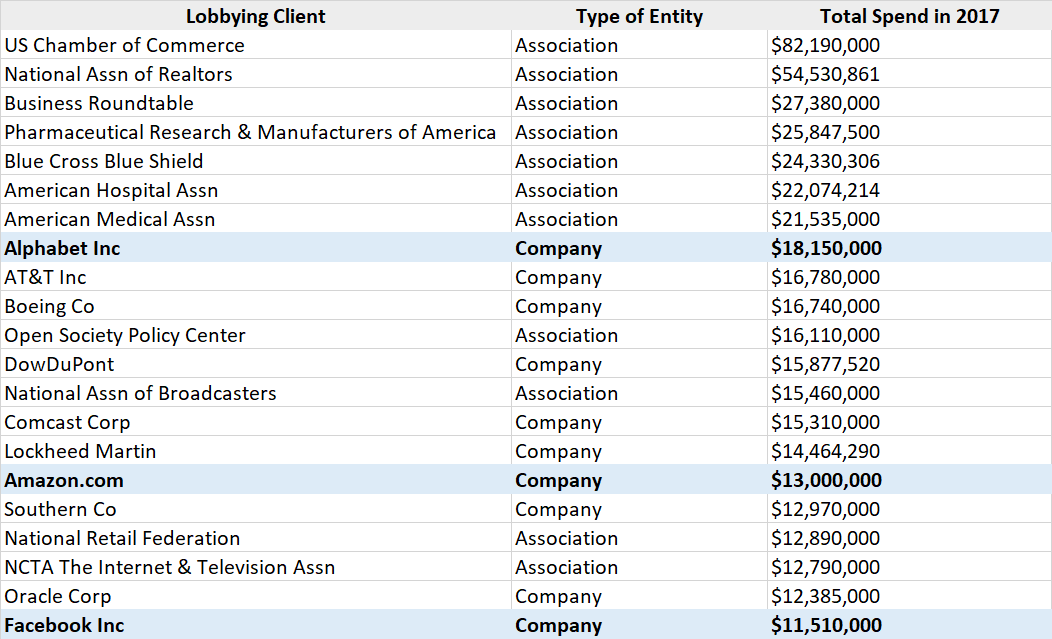

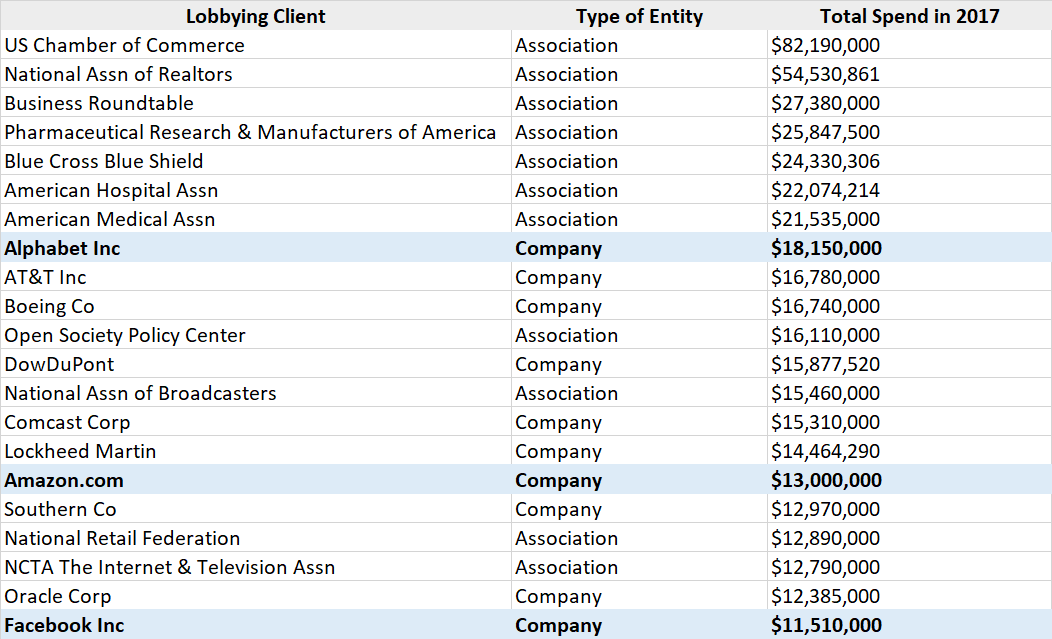

Alphabet Inc. spent the most as a company (not an association or business group) on lobbying in 2017. Amazon and Facebook too saw an increase in lobbying spend in 2017.

Why wouldn’t it be?

Alphabet Inc. spent the most as a company (not an association or business group) on lobbying in 2017. Amazon and Facebook too saw an increase in lobbying spend in 2017.

The Office for National Statistics (ONS) and the Bank of England (BoE) both released UK data on March 29 and the data doesn’t look good. Key highlights include:

Thanks again to everyone reading this and contributing to the success of this website. We have had an amazing first 75 days and would like to share what we have learnt, and we hope you will learn something new from what we learnt.

In part 1 of this series, we covered visitors and visitor interaction. You can read part 1 here.

In part 2 we cover our experience of advertising this website online. It has been quite a learning and very surprising. Continue reading “What we have learnt in 75 days of this site – Part 2: Advertising this website online”

Goldman Sachs computer model warns a bear market is near, but the firm’s analysts don’t believe it (read here). So, if a bear market arrives – they were right (well their computer model was), no bear market – they were still right.

