Sweden is an amazing country. It is the country where Ikea, Skype, Spotify, Ericsson, Mojang (of the Minecraft fame) were founded and the country of the world’s oldest Central bank Sveriges Riksbank.

It is also the country with the highest Value Added Tax (VAT) rate and amongst the highest income tax rates.

We look at the Swedish economic model and what makes it unique and whether the economic model could be considered as a role model for the world.

In the 1980s and 1990s things were different in Sweden.

The Swedish economy then used to suffer from low growth and high inflation.

The currency, the Swedish krona was repeatedly devalued.

In the early 1990s, banks became unstable and two banks (Nordbanken and Götabanken) were nationalised. During that period unemployment also rose rapidly, government spending massively increased as did Sweden’s national debt.

Since then Sweden has completely transformed its economy.

What makes Sweden unique?

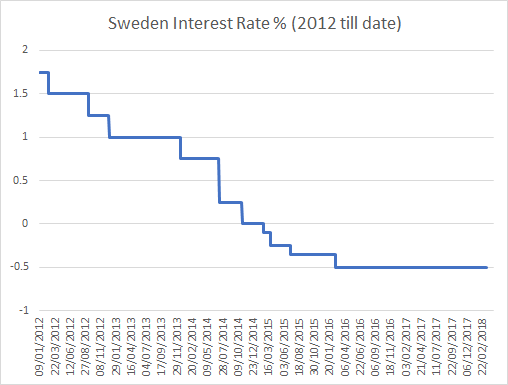

Negative interest rates

Sweden has had negative interest rates since early 2015. When the ECB announced a €1.1 trillion quantitative easing programme in early 2015 to buoy the eurozone, the euro weakened against Sweden’s krona. The cost of importing goods into Sweden fell and brought down inflation. The Riksbank has had to cut its own rates in response to avoid deep deflation.

High Savings Rate

Sweden has high savings rates, the third highest in the developed world according to the OECD at over 15%.

High rate of taxation

Sweden has the highest Value Added Tax (VAT) rate at 25%. It has amongst the highest income tax rates in the world as well with an average highest marginal (on income of over SEK 662,400) rate at 57.34%. Top marginal tax rates vary for all municipalities. As examples: Stockholm 55.055%, Gothenburg 57.846% and Malmo 57.176%.

The top marginal rate in 2018 has fallen from the 2017 rate of 61.85%.

Balanced Budget

With support across the political spectrum, the Swedish government has a ceiling on expenditure and a budget surplus goal. While countries like the US are increasing their budget deficit, Sweden has a budget surplus and paying back its debt. Negative interest rates help with that too.

Cashless economy

Sweden is the most cashless society in the world with less than 1% of the value of all payments made using coins or notes in 2017.

Across the country, cash is now used in less than 20% of transactions in stores – half the number five years ago, according to the Riksbank.

Stockholm metro does not accept cash niether does most public transport. Most retailers only accept card payments and street vendors accept cards too. Even smaller payments are cashless with widespread card acceptance. iZettle – one of the most popular small retail payment processers is actually a home grown company from Sweden. Retailers are legally entitled to refuse coins and notes.

About 65% of Sweden’s 1500 odd bank branches no longer handle cash. Further many no longer even have ATMs.

Riksbank figures reveal that the average value of Swedish krona in circulation fell from around 106 billion in 2009 to 65 billion in 2016.

Intergenerational mortgages/home loans

Most home loans in Sweden have a term of over 100 years. Intergeneration mortgages are common there (like they are in Switzerland and Japan). The maximum mortgage term has been reduced to 105 years now. Most people lock in their mortgage for 10 years or longer at a time at a (low) fixed rate.

Should the global economy be more like Sweden?

Sweden is a dynamic, diverse and vibrant economy. Structurally, the government is doing the right thing, but risks remain. It is very difficult to find somewhere to live (buy or rent) in Sweden. Because of the state retrenching from the housing sector and the wrong type of homes being built along with rapid population growth there is a severe housing shortage. Property prices have soared and there is a big risk that the bubble might burst causing a recession.

Wealth in Sweden is more evenly distributed across regions than anywhere else in the EU and wealth distribution is probably the best in the world.

A fiscally sustainable government, an innovative economy and an open approach to trade. The world can learn a lot from Sweden.