The Euro Area, China, Canada, Mexico and Japan together account for over 70% of U.S. trade. Have these countries (including the Euro Area group of countries) manipulated their currencies to boost exports? In this century (2000 onwards) the Chinese Yuan, the Canadian Dollar and the Euro have appreciated against the dollar. The Japanese Yen has been largely unchanged against the U.S. dollar since the start of this century and only the Mexican Peso has weakened against the dollar.

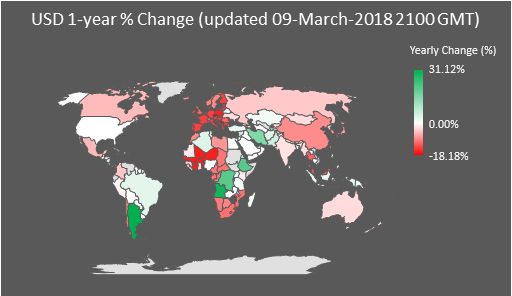

Currency carnage everywhere, here’s how every currency in the world has performed against the US dollar over the past year

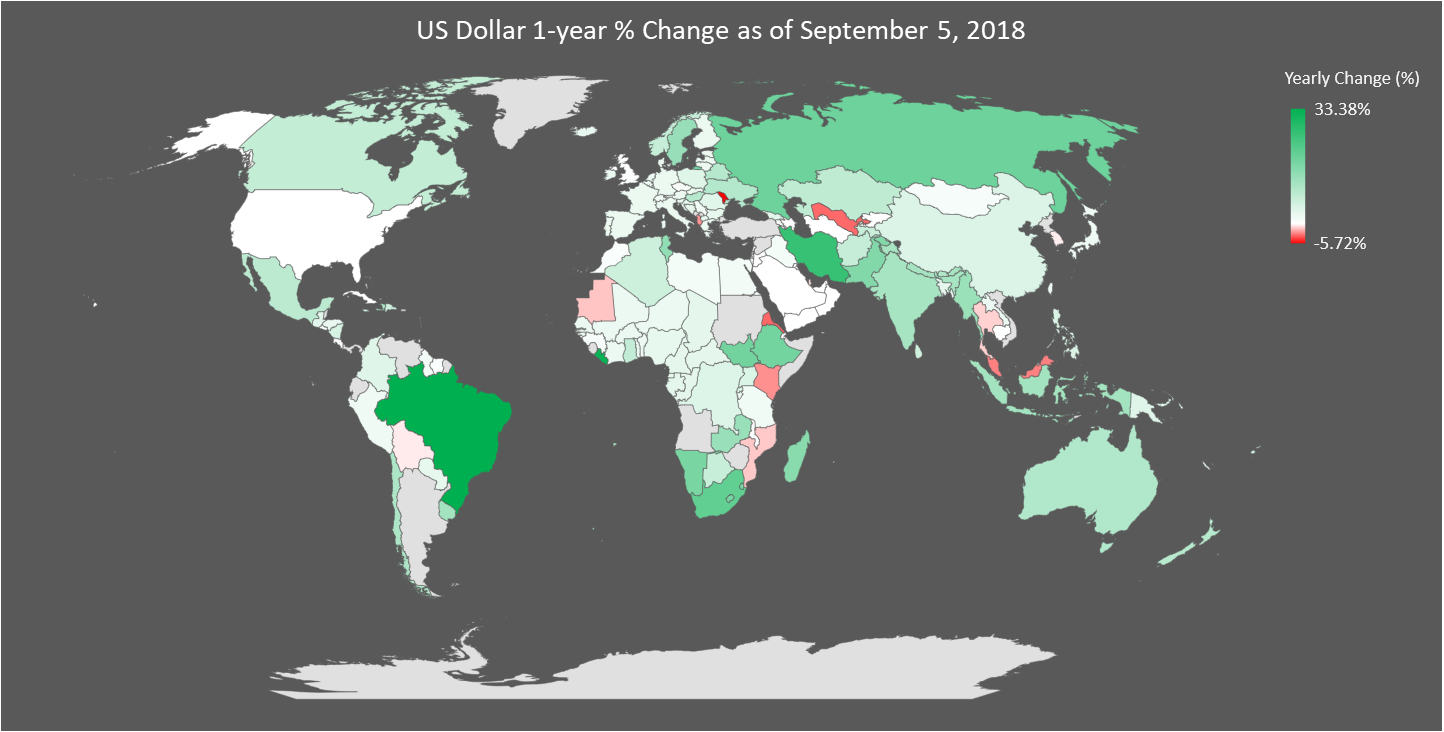

What a difference six months makes, here’s the performance of the US dollar against each currency as of the 5th of September 2018,

Notes: 1. We have excluded the performance of Angola, Sudan, Argentina, Turkey and Venezuela on the map because they are major outliers. They are included in the data set below. 2. Currency price data updated 05-September-2018

History is repeating itself, is this the end of the current cycle of global synchronised growth?

