With the UK government recently proposing extra spend for the National Health Service and potentially extra taxes to fund it, we look at how UK tax collections for different taxes have grown over time.

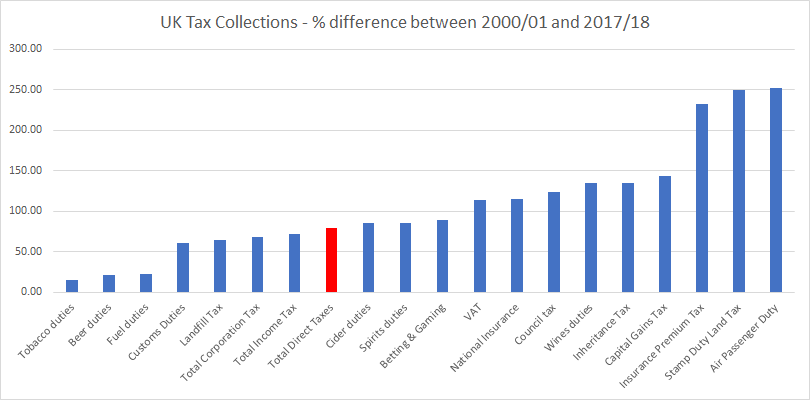

While total tax collections have grown 80% between 2000/01 and 2017/18, income tax has only grown 72% and Corporation tax only 68%. Value added tax (VAT) collections has grown 114%. Stamp duty land tax (which is charged on purchase of property) has grown 250% and Air Passenger duty (charged for every flight departure from an UK airport) has grown 252%.

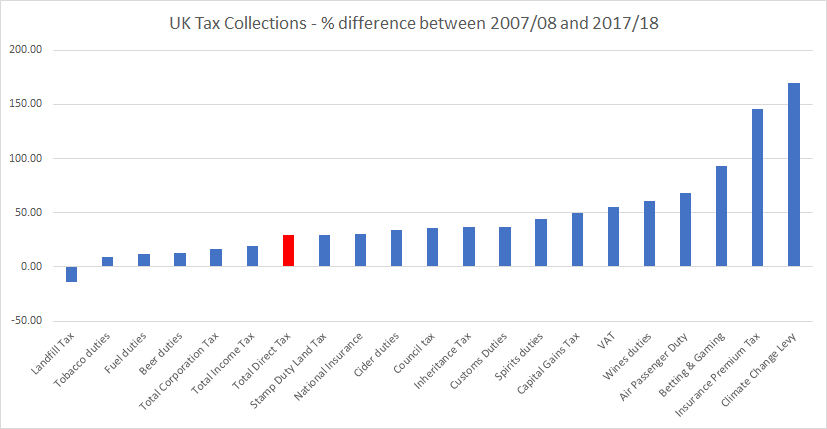

The numbers are different for tax collections between 2007/08 and 2017/18. Total direct taxes have grown 29%, income tax collections have grown 20% and Corporation tax collections have grown just 16%. Value added tax collections have grown a massive 56%, Air Passenger Duty 68% and Insurance Premium Tax collections have grown 146%.

