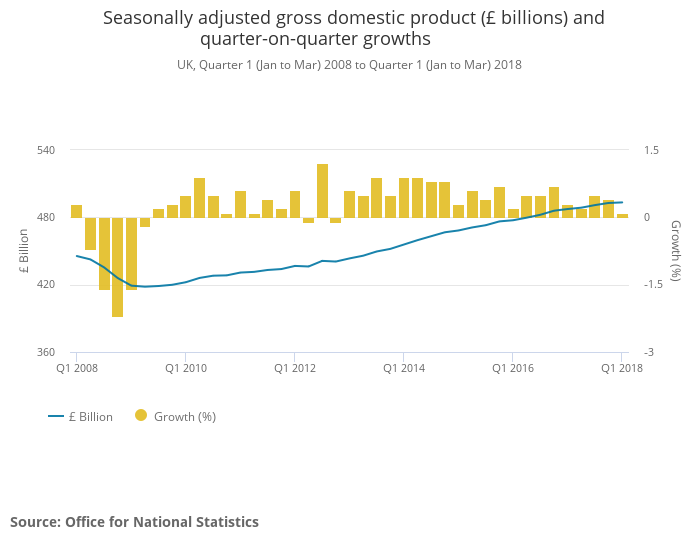

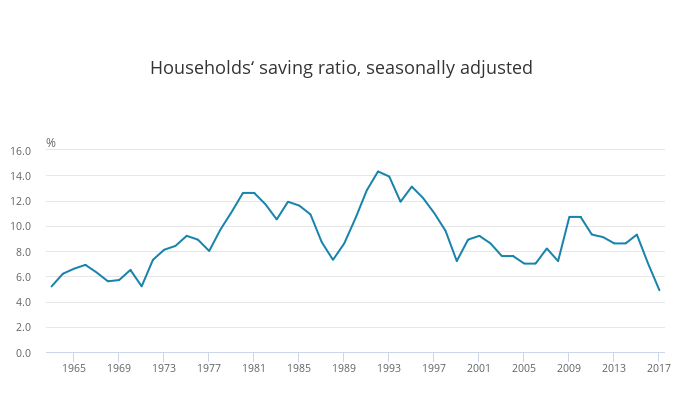

We recently wrote about the UK household savings ratio falling to a record low of 4.9% in 2017 (since comparable records began in 1963) as growth in households’ spending exceeded the growth of households’ income. (Read more here).

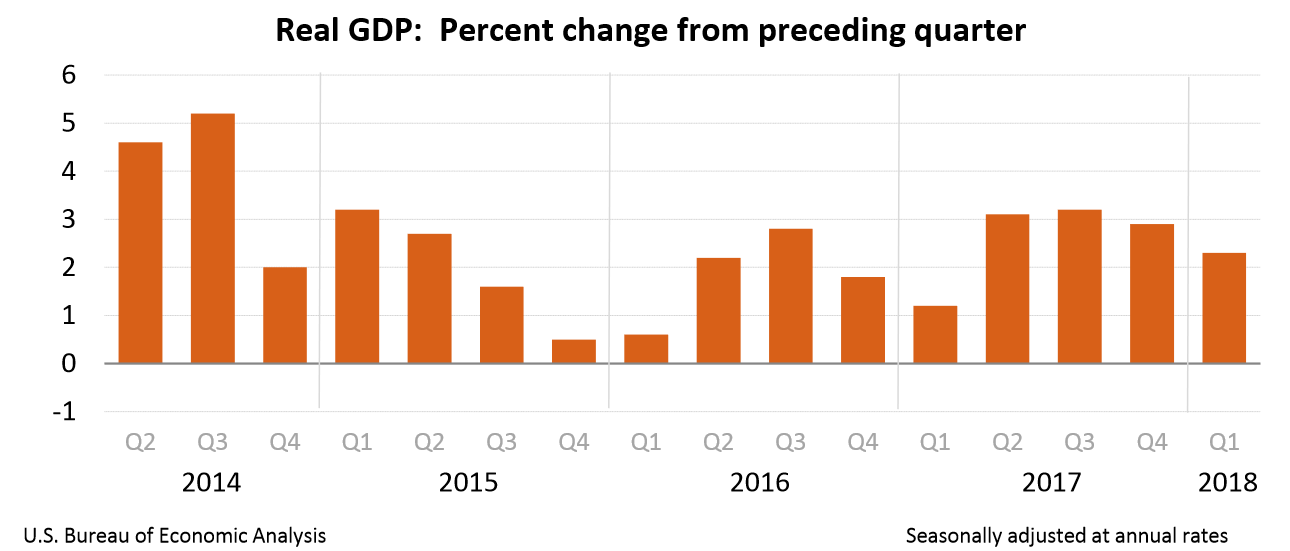

We also wrote about the household savings rate in the US falling to a multi-year low of 3.1% as household expenditure grew quicker than income (Read more here). Continue reading “Household saving rates are falling globally”