Amazon accounts for about 52% of all online retail sales in the U.S. and its performance acts as a barometer for total online sales growth for the United States.

The most recent sales report for Amazon was for Q1 (January to March) 2019. Net sales increased 17% to $59.7 billion in the first quarter, compared with $51.0 billion in first quarter of 2018. Gone are the days when Amazon was growing at 200%, 100% or even 40%. The base is inevitably large now but what really is happening at Amazon?

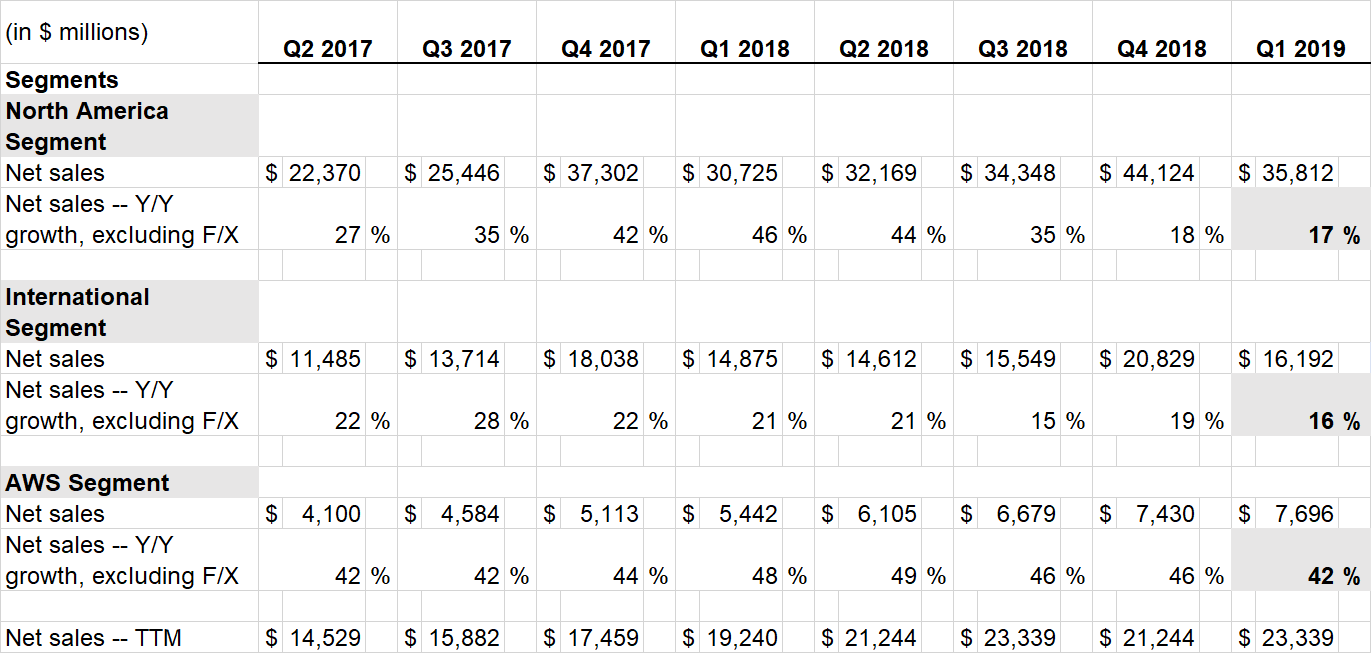

North American Sales grew just 17% (Q1 2019 vs Q1 2018), compare this to a year ago when the growth was 46% (Q1 2018 vs Q1 2017).

International Sales grew 16% (Q1 2019 vs Q1 2018) excluding currency movements. Including currency movements – the growth was just 9%. This despite Amazon adding Australia and Turkey to its online portfolio during the past year and spending significant money expanding in India.

Amazon Web Services (AWS), the cloud division is the bright spot with growth still in excess of 40%.