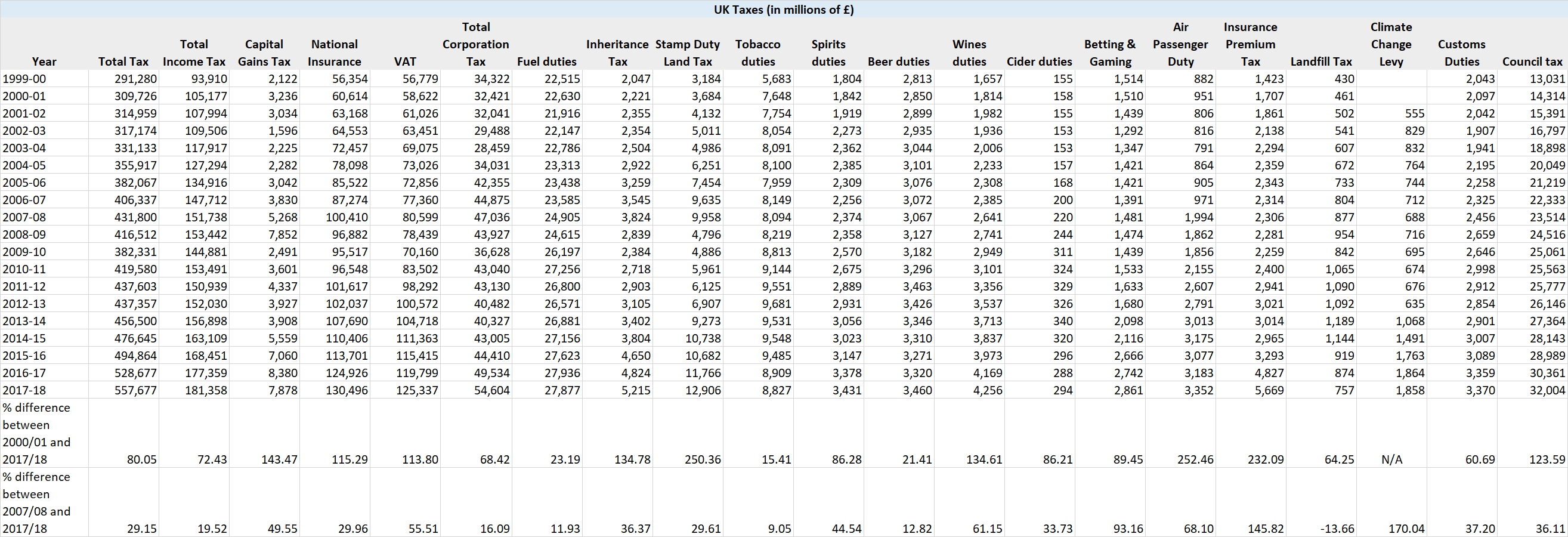

Here is a table of all tax collections since the year 1999/2000 until 2017/2018,

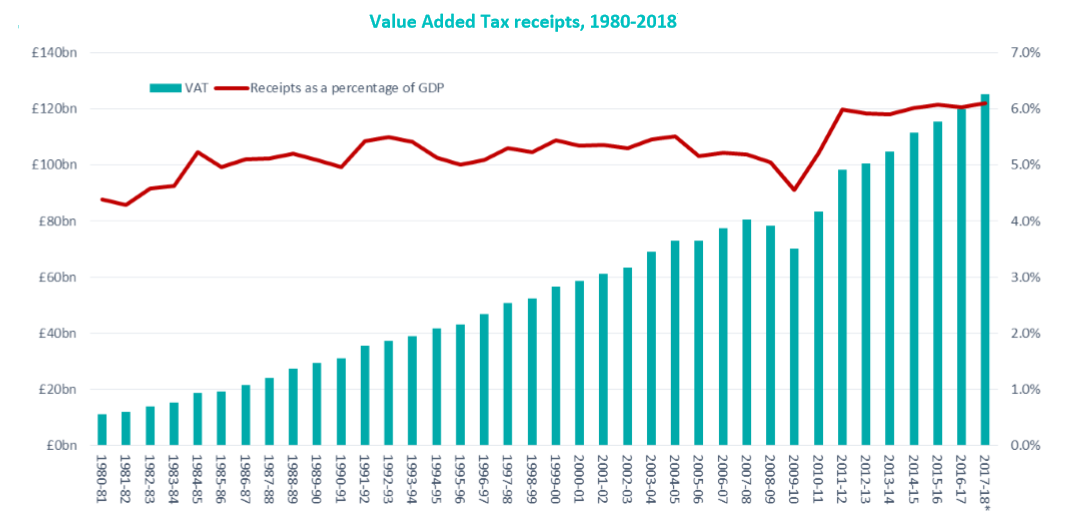

Value added tax now accounts for 6% of GDP for the United Kingdom and could become the largest tax collection component exceeding income tax.

Which taxes will the UK raise to fund the extra spending on the National Health Service?

Well, Inheritance tax rates have gone up in recent years, as have council tax rates. Air Passenger Duty has been increasing too and Insurance Premium tax rates have soared in recent years. National Insurance Rates have been growing too.

Income tax rates haven’t grown (other than in Scotland which now has different rates to the rest of the United Kingdom) and the minimum threshold has been growing too.

On the other hand, Corporation tax rates have been falling. Would the government increase those? We think that is unlikely.

We think National Insurance rates are moving up further, but VAT rates could be hiked too. A 1% hike in VAT would fund the extra spending.

Whatever happens, it would appear individuals and households will end up paying more taxes rather than corporations.

Related: Income tax rates for each country