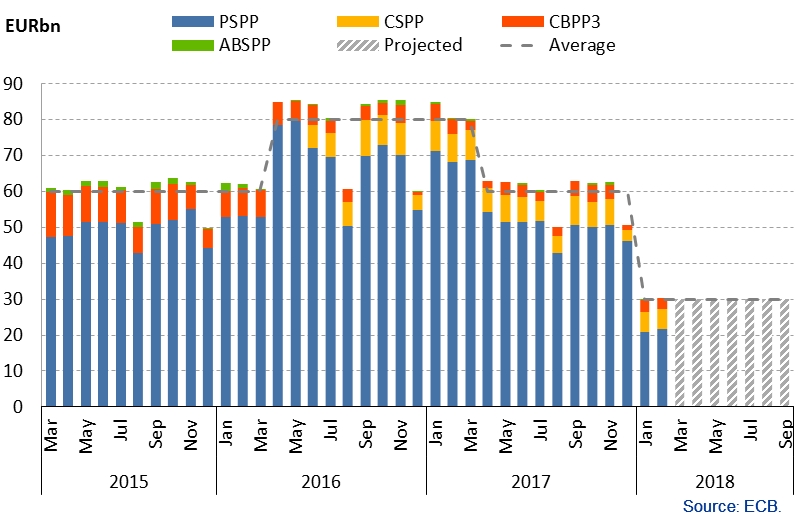

The ECB balance sheet is now over 4.5 trillion Euros, some 45% of Eurozone GDP

The European Central Bank (ECB) is by far the biggest holder of European bonds and the biggest (possibly the only) buyer of the weaker Eurozone (Italy, Spain, Portugal and Greece) countries debt.

Bond yields are being held artificially low by the buying programme. Continue reading “The ECB balance sheet is now over 4.5 trillion Euros, some 45% of Eurozone GDP”

As LIBOR moves upwards, Central Banks remain so predictable

The Federal Reserve under new chairman Jerome Powell approved a 0.25% hike that puts the new benchmark funds rate at a target of 1.5% to 1.75%.

There was once a time when no one knew what to expect when Central Bankers met. Times have entirely changed, they are so predictable. Continue reading “As LIBOR moves upwards, Central Banks remain so predictable”

Markets should ignore cyclical factors and focus at the structural factors instead

How often do analysts get the markets wrong? How often to fund managers get stock picks wrong? They get things wrong far more often then they get it right.

2017 was probably the worst year for hedge funds. And the start of 2018 isn’t turning out to be any better.

The problem probably lies with everyone focussing on the business cycle rather than the structural factors driving the markets. Continue reading “Markets should ignore cyclical factors and focus at the structural factors instead”

Here are some interesting things you may have missed in the equity, commodity, currency and bond markets

1. Hong Kong’s Hang Seng Index is up 34% over the past year.

2. Tencent Holdings (the owner of WeChat – the WhatsApp equivalent in China and several other things) is up 116% over the last year. It is currently worth over $550 billion and is most valuable social media company (bigger than Facebook).

3. Ping An Insurance (Ping An Insurance Group Company of China Ltd) is now the world’s largest and most valuable insurance company. Its stock is up 110% over the year. Continue reading “Here are some interesting things you may have missed in the equity, commodity, currency and bond markets”