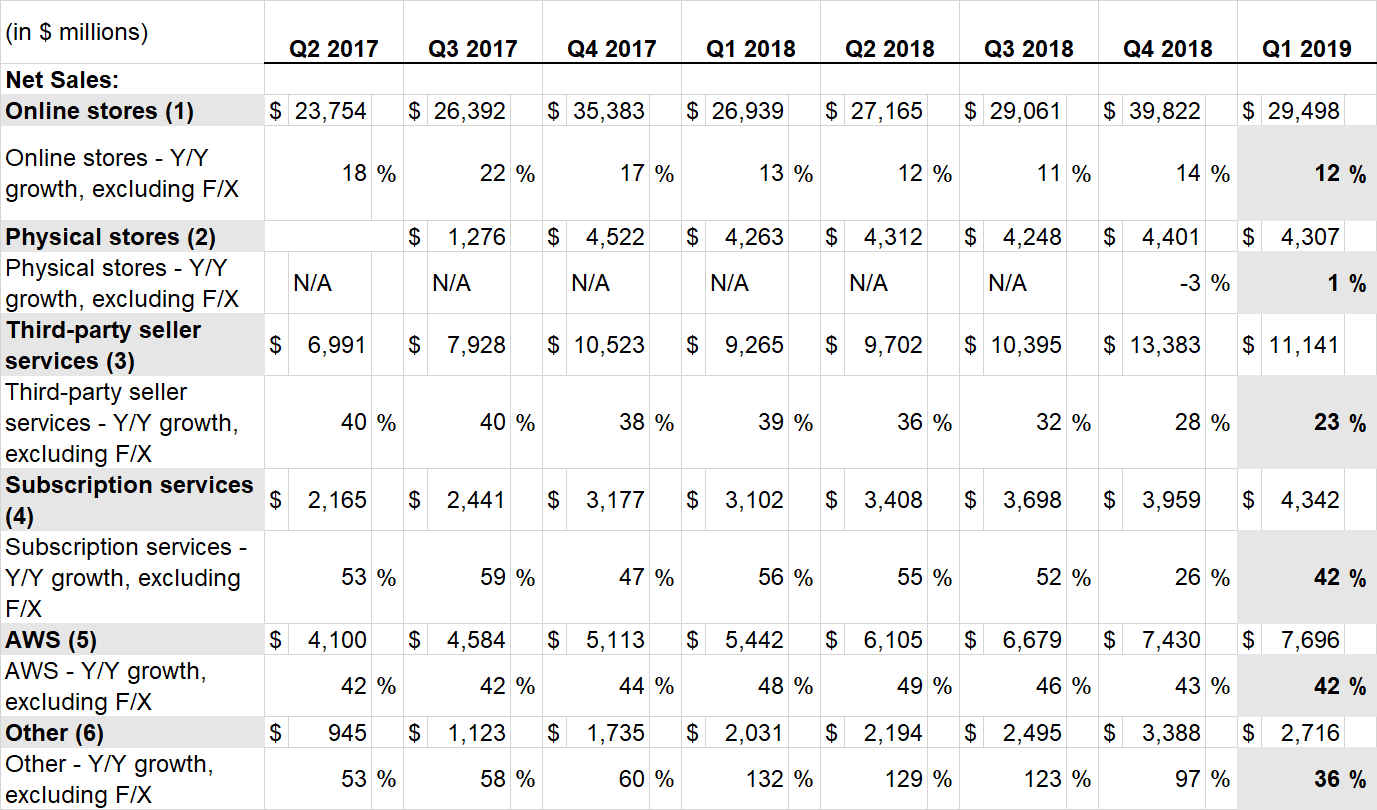

Core online sales grew just 12%. Core sales includes sales of goods sold by Amazon (not sold by others and simply fulfilled by Amazon).

Third party sales on the site (Amazon Marketplace, like eBay) grew 23% (Q1 2019 vs Q1 2018). Third party sales have moderated from the 39% growth rate last year (Q1 2018 vs Q1 2017).

Subscription services including Prime grew 42% (Q1 2019 vs Q1 2018) thanks mainly to a 20% increase in prices for the U.S. Prime Subscriptions. Without that price hike, growth would have probably been under 15%.