We wrote earlier this year on the downsides of synchronised global growth. We wrote that when global synchronised growth begins to end the U.S. dollar strengthens, investors run away from emerging markets, interest rates continue to rise to tame inflation and bad debt becomes an issue. All of this is happening now, first the US Dollar, here is the 1-year performance of the U.S. Dollar mapped,

Weekly Overview: Emerging Market Rout; New Italian Government; Japan GDP; Oil surge continues

Emerging Markets are being routed with rising oil and a soaring US dollar

Here is the performance of the US dollar against emerging market currencies (figures in brackets are 1-month % change),

USD/MXN – Mexico 19.9450 (+8.17%)

USD/INR – India 67.9850 (+3.23%)

USD/TRY – Turkey 4.4894 (+10.07%)

USD/BRL – Brazil 3.7375 (+10.33%)

USD/ZAR – South Africa 12.7550 (+6.71%) Continue reading “Weekly Overview: Emerging Market Rout; New Italian Government; Japan GDP; Oil surge continues”

A brief history of global trade or reserve currencies

Historically, just a single currency has played a dominant role globally.

Historic global trade currencies

The silver Drachma issued by ancient Athens in the 5th Century B.C. was most likely the first currency that was widely circulated.

The gold Aureus and silver Denarius coins issued by Rome were next and they were the dominant currencies from 1st Century B.C. to 4th Century A.D.

Inflation caused major devaluation of the Roman-issued currencies, causing them to become increasingly less accepted making way for the Byzantine Empire’s gold Solidus coin to become the dominant currency in international trade from the 5th Century to 6th Century. Continue reading “A brief history of global trade or reserve currencies”

Oil highest since November 2014; Dollar index hits its highest level in 2018; Warren Buffett and Bill Gates on Cryptocurrencies

Oil Prices

The price of crude oil crossed $70 per barrel today, the highest since November 2014.

US firm ConocoPhillips has taken over oil inventories and terminals of Venezuelan state-owned PDVSA under court orders to enforce a $2 billion arbitration award by the International Chamber of Commerce. Further, US President Donald Trump said he’d announce his decision on the Iran nuclear deal on Tuesday. Both developments contributed to soaring oil prices. Continue reading “Oil highest since November 2014; Dollar index hits its highest level in 2018; Warren Buffett and Bill Gates on Cryptocurrencies”

Apparently, there are days when no one trades some Japanese government bonds; Could China devalue their currency or sell US Treasurys?

Some 80% of 10-year Japanese government bonds are held by the Bank of Japan. And apparently there are days when no one trades those 10-year bonds because there is no point of trading it. Why? Well, because the Bank of Japan has a policy to control yield curves and since they hold majority of it there are hardly any price movements.

But is also claimed that there are days when the 2-year bonds aren’t traded. That is interesting because the Bank of Japan only holds a small proportion of 2-year bonds. How to traders keep their jobs then? They trade bond futures instead. Continue reading “Apparently, there are days when no one trades some Japanese government bonds; Could China devalue their currency or sell US Treasurys?”

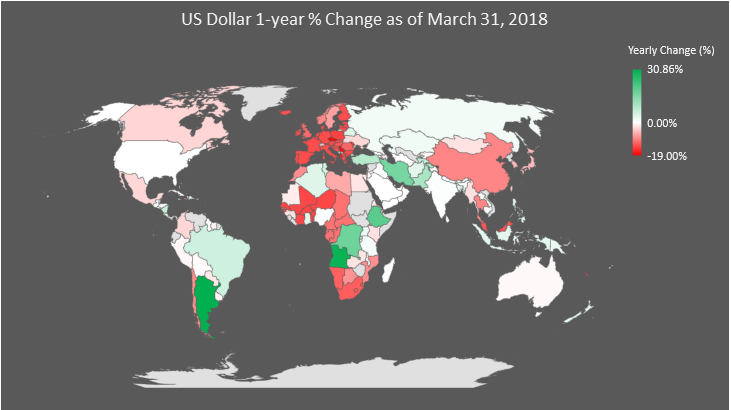

Not an April Fools’ Day joke – this really is how the US Dollar has performed against each currency of the world over the past one year

Here is the performance (1-year % change) of the US Dollar (USD) mapped against currencies and countries around the world (the data set is after the map),

Here are some interesting things you may have missed in the equity, commodity, currency and bond markets

1. Hong Kong’s Hang Seng Index is up 34% over the past year.

2. Tencent Holdings (the owner of WeChat – the WhatsApp equivalent in China and several other things) is up 116% over the last year. It is currently worth over $550 billion and is most valuable social media company (bigger than Facebook).

3. Ping An Insurance (Ping An Insurance Group Company of China Ltd) is now the world’s largest and most valuable insurance company. Its stock is up 110% over the year. Continue reading “Here are some interesting things you may have missed in the equity, commodity, currency and bond markets”

USD 1-year % change mapped

Here is the performance (1-year % change) of the US Dollar (USD) mapped against currencies and countries around the world,