JP Morgan has said investors are ‘overreacting’ and investors should buy the market dip for a big rally ahead (read here). How big? 13%. Which would just about take us back to the highs the market hit at the end of January. Will they do as they say? Who knows.

Meanwhile, 10-year US bond yields have fallen 12 bps (to 2.78%) in the past week since the 0.25% Federal Funds rate target increase. As the Federal Reserve pares back its bond holdings, the US government is bringing more to market, yet yields have been falling.

Here are some interesting things from the FOMC releases (text in italics are our comments), Continue reading “On Equities – Do as they say, not as they do? On Bond Yields – some things from the FOMC minutes”

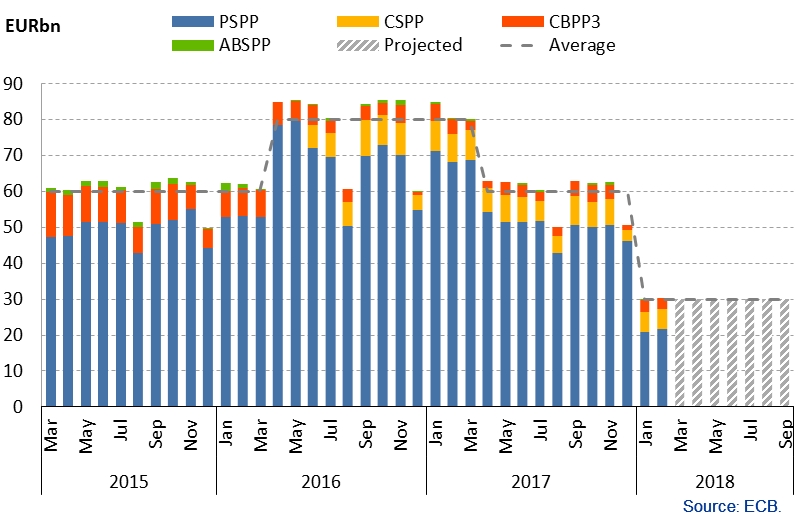

The European Central Bank (ECB) is by far the biggest holder of European bonds and the biggest (possibly the only) buyer of the weaker Eurozone (Italy, Spain, Portugal and Greece) countries debt.

Bond yields are being held artificially low by the buying programme. Continue reading “The ECB balance sheet is now over 4.5 trillion Euros, some 45% of Eurozone GDP”

Everything by design is kind of complicated. And because it is complicated it is inefficient. But inefficiency keeps people in jobs. Let us explain.

Education is form of an inefficiency. Just 20% of people go on to a role that requires their knowledge from college or university education. But keeping more people in education keeps them out of the job market.

Government regulations change so often that it inherently creates several roles. The law is complicated and inefficient, but it keeps many people in a job and creates new jobs.

New technologies become a trend and all big organizations want to keep up with the trend. The result? More jobs for new stuff. And new stuff brings with it new experts, new certifications and new training. Continue reading “Inefficiency keeps unemployment low and here is why it now matters”

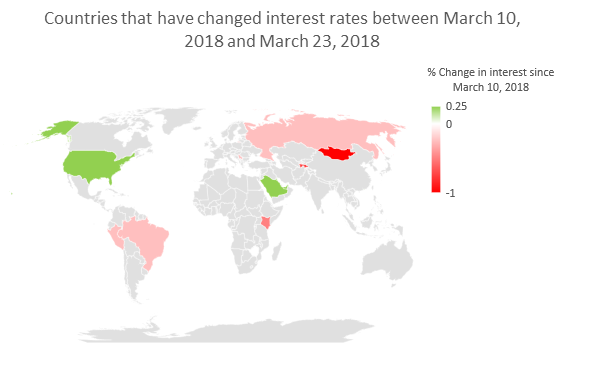

The US was not alone in hiking interest rates. The 6 other countries that hiked interest rates by 0.25% in line with the US were United Arab Emirates, Bahrain, Kuwait, Saudi Arabia, Hong Kong and Macau – all of which peg their interest rates in line with the one in the US.

Meanwhile Russia, Brazil, Mongolia, Tajikistan, Kenya, Serbia and Peru all lowered their interest rate.

Continue reading “7 countries hiked interest rates and 7 lowered interest rates in the past 2 weeks”

There were two articles in the news on social media recently, one from CNBC on how most trending videos in India on YouTube are often overwhelmingly hoaxes (click here to read it) and another from the BBC on how UN investigators have said the use of Facebook played a “determining role” in stirring up trouble in Myanmar (click here to read it).

The use of Facebook data to target voters and change election outcomes has triggered massive outrage globally but that isn’t the only bad thing Facebook has done. Continue reading “The biggest danger of social media is the way it has and continues to be used as a propaganda machine”

The Federal Reserve under new chairman Jerome Powell approved a 0.25% hike that puts the new benchmark funds rate at a target of 1.5% to 1.75%.

There was once a time when no one knew what to expect when Central Bankers met. Times have entirely changed, they are so predictable. Continue reading “As LIBOR moves upwards, Central Banks remain so predictable”

How often do analysts get the markets wrong? How often to fund managers get stock picks wrong? They get things wrong far more often then they get it right.

2017 was probably the worst year for hedge funds. And the start of 2018 isn’t turning out to be any better.

The problem probably lies with everyone focussing on the business cycle rather than the structural factors driving the markets. Continue reading “Markets should ignore cyclical factors and focus at the structural factors instead”