Physical Stores sales growth was just 1%. Physical Stores mainly include Whole Foods.

Other sales – which mainly includes advertising and other business moderated to a growth rate of 36% (Q1 2019 vs Q1 2018).

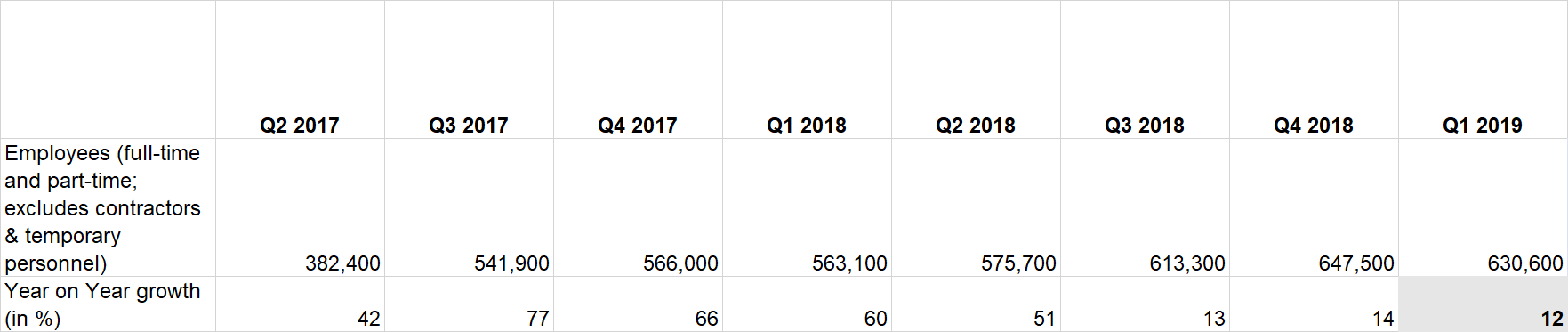

Amazon headcount was down 16,900 employees during the quarter (Q1 2019 vs Q4 2018). On a quarter on quarter basis, this was the worst quarter ever with job losses. Year on year (Q1 2019 vs Q1 2018) employee headcount was up just 12%, the slowest growth ever on record.

As Amazon sales slows, so does the growth of the total e-commerce growth rate of the United States,

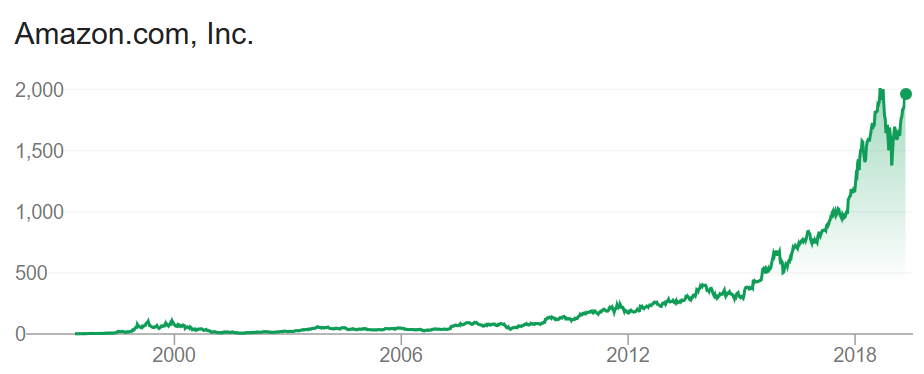

Peak Amazon? Not yet, but the share price looks well valued.

Amazon’s profit margin was 7.4% during against 3.8% a year ago. Amazon used to chase revenue at the cost of profits, it is now chasing profits at the cost of revenue growth. Amazon’s profit could grow significantly if it stops investing in growth but there is where the problem is – Amazon would no longer be a growth story.

Related:

Amazon’s spending on lobbying increased 600% since 2009

Technology Companies granted an astonishing amount of Restricted Stock Units by value in 2017